The Exit Edge: How Pricing Can Unlock 10% or More in Valuation Upside

As private equity firms prepare for a surge of exits following prolonged delays, many face a tough reality: achieving target returns may be challenging in today’s environment. One proven way to bridge the valuation gap? Pricing.

This executive briefing shares insights from a survey of 100 PE deal partners across the US and Europe and outlines a practical path to capturing pricing upside at exit.

Key Findings

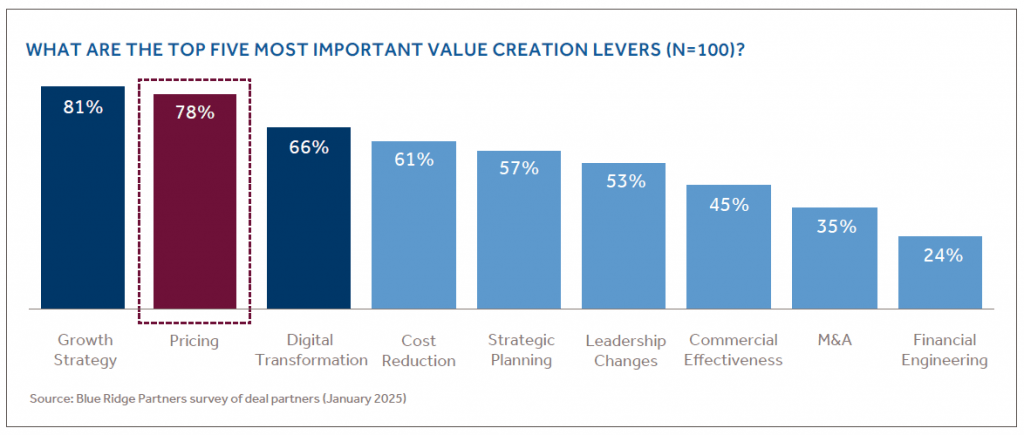

- Pricing ranks as the #2 value creation lever…

- Yet, ~60% of portfolio companies never pursue a strategic pricing initiative during the hold period.

- 56% of deal partners cite “other priorities” and “management pushback” as the top barriers to pricing initiatives.

- When done right, pricing can add 10–20% or more to exit valuation with limited downside risk—but only if supported by the right execution.

A Historic Backlog of Exits

The private equity industry is sitting on a backlog of 4,000 to 6,500 unsold companies — nearly four times what we saw during the global financial crisis. Many of these investments are aging beyond five years, having been acquired when valuations were considerably higher. As market conditions stabilize, the demand for liquidity will push a surge in exits, forcing deal teams to find credible upside stories that bridge the valuation gap.

Pricing: A Powerful but Underused Lever

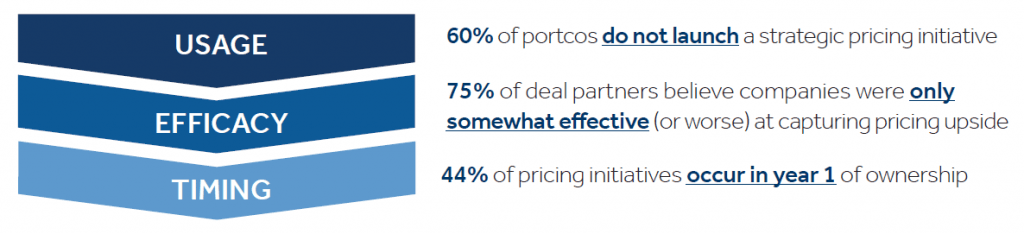

Blue Ridge Partners recently surveyed 100 private equity deal partners. Pricing was ranked as the second most important value creation lever — right behind growth strategy. An overwhelming 98% of respondents reported running pricing initiatives in at least one portfolio company. Despite this, nearly 60% of portcos never launch a strategic pricing initiative during their hold period.

Even among those that do, 75% of deal partners rated their efforts as only “somewhat effective” or worse. Most initiatives take place early — with 44% in the first year — and are rarely revisited closer to exit, leaving untapped value on the table.

Significant Margin and Valuation Impact

Our experience at Blue Ridge Partners shows that effective pricing initiatives drive an average of 850 basis points of additive EBITDA margin. More importantly, when revisited with fresh data and external market insights closer to exit, pricing can add 10% to 20% — or more — to valuation.

Yet, only 45% of confidential information memoranda (CIMs) mention pricing as a value lever, and just a fraction include stories strong enough to be underwritten by investment committees.

What’s Holding Back Pricing Efforts?

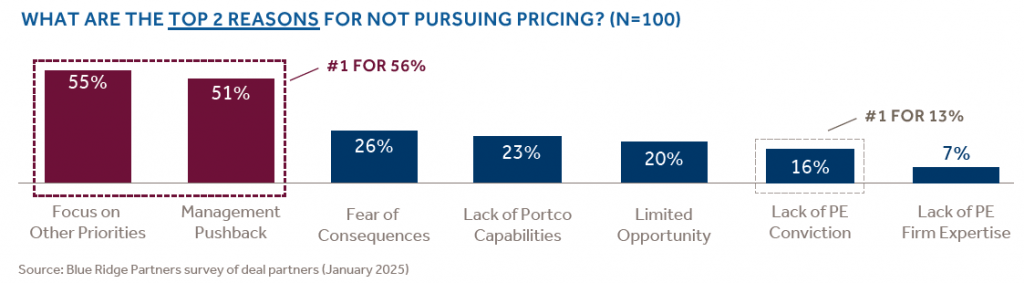

The two biggest barriers: management focus on other priorities and pushback. Over half of deal partners cited one of these reasons as the top obstacle. Interestingly, only 13% pointed to a lack of belief in the pricing opportunity.

This suggests that deal teams see the value — they just need a better path to execution that doesn’t overburden management or risk buyer skepticism.

The Case for Exit-Focused Pricing

We’ve seen firsthand how pricing can dramatically change exit outcomes. In one case, a B2B software company facing stagnant growth engaged us less than a year before exit. After conducting a rigorous pricing assessment, we identified key drivers of underpricing. With a fact-based, buyer-ready narrative, the company secured a 20% higher valuation — despite not yet realizing the EBITDA gains.

The Exit Edge – Pricing: A Purpose-Built Offering

To help deal teams seize this opportunity, Blue Ridge Partners created The Exit Edge – Pricing — a low-burden, high-impact pricing engagement tailored for late-stage ownership. Our approach focuses on:

- Credible, quantified, and verifiable upside that potential bidders can underwrite

- Management team conviction backed by real proof points

- Risk-aware execution that avoids blunt, one-size-fits-all tactics

- Efficient use of management time, with a low-burden, high-impact approach

At Blue Ridge Partners, we bring deep experience in pricing due diligence and exit preparation. Our Exit Edge – Pricing engagements are designed specifically for late-stage ownership, ensuring firms can articulate a compelling, data-driven pricing story that stands up to scrutiny – driving stronger returns and sustainable value for next owner.

Don’t Leave Money on the Table

If pricing hasn’t been revisited recently, now may be the time. We would be happy to share how a focused initiative could create a credible valuation upside story ahead of exit. Reach out to author Peter Regen 📩 [email protected] or contact us at [email protected] to learn more.