Digital Headwinds in BioPharma: 3 Challenges to Driving Top-Line Growth Through Digital Channels

The U.S. healthcare system is undergoing a massive transformation that is forcing pharmaceutical, biotechnology, and medical device companies to re-evaluate their strategies for driving top-line revenue growth. As healthcare migrates from a cost-based to a value-based delivery model, drug and device manufacturers have the chance to play key roles in lowering the cost of care through reducing readmissions, encouraging adherence to care regimens, and helping to keep chronic conditions in check. As a result, brand and marketing leaders are seriously re-evaluating how best to educate and engage healthcare providers, patients, and payers on the value their products can deliver in today’s rapidly changing healthcare landscape. At the same time, these leaders are navigating a host of issues that challenge traditional approaches to promotions. Decreasing access to physicians, regulatory ambiguity around digital marketing, and other challenges have intensified the search for innovative and effective marketing methods.

“We can’t keep up with the digital pace … many of the programs we develop end up being irrelevant when they finally go to market.”

Digital Marketing Manager, Pharma

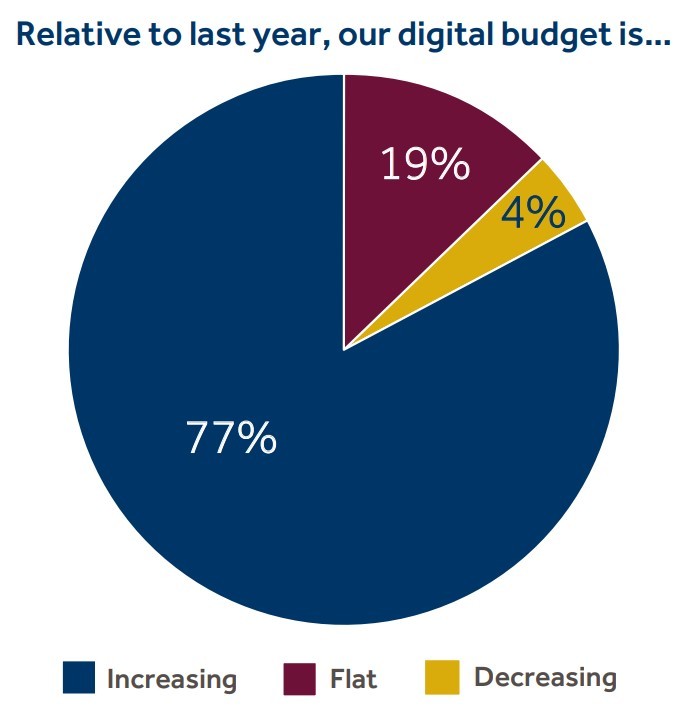

Unsurprisingly, many marketers are betting on digital channels as the way forward. Be it new technology platforms, sales enablement tools, or digital marketing tactics, there is little doubt that leading organizations are shifting significant resources toward digital endeavors. However, successful adoption and execution have been elusive for a large number of companies, which begs the question: What are the key challenges marketers face in the digital space, and what are leading organizations doing to overcome them?

We spoke with senior brand, marketing, and product leaders at pharmaceutical, biotechnology, and medical device companies to better understand the current state of digital marketing and advertising. From those conversations, three key challenges emerged that help explain why so many marketers face digital headwinds.

Organizational Barriers to Digital Adoption

- Reliance on legacy promotional channels creates adoption barriers

- Lack of internal resources

It’s hard to think of non-personal promotions as anything other than supplemental to our sales force … that’s just how our organization operates

Senior eMarketing Manager, Pharma

Ineffectiveness of Traditional Vendor Model

- Agencies of record struggle to deliver against digital expectations quickly and effectively

The ‘agency of record’ concept is outdated — using specialists produces better, faster results

