Maximizing Profit Through Price: Five Easy, Yet Powerful, Price Levers You Probably Aren’t Fully Addressing

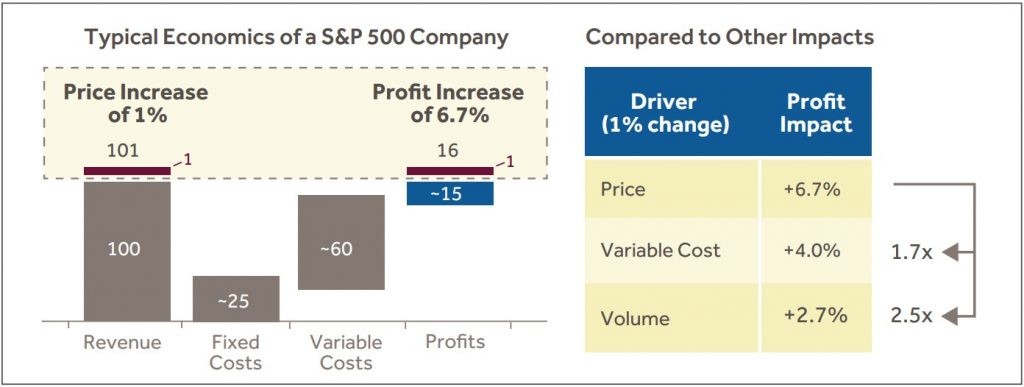

Pricing can be one of the most impactful profit levers but is often neglected. Few companies think of pricing as a strategic capability. While some pricing actions take courage, many don’t and can be considered low risk with higher upside due to the huge impact on EBITDA and enterprise value.

In our experience, pricing improvements typically have a 1:1 impact on profit and at least 200 to 500 basis points of margin improvement.

Here are five relatively easy, yet powerful, pricing actions that most companies aren’t fully addressing and that could immediately begin to impact the top and bottom lines. These levers include:

- Exercise your pricing power in the long tail of small customers and avoid giving away margin.

- Ensure your sales teams are not offering hidden discounts such as (unearned) volume discounts, or free or discounted freight, samples, or marketing.

- Enforce a price exception approval policy as a system of checks and balances for salespersons who too quickly, and too often, rely on price discounting.

- Measure price impact on gross margin to identify and replicate examples of success, and detect areas that need corrective action.

- Incorporate pricing-related levers into sales compensation plans (e.g., based on margin or discount-to-list modifiers).

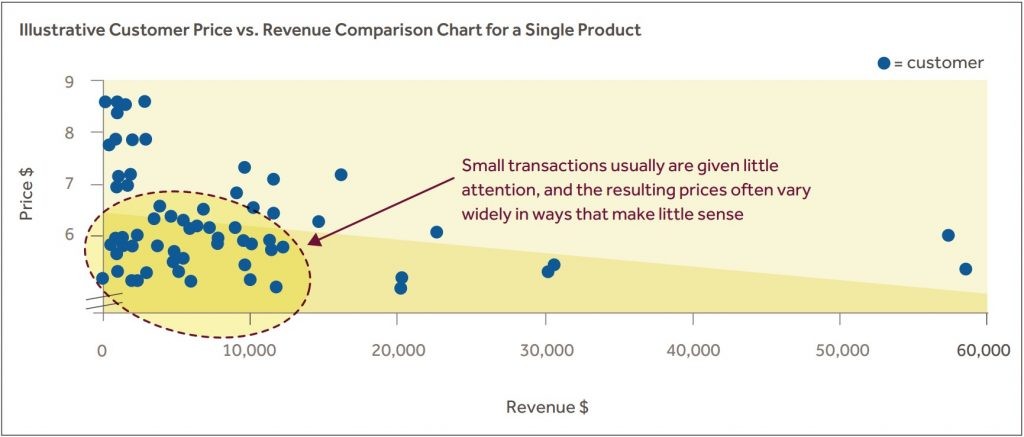

1. Exercise your pricing power in the long tail of small customers and avoid giving away margin.

While sales organizations can get maximum impact by focusing on the 20% of customers and products that drive 80% of revenue and margin, in pricing, the opposite is often the case. The biggest and most immediate impact lies in taking meaningful action on the 80% of customers that account for 20% of revenue and margin.

