How to Maximize Value in the New Era of Selective PE Exits

Private equity exits are regaining momentum — but it’s no longer just about timing. It’s about positioning.

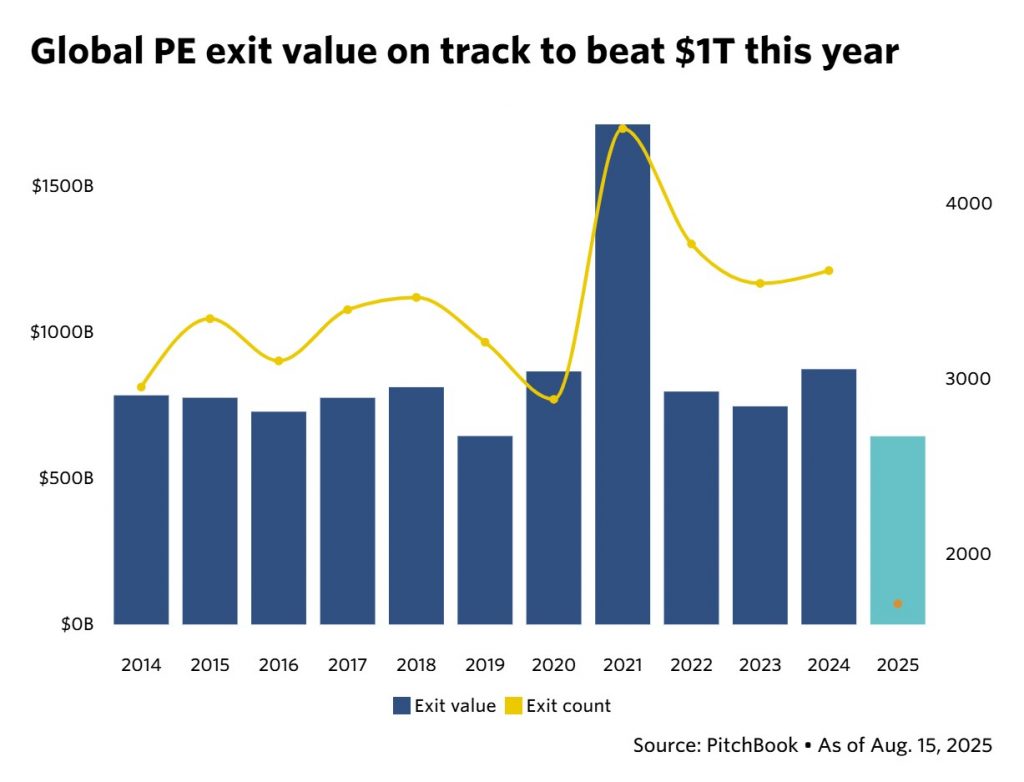

According to recent PitchBook data, global PE exits have reached $644.4 billion year-to-date — already 73% of 2024’s full-year total. That puts the industry on track to surpass the $1 trillion mark for the first time since 2021.

But there’s a catch: only 1,718 exit transactions have closed so far — less than half of last year’s deal count.

PitchBook describes this as a “selective rebound.” At Blue Ridge Partners, we see it as a shift in buyer expectations — where capital is flowing, but only to the most credibly positioned, commercially strong assets.

What This Means for PE Firms

The backlog of delayed exits is real. Many PE firms have held onto assets longer than expected due to turbulent market conditions, but the window is reopening. And now that PE firms are beginning to test the market again, differentiation is critical.

Buyers — strategic and financial alike — are scrutinizing deals more closely. They want to see:

- Clear revenue growth trajectories

- Pricing power and commercial durability

- Scalable go-to-market engines

- Proven impact, not potential alone

Put simply, only the best-positioned companies will command premium outcomes.

Introducing The Exit Edge from Blue Ridge Partners

At Blue Ridge Partners, we specialize in helping private equity firms unlock maximum exit value during the final 12–18 months of ownership.

Our proprietary program — The Exit Edge — is designed specifically for this critical phase, where small changes in perception can drive meaningful shifts in valuation.

We help sponsors and management teams:

- Sharpen the revenue story

- Highlight pricing power and commercial levers

- Build a buyer-ready strategy and narrative

- Present compelling, data-driven value creation proof points

In today’s selective market, that positioning advantage can make or break an exit.

Ready to Maximize Your Exit?

We’d be happy to share how a focused initiative with Blue Ridge Partners can help you craft a credible valuation upside story — one that resonates with buyers, aligns with current market dynamics, and unlocks the return you deserve. Reach out to exit expert – Peter Regen or contact us at [email protected] to learn more.

🔗 Learn more about The Exit Edge