Insights from PEI OP Forum Europe – How Operating Partners Are Responding to Market Volatility

Presented at the 2025 PEI Operating Partners Forum Europe, our latest research explores how value creation teams are evolving in the face of growing macroeconomic pressures. For those who couldn’t attend in London—or are navigating similar challenges—this research offers a snapshot of what 50 operating partners across the U.S. and Europe are doing differently to adapt, protect value, and build portfolio resilience.

The Landscape: Uncertainty Across Every Front

Over the last five months, uncertainty has spiked across global markets, driven by:

- Rising interest rates

- Persistent inflation

- Geopolitical instability

- Supply chain disruptions

PE-backed portfolio companies are facing challenges that exceed the bandwidth of most management teams. As a result, value creation teams have stepped in as critical agents of agility and resilience.

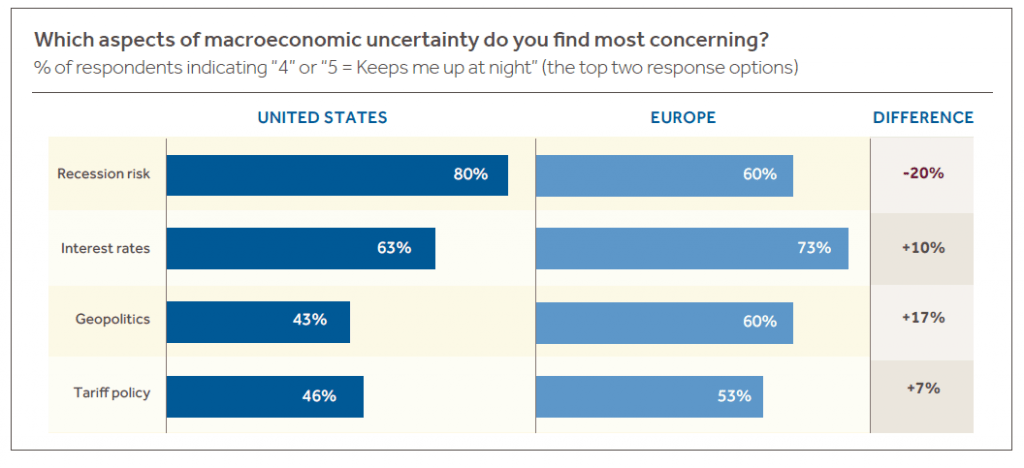

What’s Keeping Operating Partners Up at Night?

According to the survey:

- 80% of US partners and 60% of European partners cited recession risk as a top concern.

- European firms expressed deeper concern over interest rates, geopolitics, and tariff policies.

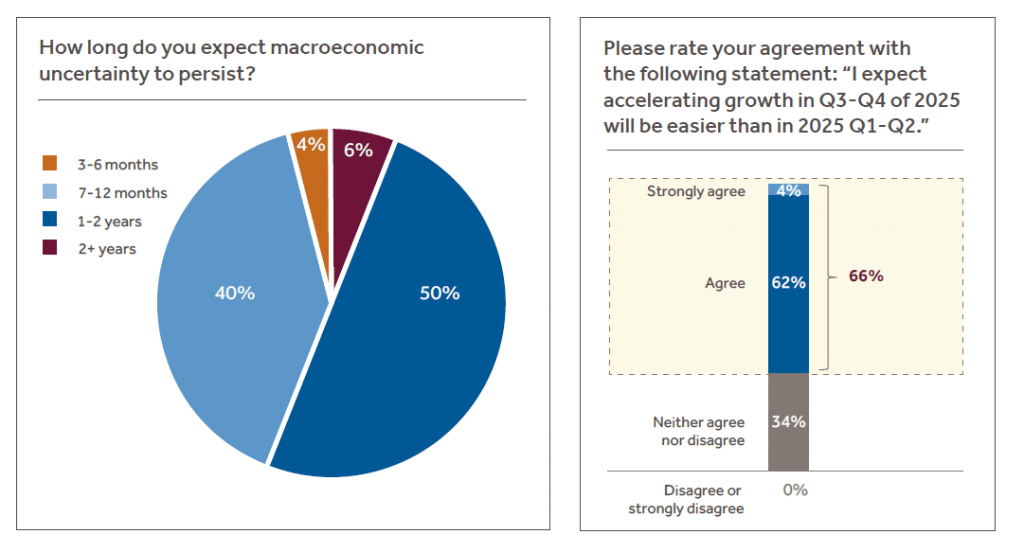

Encouragingly, 66% of respondents expect accelerating growth by late 2025, with most believing uncertainty will subside within 12–24 months.

