Driving Growth in Specialty Chemicals

Gaining Market Share in a Low-Growth Environment

The specialty chemicals industry has faced significant growth headwinds for more than a decade. Competition from emerging markets and a squeeze on prices by customers has led to an extended period of shrinking margins and slow growth. Chemical companies have responded to this tough environment by cutting costs and using acquisitions to drive an increase in top-line revenue. As 2019 draws to a close, however, there are indications that specialty chemical companies are finally seeing opportunities for stronger organic revenue growth in their existing businesses.

To learn more, Blue Ridge Partners recently conducted an online survey and held interviews with 25 CEOs and division heads with P&L responsibility in the specialty chemicals industry. Our aim was to better understand what investments they are making to gain market share in what remains a low-growth environment. After a recent period of consolidation in the industry, we wanted to know whether sales-driven organic growth was an important component of their plans.

We discovered that this shift in focus is real: specialty chemical companies of all sizes are seeing new opportunities for organic growth, and they now favor initiatives to gain market share and deliver new products and services overgrowth via acquisitions or a continued focus on maintaining margins mainly through operational improvements.

Focusing on Organic Growth

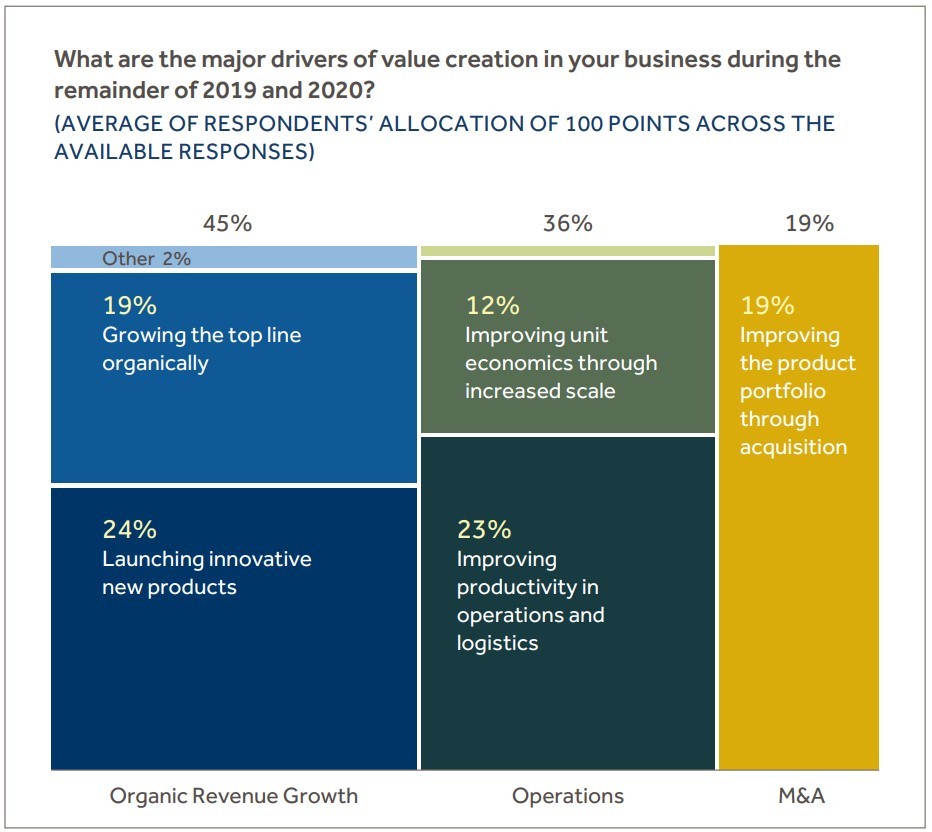

Our survey asked respondents to identify the major drivers of value creation for the remainder of 2019 and 2020, including multiple options for organic growth and operational improvements, as well as growth via M&A. Although improving productivity in operations and logistics remains a key priority for these chemical executives, they put greater emphasis on organic revenue growth options, which received more than twice the support of acquisition- led growth.