Global Brand Director, Pharma

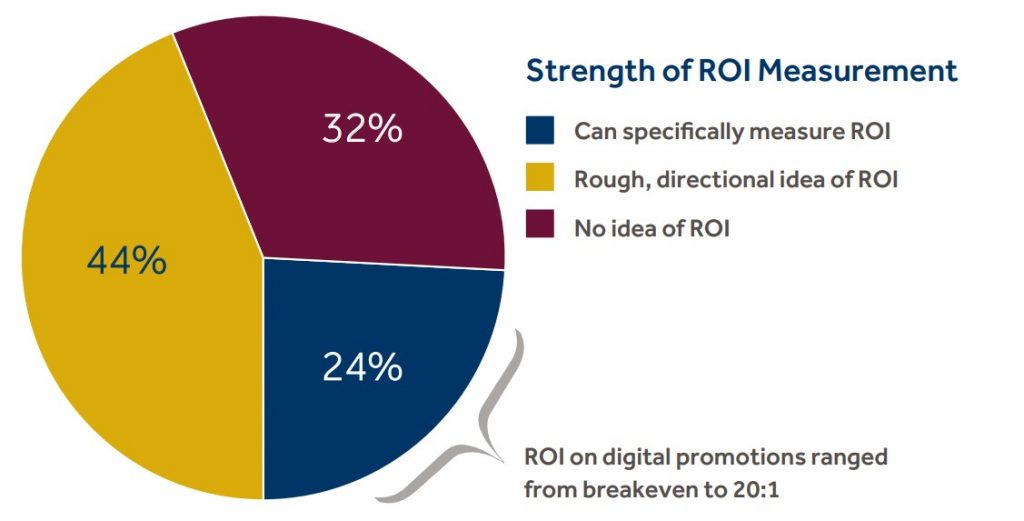

Difficulty Measuring Digital Results

- A majority of pharma companies are unable to measure results

- “Top of the funnel” metrics are common, but ROI metrics are not

Digital is a very nascent tactic for us. We have no definitive way to measure ROI, so we question how effective our digital efforts have been

Product Marketing Manager, Biotech

Challenge #1: Organizational Barriers to Digital Adoption

A confluence of three organizational factors have made digital aspirations particularly difficult to realize: legacy channel barriers, leadership barriers, and resource barriers. Legacy channel barriers, simply put, represent an organizational bias toward the field sales and detailing activities that have traditionally driven revenue growth. While this is mostly a problem for larger pharma and device companies, the perceived risk of scaling backfield activities perpetuates a reliance on in-person activities to drive results.

Second, digital initiatives generally stall without support from the executive suite. Since many senior decision-makers progressed through the ranks via the sales organization, they remain staunch supporters of the field sales team despite recent market developments. As a result, these decision-makers often reinforce the legacy channel bias. In fact, companies that are digitally progressive (at least by pharma industry standards) tend to be those with new leaders who mandated that the company find ways to become more digitally savvy.

These two barriers are made all the more challenging by a third barrier—lack of resources. Most drug and device companies, especially those focused on providers, simply did not have the personnel or infrastructure to be effective in the digital space. Some marketers with whom we spoke had limited CRM capabilities and were unable to track campaigns and marketing touches. While reliance on vendors and agency partners helps marketers execute, fully closing the gap requires more investment than most companies have been willing to make.

Many senior executives come from the sales organization— it is hard to convince them that digital promotions can be valuable, especially without hard evidence.

Multi-channel Marketing Director, Pharma

Challenge #2: Outdated Agency Relationship Models

External partners are a critical component of digital marketing efforts for pharmaceutical, biotechnology, and medical device companies. The pace of innovation in digital platforms and tactics is extraordinary, and most brand teams are fully comfortable relying on their agencies to bring new approaches to the table. However, many have expressed dissatisfaction with the ability of the traditional agency of record (AOR) model to deliver timely, high quality digital programs. A large part of the challenge for AORs has been the degree of digital specialization required. App development, user experience design, and campaign execution each require different capabilities and a single firm may not have top-notch talent in all areas. Thus, most large agencies contract with specialist firms in order to meet client needs. Aside from the extended lead time sub-contracting presents, drug and device marketers are also frustrated by the less favorable economics. Why not just work directly with the digital expert? While smaller or single-drug companies can manage several specialized agencies effectively, larger firms prefer to avoid the complexity of navigating numerous relationships, which can become particularly tricky when different franchises (and different brands within those franchises) each maintain separate AORs.

