10 “Quick Win” Opportunities for Driving Consistent Top-Line Growth in Technology Companies

Many leaders of technology companies view sales and marketing functions as somewhat mysterious and often frustrating. When problems or inefficiencies arise in operations, finance, or product development, top executives – most of whom come out of backgrounds in those areas – are well equipped to zero in on established metrics and processes, identify trouble spots and address them. However, very few technology CEOs have a sales and marketing background, so managing the details and metrics of these functions is foreign and somewhat baffling.

Adding to the problem is the fact that well-defined and time-tested metrics are not as readily available in sales and marketing as they are in other areas. And it can take several sales and marketing actions to elicit a purchase response, making it difficult to pinpoint a cause-and-effect relationship. As a result, it’s easy to miss the real source of revenue performance problems. Is it the market, pricing, sales team, sales operations, channel partners, go-to-market strategy, or what? Lacking experience in sales and marketing and the metrics to pinpoint the source of problems, many technology CEOs jump to larger-scale programs or to reorganizing the sales and marketing function when results lag expectations for some time.

Instead, companies should first focus on consistent execution of sales and marketing basics, carefully tracking the details of activity and performance. By optimizing the current system and looking for “quick wins” – focusing on execution issues versus immediately revamping the go-to-market strategy – companies can drive more immediate, improved top-line growth. Getting the strategy right is important, but most companies we see have a more rigorous, one-time strategy process, and then fall down on injecting discipline into sales and marketing execution.

By analyzing our experience with clients across many industries, we have identified 10 execution areas that are common sales and marketing trouble spots with the greatest revenue-improvement potential. By starting with the three or four areas that resonate most strongly for your organization, technology company leaders will see revenue expand and establish a systematic approach for driving continued growth.

1. Segment the market and target high-priority customers

All customers are not created equal; the time a company spends pursuing new customers and growing existing customers should not be evenly allocated or overly indexed to one or the other. Nor should it be left to individual reps to determine how to spend their time as most will gravitate to loyal accounts that are comfortable rather than to those that will bring the most growth, such as customers where the company has a lower share of wallet or prospects with a higher propensity to buy.

Effective segmentation and targeting strategy identify the most attractive customers, both prospective and existing, so sales and marketing organizations know where to focus and what to message. It also accounts for buyer values and decision-making criteria, so the sales team clearly understands how to win in each segment. When salespeople understand what is important to different buyer groups — and which prospects in that group are most valuable (e.g. high growth, quicker time to cash) — they can home in on the messages that will best resonate with each prospect, increasing the likelihood of a high-value win.

2. Develop meaningful account plans with prescriptive closure actions

Many sales reps view account planning as unnecessary additional paperwork — a “homework assignment” that is more about checking boxes than about creating something of value. But good account plans are indispensable in driving revenue growth. They enable reps to chart a plan with prescriptive closure actions for new-product growth, expand penetration of existing accounts across multiple buyers, and proactively identify needed support resources. They facilitate coaching conversations, giving sales managers a tool to coach strategy and measure progress. Over time, they enable companies to build organizational learning on what does and doesn’t work.

Unfortunately, most account plans don’t achieve this as they tend to be historical and impotent, failing to get to the heart of a closure plan. By requiring clear action plans for each key customer account – including tasks, owners, and timing – companies create a shared vision for a high-value account of what needs to happen by whom and when. They also create clear accountability and identify critical resource requirements. These don’t need to be long documents — many effective account plans can becommunicated in a few pages. But they should be entered into the CRM system and reviewed and updated periodically. They are company assets – not just an individual sales person’s asset – which eases transitions during rep turnover. Sales organizations lacking detailed and effective customer account plans will struggle to focus on the right actions to grow their business. They simply wind up reacting to requests and selling legacy products.

3. Create outcomes by driving activity with leading and trailing indicators

Business leaders aiming to inject discipline into the revenue-generation process must drive outcomes by driving activity with leading and trailing indicators. It is crucial to establish and track a defined set of indicators that aligns with growth initiatives. Lacking a focused set of activities that yields measurable outcomes, tracked by leading and trailing indicators, companies will base decisions on assumptions, anecdotes, and outdated information, perpetuating poor revenue performance.

