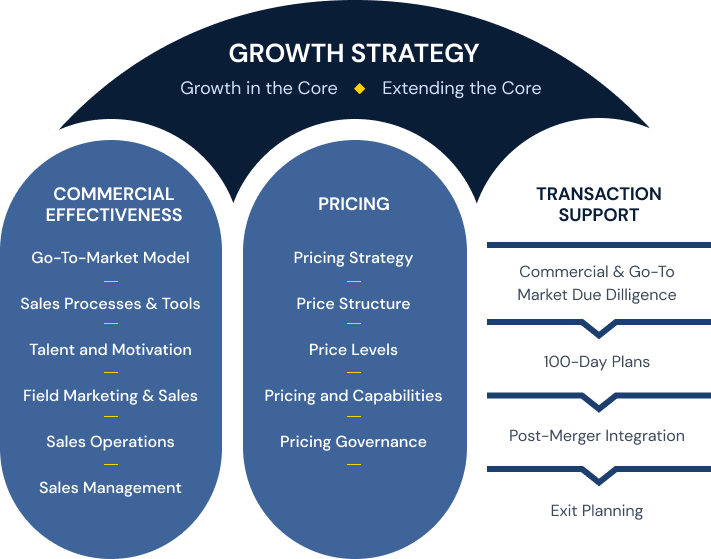

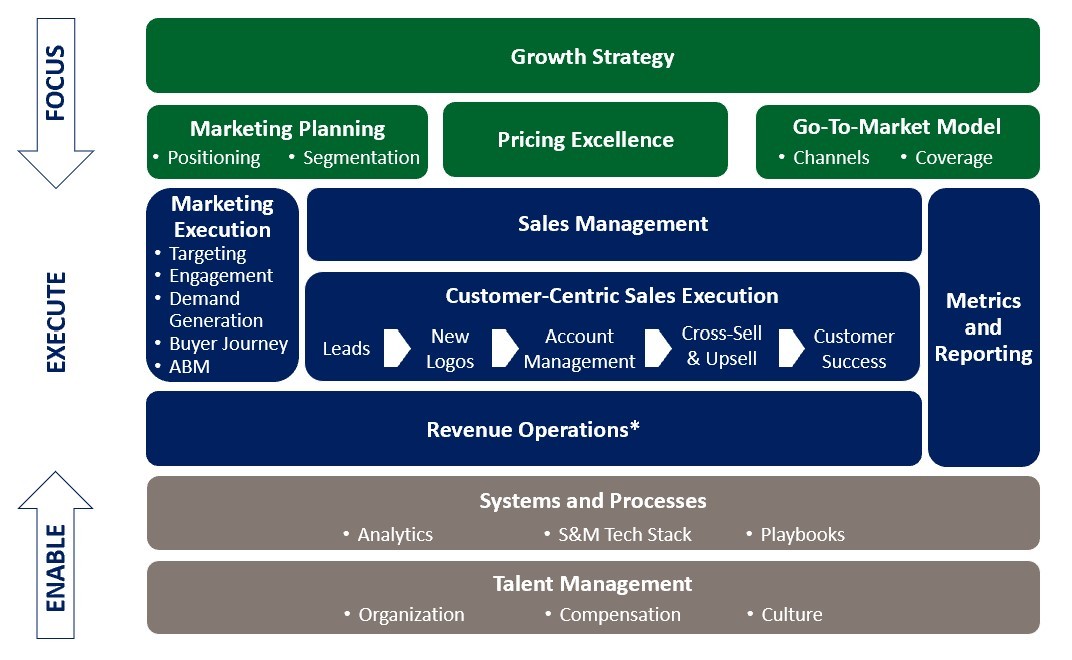

Revenue Growth Strategy

Using our proprietary methodologies, we help clients define their revenue growth strategy, including strategic actions and tactical improvements in execution.

- Market Assessment

- Competitor Position Analysis

- Internal Capability Assessment

- Opportunities to Play and Opportunities to Win

- Growth Plans Inside and Outside the Core

Commercial Effectiveness

Growth requires strong and reliable execution across an organization’s functions: sales, marketing, and customer service.

- Go-to-market model

- Talent, motivation, and culture

- Sales processes and tools

- Field marketing

- Sales enablement and operation

- Sales management

Pricing Optimization

Pricing is one of the most impactful profit levers a company can pull. Our clients often achieve 300 to 600 basis points or more of margin improvement.

Our pricing team tackles three key questions:

- How do you identify the right price?

- How do you ensure customers pay that price?

- How do you sustain and improve pricing performance?

Transaction support

Blue Ridge Partners offers transaction support throughout the life cycle of an investment including:

- Market Due Diligence

- Go-to-market Due Diligence

- 100-day Planning

- Post-merger Integration

- Exit Planning

Our approach at each stage is unique and goes beyond the basics. For example, our commercial due diligence engagements include an assessment of a company’s ability to actually execute their go to market plan.