How to Budget for Your 2026 Price Increases

For the fourth year in a row, Blue Ridge Partners surveyed 267 CXOs across software, industrial, and business services sectors to understand expectations for revenue growth and pricing in 2026. The results provide powerful benchmarks for CEOs, CFOs, and boards as they set budgets for the year ahead.

Overall Market Signals

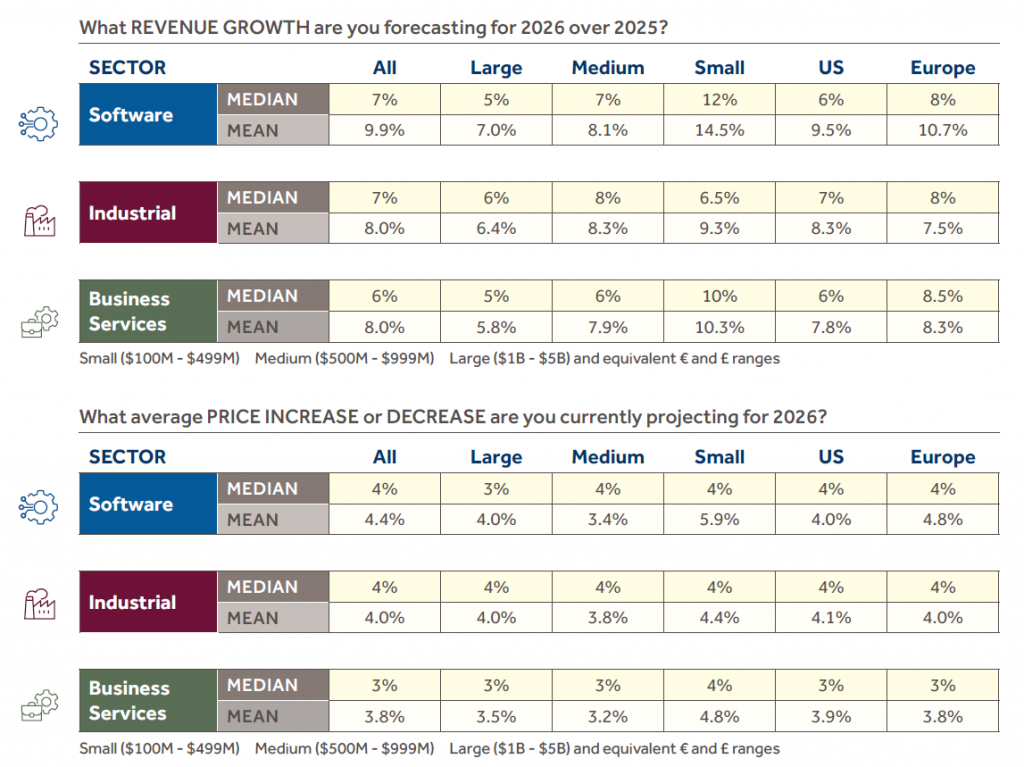

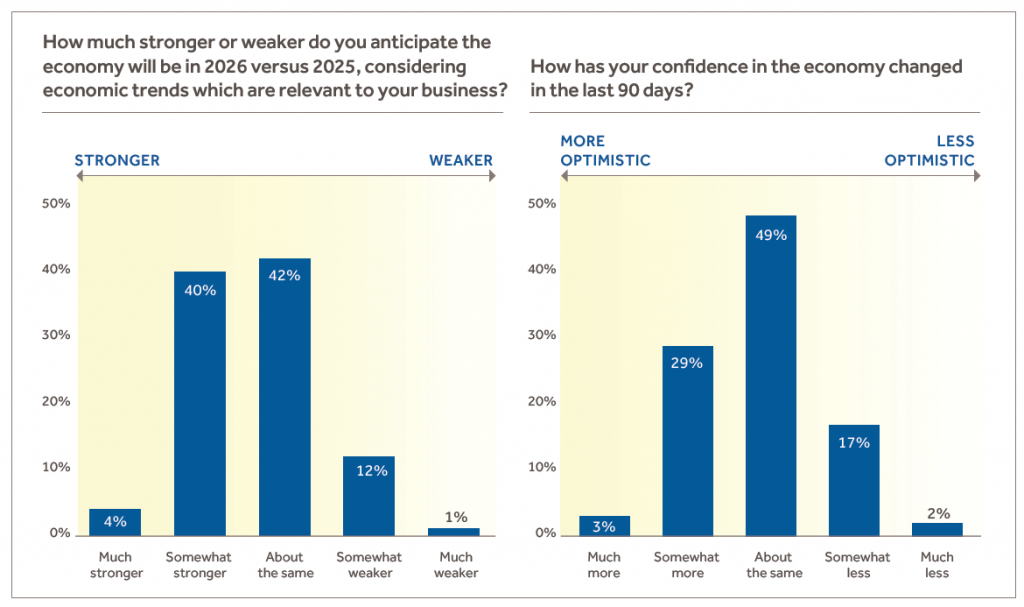

Across sectors, leaders expect 5–12% revenue growth in 2026 and plan 3–6% price increases, on average about 1% lower than in 2025.

Pricing rigor is now standard practice: most companies will conduct a significant pricing optimization initiative in 2026, including buyer “willingness-to-pay” surveys and comprehensive data analysis. And AI is becoming a pricing game-changer, influencing not just price levels but metrics and structures.

Software