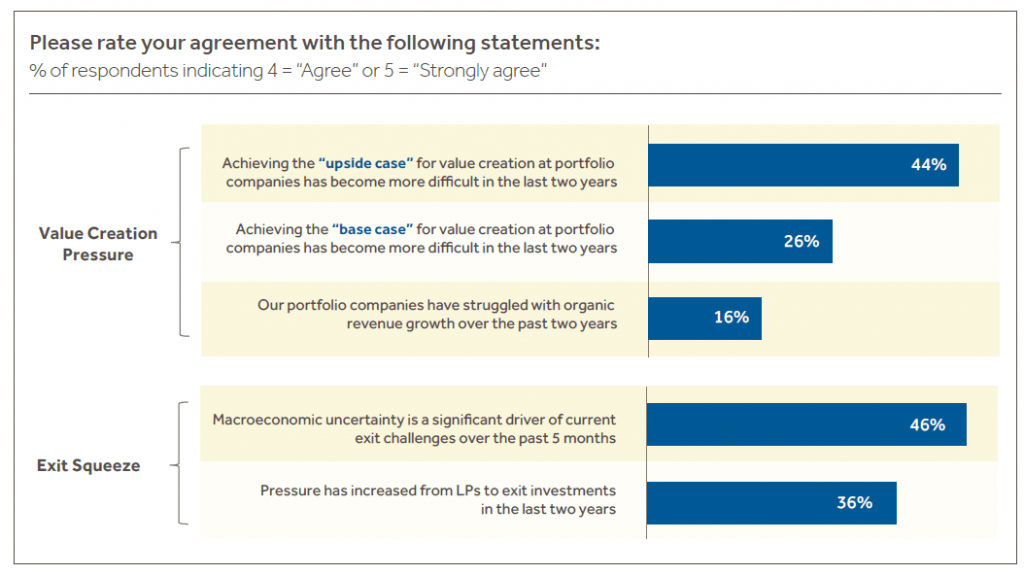

Value Creation Is Getting Harder

Operating partners reported growing difficulty in:

- Hitting base case and upside case targets for value creation

- Driving organic revenue growth (a key challenge for 16% of firms)

- Navigating tighter exit windows, with LPs increasing pressure to realize returns