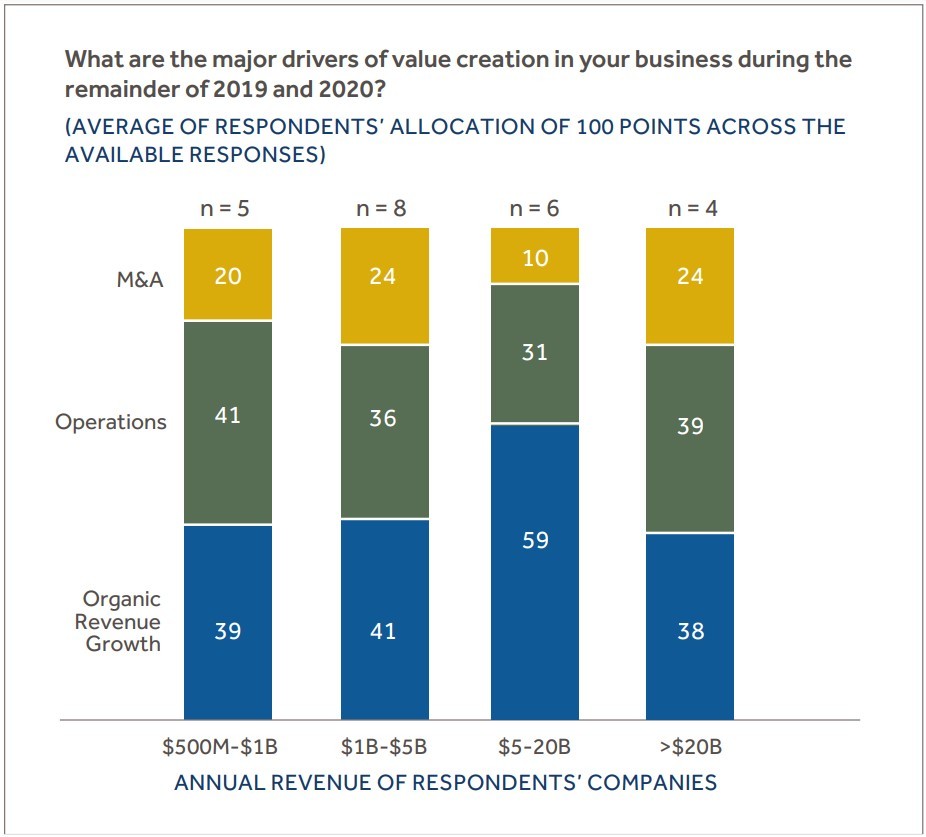

With respondents telling a clear story of the importance of organic growth initiatives—in particular, the strong focus on launching new home-grown products—we dug deeper into the data to see if this new turn away from M&A was specific to certain subsegments. When we separated these responses according to the size of each respondent’s company (in annual revenue), the relative importance of organic growth, operational improvements, and acquisitions was somewhat consistent regardless of size.

As the chart above demonstrates, each of the size segments put roughly equal importance on organic growth and operational improvement, both of which were clearly preferred over M&A. The one exception was in the large ($5-20B/year) segment, in which respondents had a very strong preference for organic growth over operational improvements and M&A. This suggests that these large chemical companies are seeing opportunities for new product launches and market share gains beyond the opportunities seen by smaller companies (and by the very largest).

Although portfolio expansion through merger or acquisition remains an important strategic growth driver for many specialty chemical companies, the lesser importance of M&A relative to organic growth reflects the recent experiences of the companies we surveyed. Some participants felt that post-merger integration (PMI) is often handled poorly without a well-structured playbook to help manage the process, which can severely limit the actual success of an M&A transaction. PMI efforts tend to focus on systems and processes (e.g., integrating the SAP systems), which are typically what the integration team is best equipped to handle. However, scant attention is paid to people or culture issues or to retaining and integrating the “soft” elements that made the company attractive in the first place, ultimately preventing the acquirer from capturing the full value of the acquisition. As a result, integrations often take longer than needed, don’t capture the revenue synergies available, and don’t focus enough on retaining at-risk people, customers, and channel partners.