Both leading and trailing indicators are valuable. Leading indicators track the front-line rep activities that effectively predict pipeline conversion, including the amount of face-time spent with customers, coaching time, number of ride-along, number of account plans tracked in the CRM system, etc. Trailing indicators provide a fact base about a company’s conversion rates/bookings, show revenue performance over time, reveal growth opportunities and problem areas, and help leaders gauge progress and guide sound decision-making. Good indicator tracking plans encompass only those data points that relate directly to a company’s growth aspirations and levers. Don’t track a metric just because others track it or because it’s the way things have always been done. Simplicity is key here.

4. Establish strong sales management processes

One of the most powerful revenue improvement levers available to a CEO and head of sales is top-notch sales management which relentlessly inspects customer and front-line activity. Putting effective front-line sales management at the helm of sales teams has a far greater impact on performance than just upgrading the talent of individual reps. Great sales managers actively engage with their teams and customers and can lift the performance of an entire team while mediocre managers degrade team performance and often prompt top performers to leave.

One of the traits that define a great sales manager is excellent coaching – both in quality and frequency. Yet despite the well-documented advantages of formal coaching, only about 20% of companies have a process identifying appropriate coaching activities (group meetings, individual meetings, ride-along, celebrating successes, etc.), appropriate activity cadence, and tracking across managers. In other words, roughly 8 in 10 firms are missing out on a potent opportunity to drive revenue growth.

Example of Sales Manager Coaching Cadence

| Weekly | Monthly | Quarterly |

| Review each sales rep’s dashboard and recent activity | Review the previous month’s performance for each sales rep | Schedule a meeting with a sales rep to perform territory planning |

| Discuss execution of account/ territory plans | Identify individual strengths and areas for improvement and share them with a sales rep | Schedule face-to-face visit with a sales rep to perform ride-along, observe behaviors, strategies and provide feedback |

| Review weekly activities and tactics (e.g., the goal of meeting with 5 important customers/prospects per week) | Develop individual coaching plans to address weaknesses and capitalize on strengths | Conduct more frequent ride-along for new sales consultants and low-performing sales consultants |

| Help guide efforts and answer questions where needed | Leverage role-playing in coaching where appropriate | Evaluate sales rep time allocation and adjust appropriately |

| Share best practices—highlight successes |

Another important hallmark of great first-line sales managers is that they are aggressively out in the field with customers and overseeing team members on account calls. Their engagement in the field – not behind a desk – is one of a company’s highest points of leverage in achieving goals and making sure the company and its agents present the right face to the customer. Few companies do this.