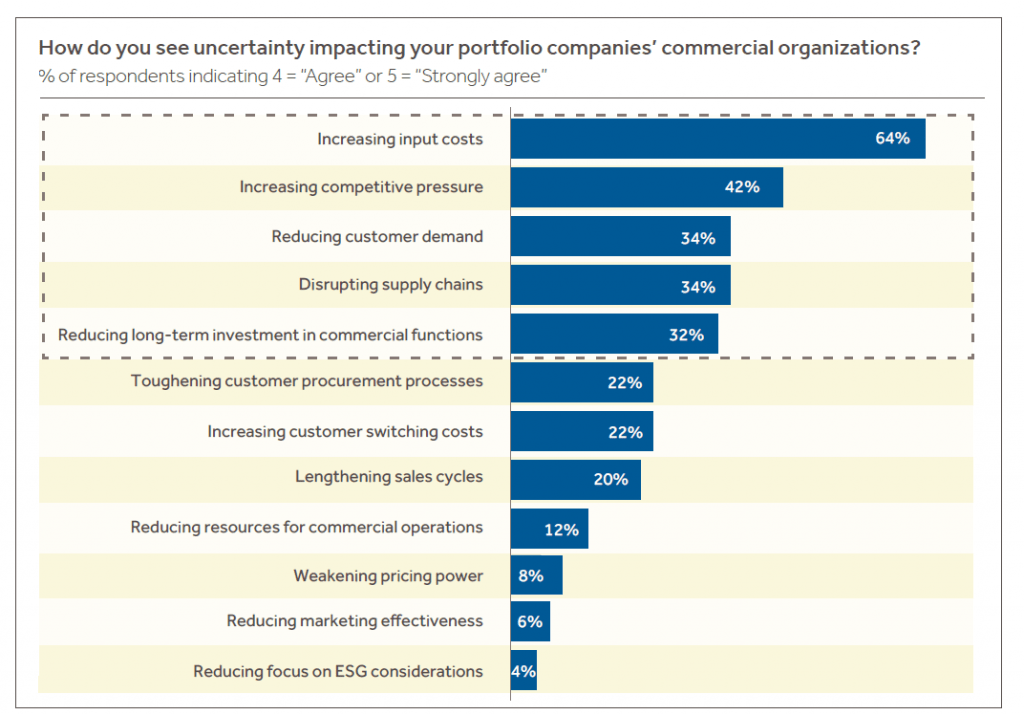

Commercial Pressure Points

Five commercial trends are hitting portfolios hardest:

- Increasing input costs

- Rising competitive pressure

- Declining customer demand

- Supply chain disruptions

- Reduced investment in commercial functions

The data show a strategic pivot from financial engineering to organic growth and strategic M&A, with less emphasis on margin or multiple expansion.

Evolving Support Models

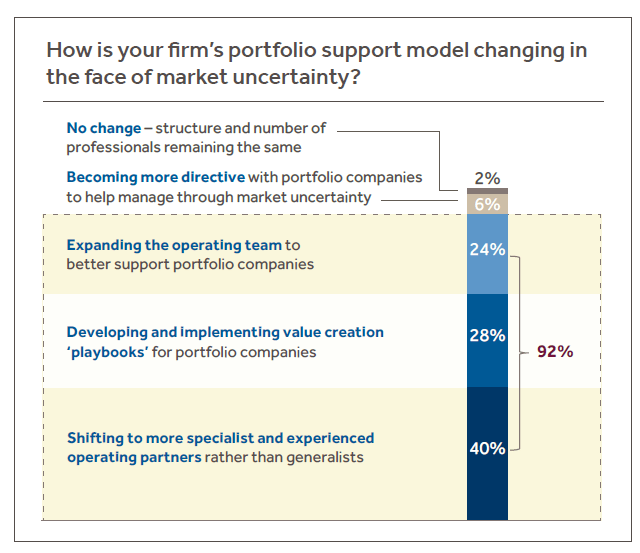

In response to market shifts:

- 92% of PE firms are enhancing their support models—expanding operating teams, deploying value creation playbooks, and bringing in specialists.

- Investment approaches are more cautious, especially in Europe. However, some US firms are leaning into bold investment strategies to capitalize on disruption.

What’s Working on the Ground?

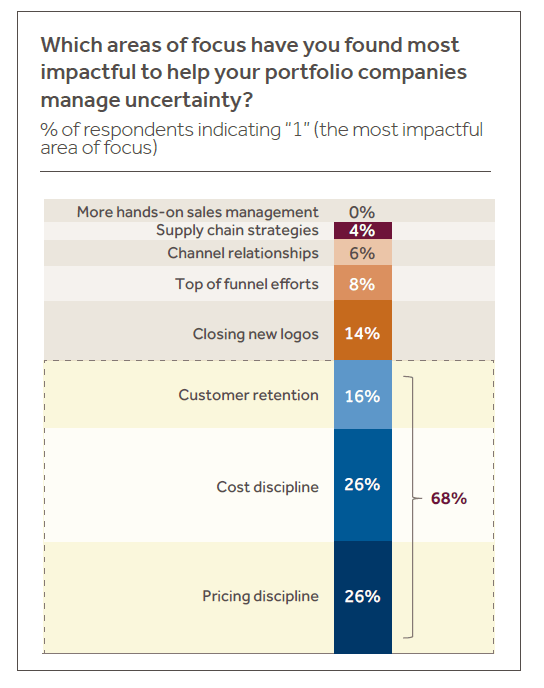

When asked what’s most effective in managing uncertainty, operating partners emphasized:

- Pricing discipline

- Cost control

- Customer retention

Customer and sales-related actions—including top-of-funnel generation and closing new logos—accounted for 38% of high-impact focus areas.

Final Word: Building Resilience While Driving Growth

Taken as a whole, these findings offer a timely snapshot of how PE firms are responding to today’s challenges. In an environment defined by volatility, the evolving role of the value creation team has never been more critical, with opportunity not just to protect value, but to build stronger, more resilient portfolio companies for the road ahead.