Software executives remain bullish on growth—5–12% revenue gains are expected, with smaller companies projecting the highest increases.

- Planned price increase: 4% median, about 1% lower than in 2025. Smaller firms expect an average 5.9% increase, while large companies target closer to 4%.

- Top performers: The most aggressive quartile aim for nearly 10% price increases, yet report little market resistance.

- AI’s role: Companies are testing outcome-based pricing and adding AI-driven functionality—sometimes as premium bundles or add-on modules. While outcome-based models don’t suit every buyer, the shift signals growing openness to new pricing metrics.

- Discipline: 96% plan a major pricing update in 2026, making annual pricing reviews the new norm.

Industrial

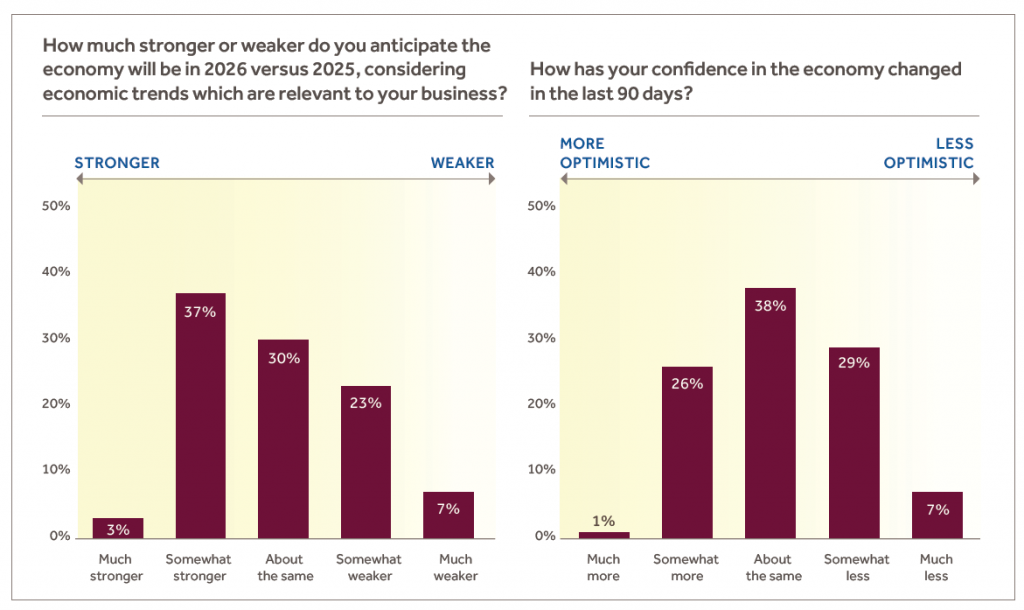

Industrial companies forecast 6–8% revenue growth, with slightly higher expectations in Europe than the US.