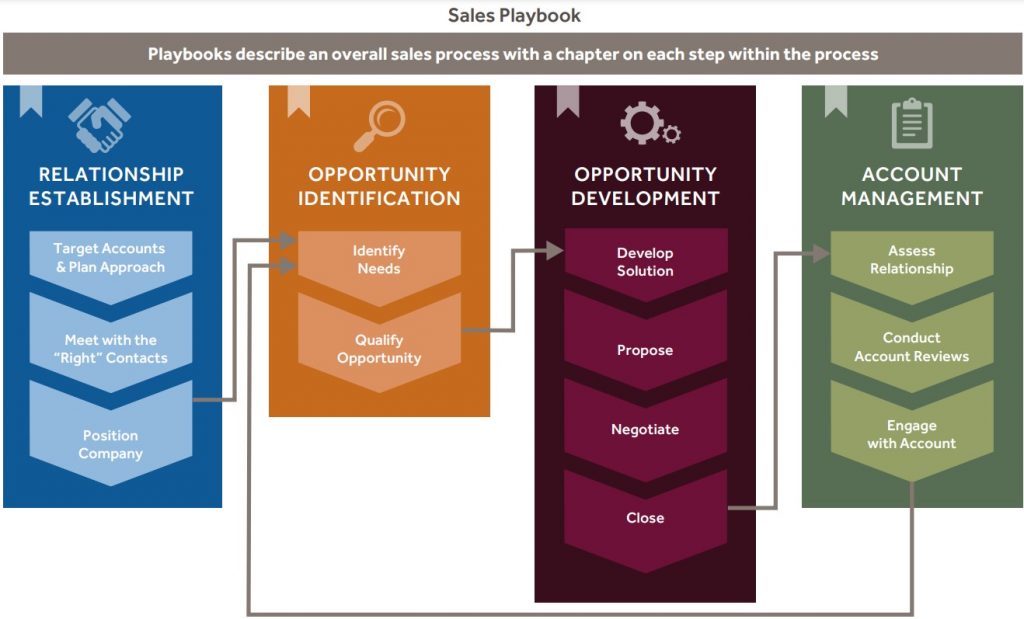

5. Document a “Company Way” of selling in a digital sales playbook

Over time, every company builds knowledge about the most effective method of selling for different sales motions for both direct and indirect sales. A key to revenue growth is spreading this knowledge throughout the company so it becomes truly institutional, not just resident in the heads of senior sales leaders or the highest performing reps. The best way to codify and document the company way of selling is to create playbooks — digital manuals of best practices that provide step-by-step instructions for accomplishing the key responsibilities of different sales roles. Their content provides the tools and templates to help guide thinking and activities, improve the effectiveness of the average rep, speed onboarding and training of new reps and ensure institutional knowledge isn’t lost through turnover.

Playbooks are living documents. Sales and GTM are constantly in a state of transformation as markets mature and competitors come and go; playbooks should be continually updated to reflect these changes and incorporate the latest knowledge and best practices.

6. Create a proactive, data-driven sales operations function

Many technology leaders view the sales ops function as largely administrative – a team that exists to mine data and produce spreadsheets. But in our experience, sales ops is one of the fundamental differences between good and great sales performance – a key to quick wins and sustained success. In organizations where the function is more strategic and proactive, it has a significant, positive effect on many key markers of performance. In its 2018 Sales Operations Optimization Study, CSO Insights observed, “Sales operations deserves more attention than it currently gets because the function literally designs, builds, maintains and evolves the sales system that serves as the foundation for everything your sales organization does.” High-value sales operations functions have their hands in nearly every aspect of sales effectiveness. They proactively deliver decision support to the executive team that drives high-level, critical decision-making. They implement and manage the tools and technologiessellers need to operate effectively. They are heavily involved in forecast and pipeline management as well as in delivering real-time metrics on individual and team performance that enables leaders to drive performance improvements. Through modeling, they help leaders see the impact of potential territory re-designs, compensation re-designs, and sales organization restructuring. If this doesn’t sound familiar, upgrading your sales ops function could be a high-impact quick win for your organization.

7. Maximize selling time

Do you know how much time your sellers are spending on customer-facing activities? In almost every organization, sales teams complain of being overburdened with administrative activities and not having enough time to spend with customers. But most companies don’t have a factual basis for understanding and addressing this issue. By conducting a short study to identify how much time the sales force spends on different activities, company leaders will better understand how salespeople spend their days and discover opportunities to increase selling time.

A key goal in any study is to identify ways to eliminate non-value-added activities. For example, if the study reveals sales reps are spending a large percentage of their time on administrative activities that could be automated or shifted to sales support, leaders can make those changes and free up that time for sellers to spend with customers. Processes and responsibilities may need to change in order to drive results. Similarly, it is important to circle back and measure that reps are using the time they’ve gained through this effort on customer-facing activities. Without follow-up, it is easy for the extra time to get absorbed by other low-value activities.