Defining roles and responsibilities among our brand teams, multi-channel teams, and agencies of record is a huge challenge. We constantly have

Global Marketing Leader, Biotech

to evaluate which group is best suited for the task.

Challenge #3: Difficulty Measuring Impact

Even when brands overcome organizational barriers and develop the right vendor relationships, they inevitably face the most challenging question of all: Are my digital efforts paying off? The answer to that question was resoundingly uncertain, ranging from “I think so, but I’m not sure” to “I have no idea.” Drug and device marketers have become relatively comfortable with some of the “leading indicators” of digital effectiveness—top-of-the-funnel metrics such as click-through rates or time on site are easily tracked and regularly reported. Understanding digital ROI, however, is quite rare. In many cases, marketers have only recently begun to ask how to quantify ROI. While measuring digital ROI is by no means easy (especially at the tactical level), developing an aggregate picture of prescription lift or increased procedure volume as a result of marketing is quickly becoming an expectation of senior executives. Although digital marketing budgets have generally been gaining share relative to other channels, brand and marketing leaders are also seeing the most scrutiny on these dollars.

How Organizations are Responding

To drive top-line growth, drug and device companies are using a number of strategies and tactics that include organizational changes, new investments, reprioritized tactics, and strategic partnerships, among others.

Some of the more effective approaches include:

- Evolving and Elevating the Role of Digital: While cross-functional, multi-channel marketing roles have become the norm at larger pharma companies, forward-thinking leaders have gone a step further, creating entirely new roles focused on chasing the cutting edge of digital. These strategists are charged with identifying, evaluating, and implementing digital innovations, which include both platforms and tactical executions. Some companies are also centralizing key activities in digital Centers of Excellence (COEs). The scopes of these COEs vary by company, but they often support the work of marketing by providing technical resources, developing standard formats (such as site design or templates), and making recommendations on external partners.

I’m pretty sure our ROI is positive, but I’m not certain. I think the industry as a whole is still trying to figure that out … it would be really valuable to have a clearer picture.

Senior Digital Marketing Manager, Pharma

- Funding Digital Experimentation: In addition to developing new organizational elements, marketing leaders are also setting aside funding to test new digital programs that could drive incremental top-line growth. To encourage exploration of truly novel programs, this funding sits outside the brand team’s standard budget. In practice, the incremental funds have led to a number of pilot programs that range from mobile application development to micro-targeted patient engagement campaigns. The results of successful programs are disseminated throughout the organization and, if applicable, rolled out to other groups who may benefit.

Best Practices in Overcoming Digital Headwinds

- Exploring New Partnership Models: To further address resource and capability issues, drug and device marketers are changing the way they engage with external partners. Franchise and brand leaders are engaging digital firms at the strategic level to ensure alignment with growth objectives and to leverage efforts across the portfolio. These partners receive a clear mandate: deliver strong ROI or risk losing the relationship.

Our team is quick to fire agencies and vendors who can’t prove how their value is driving our business.

Global Brand Director, Pharma

Marketers want greater visibility into the link between programs and revenue, which some external partners successfully address by demonstrating increases in prescription volume as a result of specific campaigns. To ensure that promotional dollars are well invested, brand leaders have also engaged in novel program designs that include at-risk fees or guaranteed ROI thresholds.

Though our conversations revealed common challenges in using digital channels effectively, it is clear that there’s no silver bullet to overcome them. The path to success will vary based on such organizational factors as size, the number of brands or therapeutic areas, primary marketing audiences, and available resources. As more pharmaceutical, biotech, and medical device companies ascend the digital learning curve, acceptable standards for successful digital marketing will only get higher. In this evolving, competitive environment, all marketers will ask whether their digital efforts are paying off. Those who can answer the question clearly by proving value will be the ones who thrive.