Organic Growth Priorities

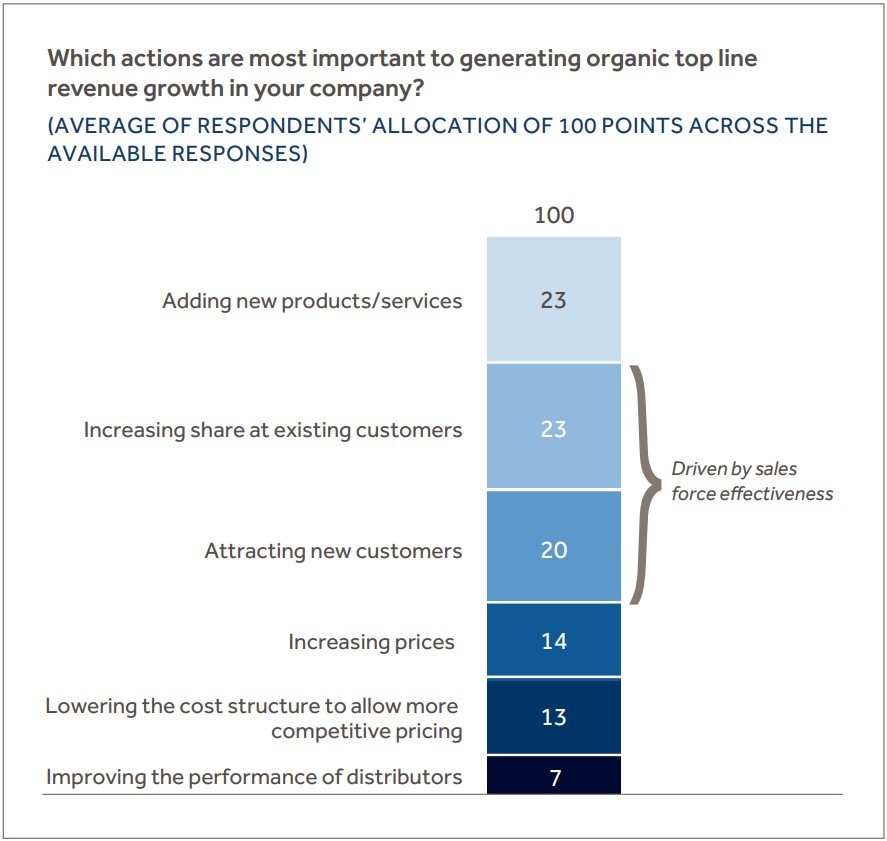

To better understand how these chemical executives viewed their organic growth opportunities, we asked them to specify which elements of revenue growth were their priorities over the next 1-2 years. We found that the launch of new products/services was highly rated at an average of 23 points out of 100 total points allocated, but this was eclipsed by the combination of two elements that are dependent on the effectiveness of a company’s sales force: the increase of wallet share at existing customers, and the addition of new customers. Together, these two sales force effectiveness measures comprised almost half of the total responses.

Regarding the rollout of new products/services, the respondents indicated that the impact of new product introductions on growth is often hindered by process constraints, such as:

- Not effectively leveraging field sales teams as a resource in generating new product/service ideas

- Poorly synchronized launch processes between the product development, marketing, and sales organizations, resulting in slower new product sales ramps and more limited market impact than planned

These results reveal that after years of cost-cutting and driving operational efficiencies, specialty chemical makers are now refocusing on the importance of attracting, training, enabling, and retaining high-quality sales reps.