8. Leverage a CRM system to enhance coverage, knowledge, and outreach continuity

CEOs and sales leaders of tech companies often spend millions on CRM systems only to find the systems are underleveraged and, as configured and used, don’t provide the visibility into customers and sales activities that is necessary for systematically enabling decision making and driving growth. Nearly every technology company, large or small, owns a CRM system – in some cases, three or four of them following acquisitions – but it is rare to find a company using these systems at their maximum potential. Many CRM systems are selected by executives without critical input from sellers, so the systems and interfaces wind up being a poor fit for how the sales team works on a day-to-day basis. It’s also not unusual for sellers and front-line managers to rely on off-line spreadsheets or “shadow” systems they feel more accurately reflect the data and information they need to be successful, making the company’s system irrelevant and not the “single source of truth” of the health of the sales engine.

For most organizations, CRM offers a powerful opportunity to drive improved performance. The CSO Insights’ 2018 Sales Operations Optimization Study found organizations with “greater than 75% CRM adoption that have a formal or dynamic sales process out-perform organizations with only a random or informal sales process by 14.9% for win rates and 19.3% for seller quota attainment rates.” The first part of that finding – “greater than 75% CRM adoption” – is key. When used consistently, CRM systems coupled with sales playbooks and account plans enable increased sales productivity through contact management, tasks, calendars, etc.; better customer profile information; greater visibility into buying behavior; and a more complete understanding of market penetration. For marketing, a CRM system provides a more complete contact database for marketing activities as well as a source for measuring the relative value of content, channels, cost per lead, etc. And for sales managers, the system provides visibility into sales time allocation as well as more accurate measurement of activity and performance in sales and marketing.

| CRM BENEFICIARY | KEY BENEFITS |

| Sales | Increased sales productivity through contact management, tasks, calendars, etc. Better customer profile information Greater visibility into buying behavior More complete understanding of market penetration |

| Marketing | More complete contact database for marketing activities Potential to measure the relative value of content, channels, cost per lead, etc. |

| Management | Better visibility into sales time allocation More accurate measurement of activity and performance (both sales and marketing) |

CRM systems do not automatically yield these benefits. Those benefits are only achieved if support and discipline are driven from the top, if everyone uses the system if the information is accurate and current and if there are clearly defined metrics aligned with the desired growth levers.

9. Optimize pricing discipline and effectiveness to ensure value-based selling

Pricing is one of the most effective profit-generating levers available to companies. On average, a 1% increase in price yields a double-digit increase in operating profit. However, effective pricing isn’t about simply raising prices — it is a complex area that encompasses many elements including base pricing, discounts, recouping cost-to-serve elements, charging for ancillary services, and more. For most technology companies, the initial goals for pricing effectiveness should be to reign in unwarranted discounts or discounts and channel incentives that do not yield an attractive ROI and to get paid for customer practices that increase the cost-to-serve. Such costs include customizations, help desk, non-contracted technical support services, and other special efforts.

Achieving these goals starts with monitoring unearned customer discounts and understanding why customers with similar volume levels are given vastly different prices. It also means developing a complete understanding of total cost-to-serve at a segment and customer level. Most companies do not capture the full extent of cost-to-serve components and thus do not get full compensation in their prices. Once companies capture the right cost elements, better pricing decisions can be driven for those segments and customers who are being over-served, either by raising prices or reducing services.

10. Align incentives with specific growth aspirations

As companies evolve their product portfolios and their growth and go-to-market strategies, they need to ensure their sales compensation plan remains aligned with those changes and has an appropriate balance of risk and reward, otherwise, they risk failing to incent new growth behaviors – or worse, incenting the wrong behaviors resulting in unintended consequences. This puts their revenue goals in jeopardy.

| Incentive Principle |

| Significant: reinforce a “pay for performance” culture with significant differentiation between high and low performers. Primary metrics should be aligned with the outcome delivered by the role |

| Simple: incentive metrics should be kept as simple as possible to drive focus and limit confusion |

| Immediate: incentive payouts should match each role’s sales cycle and operating rhythm |

| Aligned: sales reps should be paid based on their success and achievement of corporate strategic goals; comp should be aligned to margin and cash collection |

| Managed: managers should be paid based on their team’s success and manager competencies (e.g., goal setting, performance management, sales coaching) |

| Benchmarked: Pay philosophy should include a Target Total Compensation (TTC) for each role, benchmarked against the market |