Businesses often underestimate their ability to command higher prices with smaller customers and overestimate the related risks. Underlying drivers of this opportunity include:

- Small customers can be hard to serve; losing the customer may still be a win.

Factoring in cost-to-serve and minimum fixed costs often reveals many small customers to be unprofitable or nearly so. - Small customers tend to have limited bargaining power.

While not a certainty, bargaining power often resides with the supplier if the customer’s purchases are a small portion of the supplier’s revenue. - These changes can fly under the radar. Customers tend to focus procurement resources on products that make up a larger portion of their spending.

- Your competition is probably not trying to steal the business.

Winning new business takes effort, and your competitors are probably not investing heavily in efforts to steal away your smallest customers.

A similar pricing lever exists for low-velocity, niche products.

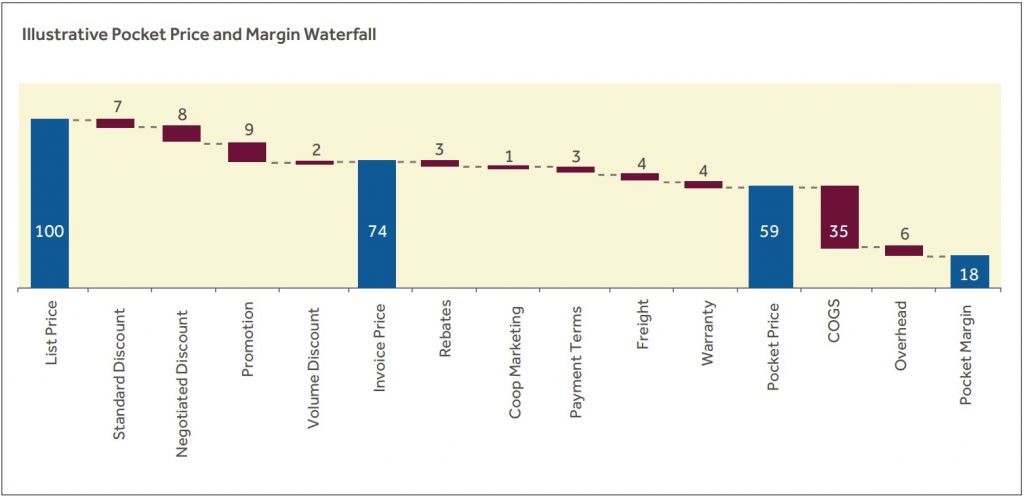

2. Ensure your sales teams are not offering hidden discounts such as (unearned) volume discounts, or free or discounted freight, samples, or marketing.

A pocket price and margin waterfall can reveal numerous sources of leakage, both at an aggregate level and for individual customers, that can cumulatively cause significant margin erosion.

While the specific components of the waterfall will vary for each business, the impact is often the same:

- Multiple, uncoordinated discounts can stack, resulting in invoice prices far below what was intended.

- Off-invoice items such as rebates, payment terms, and freight are often negotiated independently of each other and of price in general, limiting visibility into their cumulative impact

- Other services are often provided for free and without good visibility into costs.

- Leakage may result from poor policies, lack of policies, and failure to adhere to existing policies.