Alignment between Senior Management and Sales

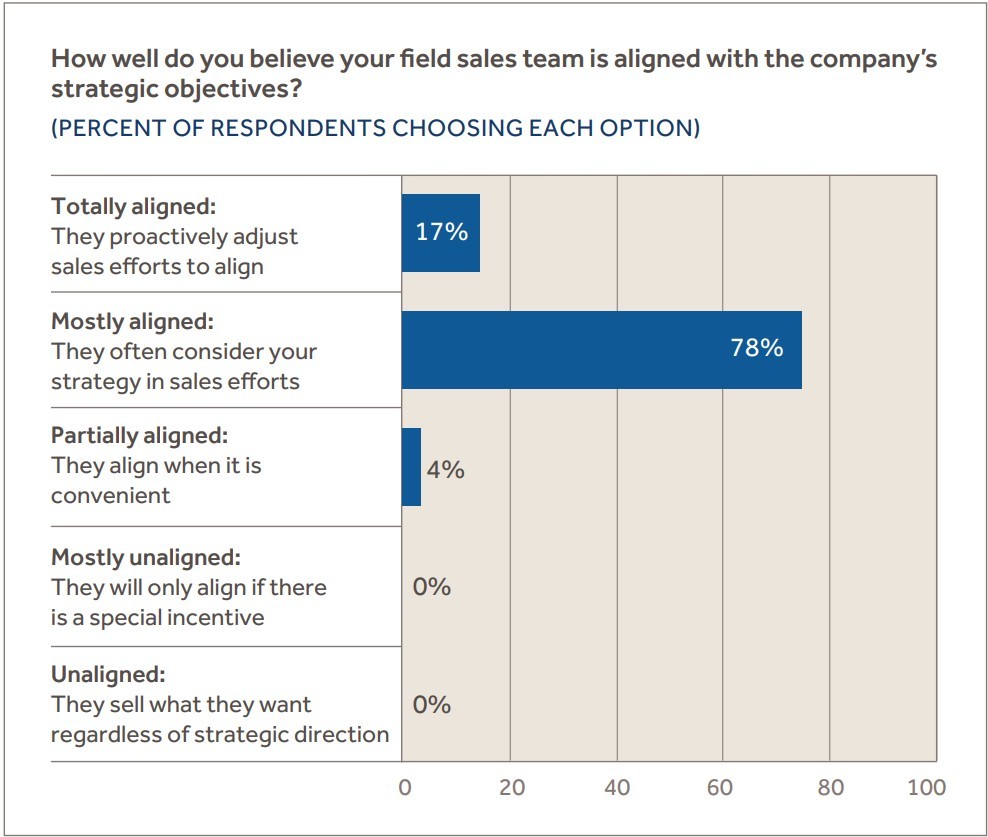

As new sales growth takes center stage with specialty chemical companies, a key issue they must address is the alignment between the strategy pursued by senior management and the priorities of their sales teams. When sales teams are not fully aligned with the strategic priorities of senior management, sales efforts can be counterproductive. Our survey revealed that while nearly every respondent’s organization was at least mostly aligned between management and sales, very few met the standard of full alignment.

These results reveal that although most specialty chemical executives have achieved good alignment with their sales organization, there is still much work to be done to ensure sales efforts are totally aligned with the strategy of the business.

Pricing as a Growth Driver

Specialty chemical companies are able to differentiate their products/services in many product categories, so value-based pricing can play an important role in their growth strategy.

