Latest Report Shows: Revenue Growth is the #1 Driver of Private Equity Value Creation

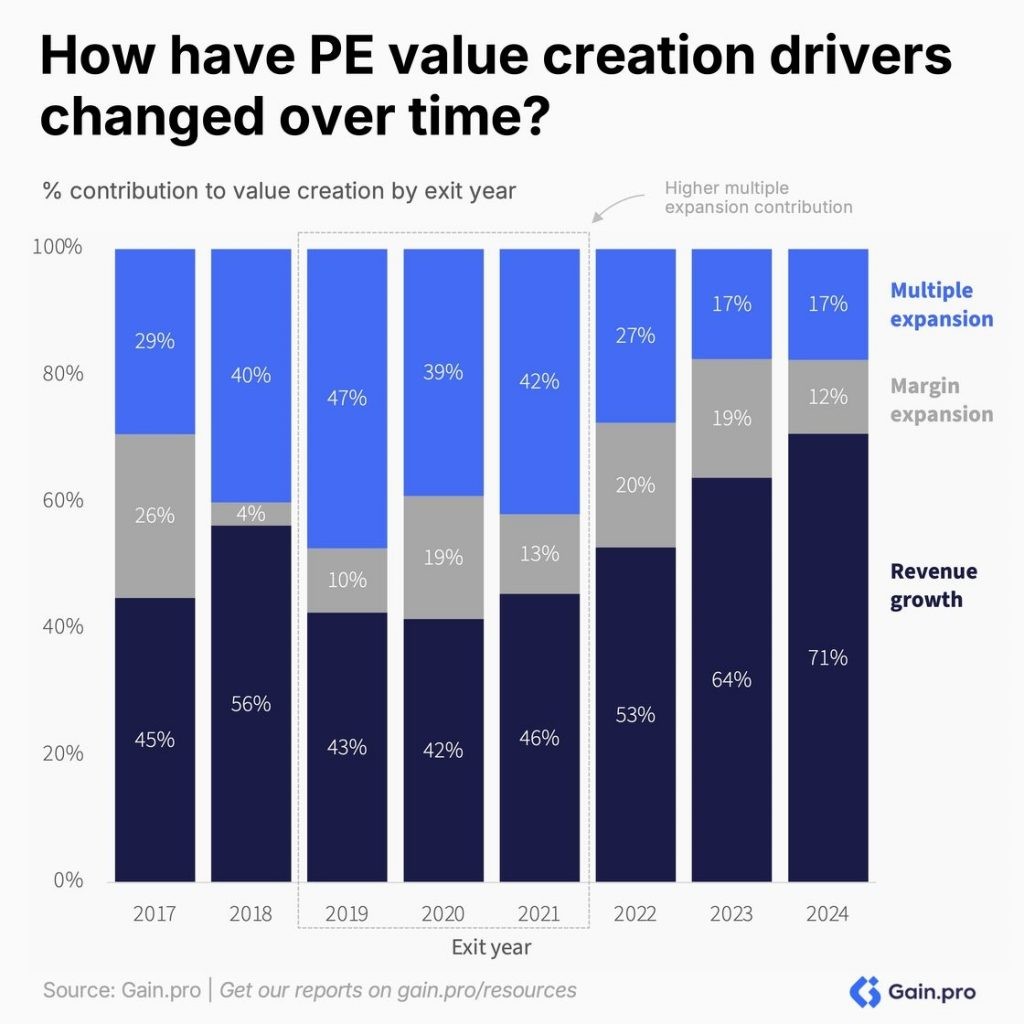

According to Gain.pro’s newly released 2025 Private Equity Value Creation Report, revenue growth is responsible for 54% of total value creation—more than any other driver. This statistic affirms something we’ve known and championed for years at Blue Ridge Partners: accelerating profitable revenue growth is the single most powerful lever for driving investor returns.

Why Revenue Growth Matters More Than Ever

In a market environment marked by compressed multiples, elevated interest rates, and operational complexity, PE sponsors are finding that traditional levers like financial engineering and cost-cutting aren’t enough. The Gain.pro report makes this clear:

- Revenue growth accounted for 54% of total value creation

- By comparison, multiple expansion contributed 32%, and margin improvement just 14%

- Fast-growing companies also achieved 30–50% higher exit multiples, amplifying value even further

These findings aren’t theoretical—they’re data-driven insights derived from over 10,000 global PE investments. And they validate what Blue Ridge Partners has built our advisory model around: commercial excellence that unlocks sustainable top-line growth.

Commercial Growth as a Strategic Imperative

We’ve long advocated that revenue growth must be intentional, not incidental. In our work with private equity and their portfolio companies, we help management teams focus on actionable levers like:

- Pricing optimization

- Salesforce effectiveness

- Channel and customer segmentation

- New product/market growth

This commercial toolkit is essential, especially as holding periods lengthen and sponsors look for durable value beyond financial engineering.

What the Best PE Firms Are Doing Differently

The report also highlights that companies with active buy-and-build strategies and strong revenue trajectories dramatically outperform their peers. However, these strategies are only effective when growth is deliberate, integrated, and efficiently executed.

That’s where the most forward-thinking investors are turning to trusted advisors like Blue Ridge Partners—to ensure that commercial strategy keeps pace with deal strategy.

Let’s Talk Growth

If you’re a private equity investor, operating partner, or portfolio company leader, the message is clear: Revenue growth is no longer optional—it’s essential.

📩 To learn how Blue Ridge Partners helps private equity firms and portfolio companies unlock this #1 value creation driver, or to get a copy of the report referenced, contact us at [email protected] or reach out to one of our Managing Directors.