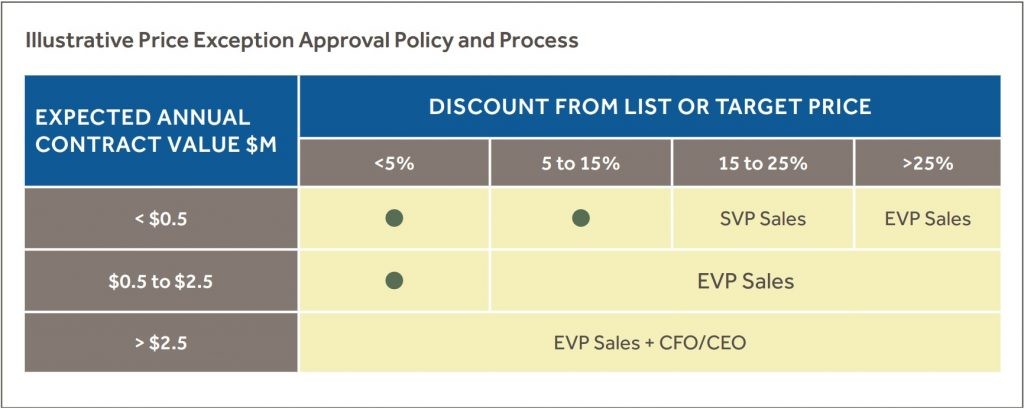

3. Enforce a price exception approval policy as a system of checks and balances for salespersons who too quickly, and too often, rely on price discounting.

A well-designed price exception approval policy and process ensure price exceptions are managed in a thoughtful, orchestrated way without introducing bottlenecks to closing the deal. In its absence, salespersons are often forced to make profit-impacting pricing decisions with what is often insufficient, tribal knowledge that may not reflect the broader business strategy.

The benefits to a price exception approval policy and process include:

- Maintaining control, where people work within the system and not around it.

- Ensuring the salesperson is aligned with the broader business strategy and not relying on outdated or inaccurate information.

- Maximizing velocity for routine transactions and not slowing down the sales funnel.

- Communicating prices that reflect the value created and not anchoring to prices that are artificially low.

- Enabling salespersons with a price-negotiation support system and not leaving them to swim with the sharks.

- Minimizing price execution problems and unintended price variation.

4. Measure price impact on gross margin to identify and replicate examples of success, and detect areas that need corrective action.

Measuring price impact can be a strategic tool and not just record-keeping. To be effective, you must maintain a regular review cadence with dynamic reporting that allows you to slice and drill down by key customer, product, sales team, and geographic factors.

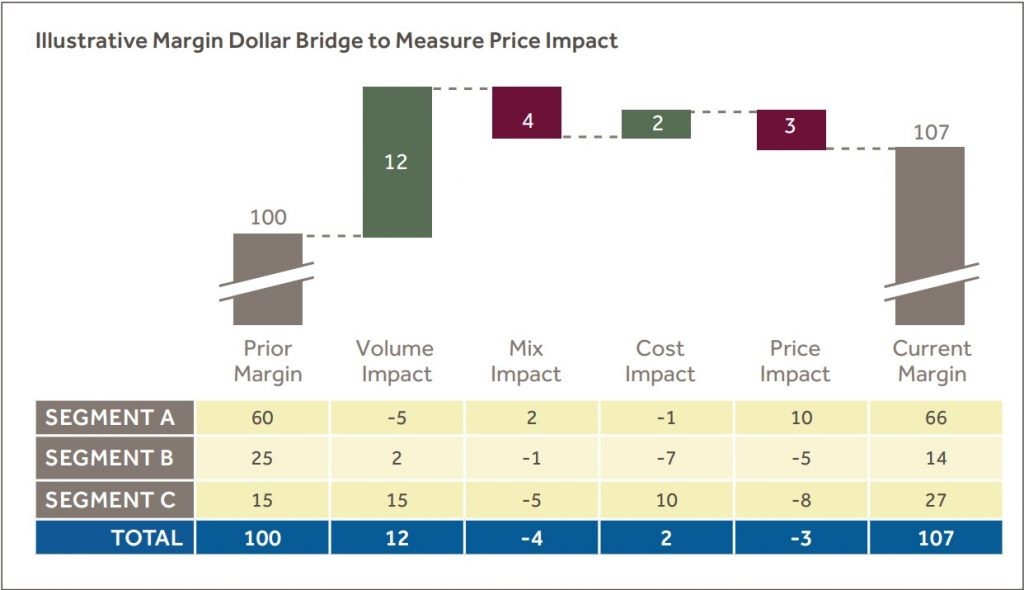

The margin dollar bridge measures the results of your price actions by segmenting the change in gross profit and provides transparency and insight into the hundreds of pricing decisions that occur each day.