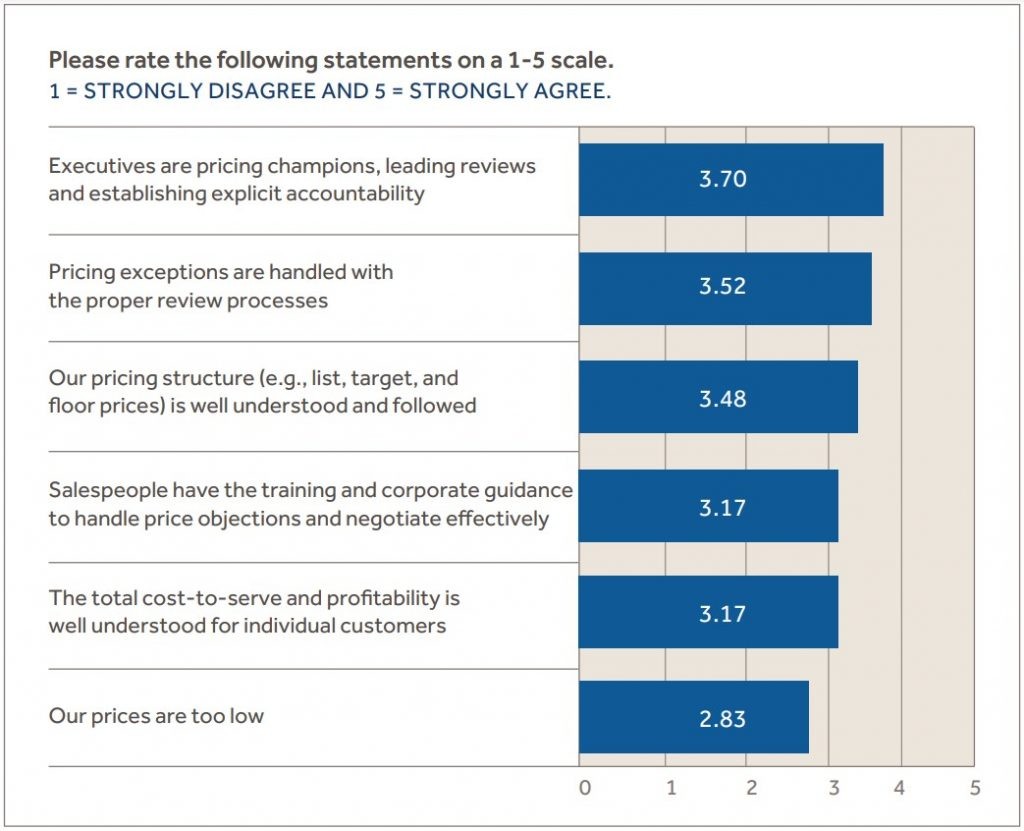

To better understand this key driver, we asked respondents how pricing processes and decisions are managed in their organizations. Although most survey respondents reported that executives in their companies were very active in setting and reviewing pricing policies, they were not as sure that their sales teams fully understood these policies and how to successfully negotiate pricing with customers. They also reported that customer profitability is not as well understood as it could be.

An interesting finding in this data is the final item: on average, respondents disagreed with the statement that their companies’ prices were “too low.” Given that one of the drags on specialty chemicals growth over the past decade has been the commodification of many product categories, the mild collective disagreement here that prices are too low suggests that the industry has successfully resisted succumbing to a “race to the bottom” mentality.

The Path Ahead: Improving the Sales Engine

Overall, participants were clear that specialty chemicals companies need to improve sales engine performance to accelerate organic revenue growth and capture greater market share. The interviewees we spoke to admitted there’s a widespread lack of focus on improving commercial excellence and suggested that this is an area of tremendous opportunity for organic growth, especially in the context of a relatively flat demand environment. M&A activity often complicates the sales management challenge and can serve as an excuse for the lack of sales performance improvements.

Salespeople in the chemicals industry are trained on products and technology but are often not adequately trained on how to sell. Many are weak on selling fundamentals and are prone to too quickly making price concessions rather than selling value. Value-based selling can drive significant organic growth, but long-tenured salesforces and embedded practices makes change difficult to implement.

That said, our interviews revealed that leading specialty chemical companies are beginning to focus on improving the effectiveness of their sales organization as a key competitive differentiator. Examples of recent sales effectiveness improvement initiatives by key players in the industry include:

- Implementing more disciplined sales processes and tools

- Getting a higher percentage of sales time focused on actually selling (it can often be 30% or less)

- Improving field sales manager skillsets and practices

- Increasing the use of “virtual” selling (a combination of digital communications and in-person meetings), coupled with advanced analytics

- Training salespeople on team-based and value-oriented selling

- Aligning incentive compensation plans with the strategic objectives of the business

- Improving the quality and retention of sales talent through clear role definition, effective hiring and onboarding, focused skills development, and career pathing

The sales function has historically been underemphasized by chemical companies in their quest for growth, while management focused on operational efficiencies and M&A to gain market share. In a low-growth environment there is a strong argument that improved commercial excellence through optimized sales performance, aligned pricing initiatives, synchronized product development, and launch campaigns, and focused post-merger integration can have a major impact on a specialty chemicals company’s ability to profitably gain market share. However, for this sales productivity improvement to occur, executives need to ensure the actions of their sales teams are fully aligned with the growth objectives of the business.