Don’t Miss a Month: How Early Value-Creation Planning Drives Top-Quartile Returns

In private equity, value creation plans (VCPs) often stall because execution begins too late. In today’s higher-cost, longer-hold environment, even a few lost months can erode DPI and compress exit value. Top-quartile performers build the value creation plan during diligence – not after close – so growth initiatives begin on Day 1, not Month 9. Quality of Revenue (QoR) diligence provides the commercial fact base that makes that possible, closing the commercial due diligence gap between underwriting and execution. It accelerates revenue, compounds enterprise value, and strengthens exit outcomes. In many cases, the difference between top-quartile and average returns comes down to how quickly execution begins.

Executive Takeaways

- Start growth planning before close – use diligence to build the commercial fact base and align the deal team and management.

- Treat Quality of Revenue (QoR) diligence as the bridge between underwriting and execution: it equips Day 1 decisions on GTM, pricing, and resourcing.

- Launch the highest-impact growth initiatives immediately post-close to accelerate time-to-value and strengthen DPI.

Why Months Matter More Than Ever

Higher rates, longer holds, and tougher exits put pressure on DPI. Avoiding “lost years” isn’t enough – even a few lost months erode value. Top-quartile performers plan for close and construct the value creation plan (VCP) during diligence, so execution begins on Day 1.

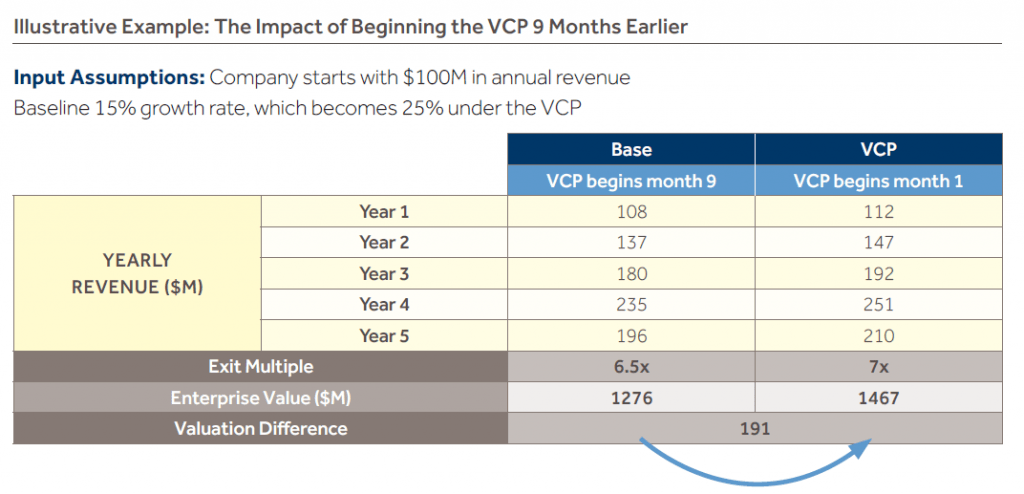

Activating a VCP nine months earlier can support a 10–15% valuation uplift at exit (illustrative example).

QoR Diligence: The Engine for a Day-1 VCP

QoR during diligence provides:

- A robust commercial fact base to guide strategy

- Early alignment between the deal team and management

- Clear, prioritized initiatives ready to launch post-close

- Faster time-to-value and stronger DPI

This makes GTM structure, pipeline health, pricing, churn, and sales effectiveness someone’s first priority during diligence, not after.

Examples of Early Wins

High-performing funds treat the post-close window as execution time, not planning time. Examples of early, high-ROI actions include:

- Rapid pricing harmonization across product or regional lines to capture immediate margin improvement

- Re-segmentation of the salesforce to focus on the highest-LTV customer segments

- Launch of cross-sell campaigns leveraging underpenetrated accounts identified during diligence

- Introduction of inside sales or SDR roles to shorten cycle times and improve pipeline throughput

- Retention playbooks targeting early churn drivers in key customer cohorts

Post-Close Reality vs. Best Practice

- Typical path: The “first 100 days” become a systems-fix exercise; data arrives late; initiatives lack owners; external support is delayed – months slip by.

- Best practice: QoR requests data during diligence, quantifies key levers, maps difficulty vs. impact, and proposes owners – so multiple VCP initiatives show progress by the first Board meeting and pricing improvements can launch within 60 days.

What to Launch from Day 1 (Starter Checklist)

- Confirm commercial leadership gaps and owners for top initiatives

- Stand up a lightweight PMO to track weekly execution cadences

- Turn on pipeline diagnostics (lead sources, conversion, cycle time)

- Implement pricing guardrails to reduce discounting leakage

- Prioritize customer retention motions to address churn drivers

- Align Operating Partner involvement level early with management

Why Blue Ridge Partners for QoR

Blue Ridge Partners integrates Quality of Revenue diligence into the deal process to produce a forward-looking revenue forecast and a prioritized commercial roadmap. The result is earlier execution and faster revenue acceleration during the hold period. To learn more about how Quality of Revenue diligence accelerates value creation, explore our QoR perspective.

FAQ

How does QoR differ from QoE?

Quality of Earnings (QoE) validates historical financial accuracy.

Quality of Revenue (QoR) evaluates the commercial engine – pricing power, sales execution, churn risk, and growth drivers – to enable Day-1 value creation.

When should value creation planning begin?

During diligence. The data-request window should be used to build the commercial fact base, align management, and pre-assign initiative owners so execution begins immediately at close.

What impact can early activation have on returns?

Starting value creation initiatives nine months earlier can support a 10–15% valuation uplift at exit by accelerating growth and strengthening exit multiples (illustrative example).