- Planned price increase: 4% median, again about 1% lower than 2025. The top quartile plan around 7% increases, while the lower quartiles range down to 1%.

- Cost pressures: Tariff uncertainty and supply-chain volatility are driving more frequent pricing updates—90% of firms expect at least one pricing review in 2026, and nearly half plan two or more.

- AI’s role: Pricing teams are embedding AI into platforms like Vendavo to handle vast product portfolios and long-tail transactions.

Business Services

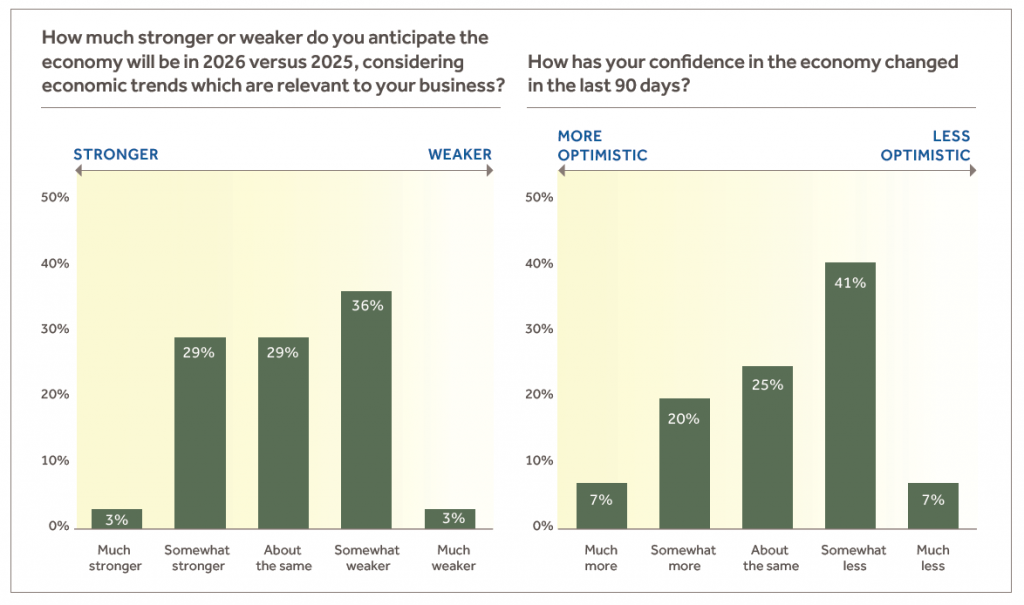

Business services firms see 5–10% revenue growth in 2026 but are slightly less optimistic than a year ago.

- Planned price increase: 3% median, the lowest among the three sectors, with the most aggressive quartile targeting nearly 9%.

- Annual pricing cycle: 88% plan a significant pricing optimization initiative—pricing sophistication continues to rise.

- AI’s role: Companies expect AI’s impact on pricing to steadily increase through 2028, enhancing data-driven price setting and structure.

- Labor costs: 61% anticipate 0–5% labor cost increases, and 20% expect 6–10%, adding pressure to protect margins.

Key Takeaways for 2026 Budgets

- Moderate but meaningful increases: Expect slightly smaller price hikes than in 2025, but they remain critical to revenue growth.

- Institutionalize pricing reviews: Annual pricing optimization is now best practice across sectors.

- Leverage AI thoughtfully: Early adopters are already reshaping pricing structures and metrics—others risk falling behind.

- Watch costs: Rising COGS in industrials and labor costs in services will require careful margin management.

Final Word

2026 will be defined by disciplined, data-driven, and AI-enabled pricing. Companies that invest in pricing rigor and embrace technology will be best positioned to capture growth and margin upside in the year ahead.

If you are interested in learning more – download the PDF above, which includes much more detail – and reach out to any of our Managing Directors or contact us at [email protected] as we are happy to talk through this with you and/or discuss any pricing challenges or opportunities being considered.