Price impact measurement helps answer key questions, such as:

- Where are my price increases sticking and where aren’t they?

- Are my price decreases generating enough volume to offset lost margin?

- Are my price adjustments outpacing cost changes?

- Is my change in profit due to effective pricing or a change in the mix?

5. Incorporate pricing-related levers into sales compensation plans (e.g., based on margin or discount-to-list modifiers).

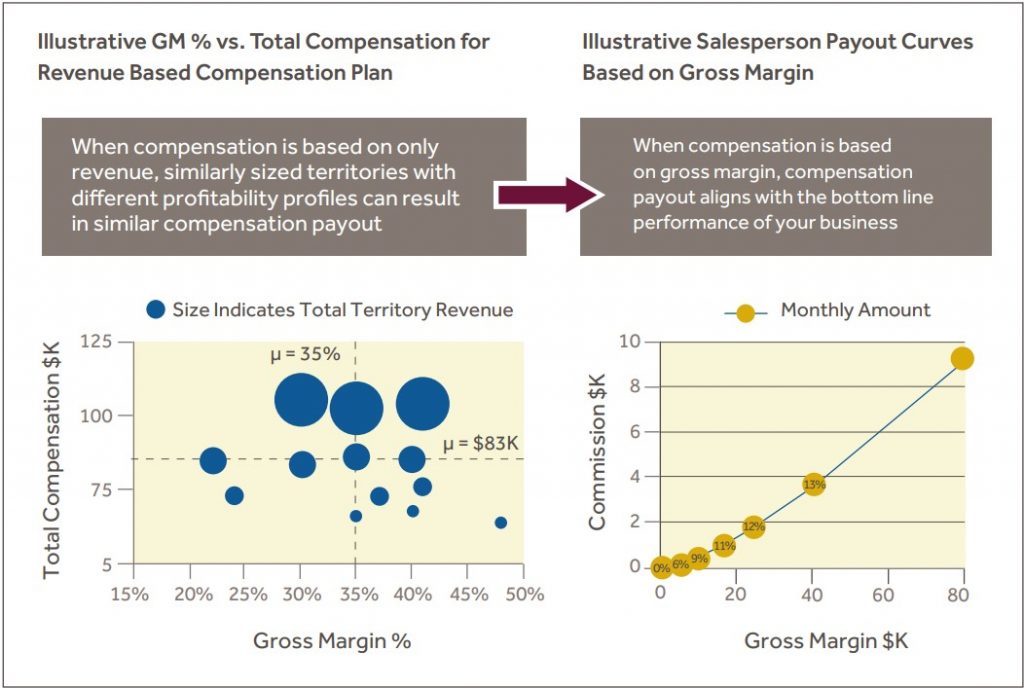

Aligning incentives to support pricing goals and gross profit maximization is an important piece of the puzzle when it comes to understanding the pricing opportunity in B2B companies. Companies that compensate salespersons based on revenue alone without regard for differences in margin can often lead to suboptimal outcomes where sales reps spend too much time and effort on low-margin products and services and too little time and effort on higher-margin products and services.

We find that world-class sales compensation plans take into consideration incentivizing margin growth. Blue Ridge Partners has seen compensation plans do this effectively by incorporating one of the following elements:

- Paying commission directly on Gross Margin where appropriate

- Adjusting payouts based on a price discount or premium to list/target price

- Adjusting payout rates or credit based on revenue categories (i.e., differentiating low value vs. high value)

The Bottom Line

Well-run businesses use pricing as a strategic lever in their revenue management toolbox.

Some strategic price decisions may seem courageous, but there are equally impactful price execution actions that are low cost and low risk. All you need is confidence. The five price actions included in this paper are easy to implement, yet powerful due to their immediate bottom line and enterprise value creation.

The investment decision is clear so go ahead — pull the pricing lever.