Feeling the Cash Burn? Why Fixing Bad Prices May Help

How targeted pricing actions can immediately inject positive cash flow into businesses

In the current economic slowdown, some companies are burning through cash and pulling every profit lever at their disposal to slow the burn. One lever many overlook is pricing which, ironically, can also be one of the quickest and easiest to pull.

Raising prices when business is contracting may sound counterintuitive, and we agree that now is not the right time for across-the-board price increases. However, for many businesses this is an ideal time for much more targeted adjustments to prices that have been flawed for some time.

We’re not talking about price-gouging. We’re suggesting going after truly “bad” prices—those that are egregiously low, drive little to no margin, or are obviously wrong. Odds are, if you’re a B2B business with negotiated pricing, you have some bad prices. And the more customers, products, and services you have, the more of them likely exist.

These flawed prices creep into your system for several reasons (see “Why Do Bad Prices Exist?”). They are inevitable and will persist unless you have strong processes in place to find and fix them.

The number of bad prices and the margin opportunity from correcting them can be surprisingly high. It’s common to uncover instances where customer prices are near or even below cost. We often find companies can generate a 1-2% increase in revenue—going straight to the bottom line—within one quarter simply by fixing them.

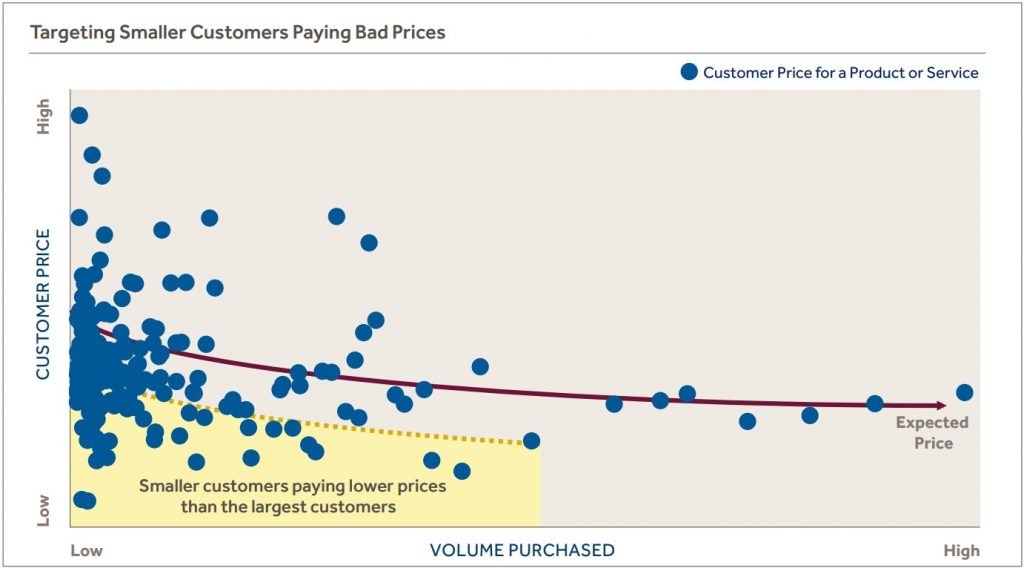

We recommend you start by targeting the lowest- hanging fruit: small customers paying prices that are below the best prices you offer to much larger customers. This is usually the easiest place to begin for a few reasons. First, small customers are more likely to have bad prices because you probably pay less attention to them than you do to larger customers. Second, small customers might be less likely to push back on price increases because they have little to gain by doing so. Finally, you benefit from the law of large numbers with smaller customers: so long as most of them accept the increase, you can afford to lose a few individual customers. The same cannot be said for larger customers.

You’ll likely find ‘right-sizing’ prices for smaller customers easier and more impactful than you expected. Once done, you can begin to go after larger customers with flawed prices or prices that missed the threshold for your initial round of action but are nonetheless questionable. You may also pivot to other cost-to-serve drivers and make appropriate changes to optimize customer profitability. Rebates, transportation, and payment terms are a few cost-to-serve examples where outliers often exist or the risk profile may have changed due to the recent economic uncertainty.

Cleaning up bad prices is good hygiene and especially important during economic downturns. While it probably won’t singlehandedly solve your cash burn woes, it will contribute to the solution by improving profitability and usually has bottom-line impact you can begin realizing within 60 to 90 days. Moreover, it may be easier and more impactful to push through price increases today than it is in normal times. Everything, including pricing, is much more volatile now, and most businesses are scrambling to adjust to a new normal. As a result, price changes might fly under the radar, especially if your products and services account for a small part of your customers’ total spend.

Why Do Bad Prices Exist?

- Falling below volume agreements. A consumer products company offered a deep discount to a prospect that promised significant volume that never materialized. Three years later, the discount was still in place.

- Failing to review renewal pricing. A SaaS provider did not review prices for more than five years; when it did so, it found its renewal prices were well below market value. Maintaining legacy pricing while costs escalate. A manufacturer acquired a small distribution business but lacked a process to update prices automatically when costs changed. After several years, it found it was pricing over 10% of SKUs below its own acquisition cost.

- Not adjusting to competitive situation. A veterinary hospital dropped the price of an office exam by 50% to match a competitor that opened a practice in the same shopping center but failed to raise the price again after the competitor left.

- Extending “one-time” special pricing. A wire rope manufacturer that manually updated prices accidentally left temporary clearance pricing in place for a significant number of customers. Making data-entry errors. An inside sales rep for a laboratory testing services company mistakenly entered a price for a recurring order as $9 instead of $90.

- Failing to review sales rep pricing adequately. A networking solutions company that did not review pricing on quotes below a minimum threshold found a handful of sales reps routinely gave deep discounts to hit quarterly targets.

Tips for Fixing Bad Prices

- Create buy-in by including sales leadership throughout the process and engaging frontline sales reps and sales managers to help refine repricing recommendations. Most importantly, give sales reps the ability to review and revise recommendations before finalizing them.

- Support your sales team with customer-specific facts (e.g., competitor pricing, customer switching costs, market demand) and messaging (e.g., your cost changes, ability to push price increase to their customers) to give them confidence and help them explain the price increases to customers. In many cases, simply explaining why the bad price exists is sufficient (e.g., data entry error, one-time special pricing never updated).

- Ensure recommendations are executed in a timely manner by setting aggressive but realistic targets for fixing bad prices, assigning work to individuals, clearly communicating your expectations, and implementing a cadence to measure progress and hold people accountable.