Getting Sales Compensation Right to Weather the Storm

Given the crisis in the world economy, most companies have experienced revenue drops, at times significant. These drops are limiting sellers’ ability to earn variable compensation, adversely impacting their motivation and retention. As a result, commercial leaders are adjusting compensation plans to boost motivation – but must weigh these adjustments against economic realities and the impact on overall cost of sales.

It is easy to misstep in this critical balancing act. When it comes to addressing compensation issues during a crisis, we see companies make two types of mistakes: 1) Paralysis – leaders are unsure if and how to change compensation plans, so they make no changes at all, or, 2) Overreaction – faced with plummeting sales and pressure to turn things around, leaders make dramatic changes to their compensation plan.

Those in the first group tend to watch as the situation deteriorates, hoping the crisis will be shorter than expected. Consequently, they run the risk of having to make significant adjustments quickly if business does not return. Leaders in the second group tend to make sweeping changes, not sufficiently thinking through ramifications, which may last past the downturn. For instance:

- One company was worried about retention of their sellers and took quick action to “make them whole” by guaranteeing a portion of their variable compensation for the remainder of the year. Sellers were happy to stay but were unmotivated to drive growth and push for target performance, ultimately slowing the pace of recovery from the downturn.

- Another company, trying to motivate top sales reps, adjusted the variable compensation rate on each closed sale from 3.5% to 6% for the balance of the year. This will result in a significantly higher cost of sales if volume recovers more quickly than expected.

- A third company cut the base pay of sales teams to match the rates of pay reduction for the other functions of the company, wanting to communicate a “we’re all in this together” message. But this action lost sight of the fact that sales reps’ income had already been cut when they could not earn variable compensation anywhere close to their target level, resulting in turnover of key sellers.

What are the right compensation adjustments to help motivate and retain sellers while managing cost of sales and position the company for a speedy recovery thereafter? This depends on many variables, including compensation mix (variable vs. base), plan type (commission vs. bonus), disparity in individual performance, the magnitude of impact the crisis is expected to have on the current year’s performance, size of sales force, and other criteria specific to the sales model.

Commercial leaders can use the following principles to define compensation adjustments and techniques that work for their organization in a crisis:

- Target adjustments to incentives that encourage productive activity and drive the highest priority behaviors.

- Choose compensation adjustments with shorter, rather than longer-term, impact whenever possible in light of elevated uncertainty.

- Align the financial impact of adjustments with broader cost-optimization objectives.

- Communicate to the sales team in ways that generate and maintain high levels of energy in day-to-day activities.

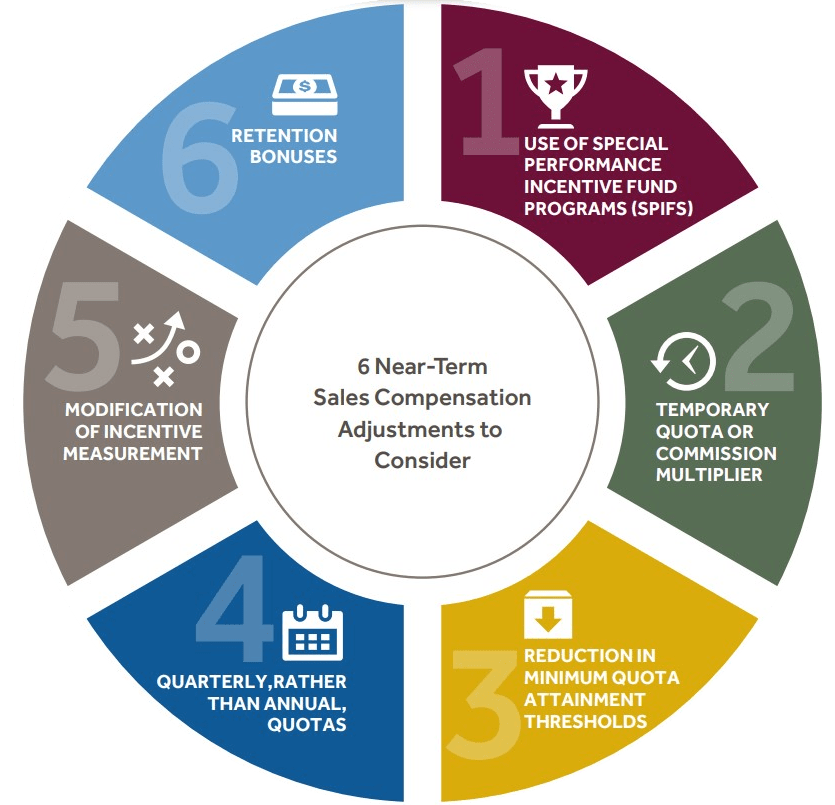

We recommend tailoring a set of six potential near-term sales compensation adjustments to balance the motivation and retention benefits with economic realities.

6 Near-Term Sales Compensation Adjustments to Consider

- Use of Special Performance Incentive Fund programs (SPIFs). Even in a crisis, effort is entirely within a rep’s control. A SPIF is a low-risk, temporary initiative that rewards effort while driving growth and staff retention in the short term. SPIFs are most effective when used to pay for predefined, leading-indicator activities expected to help reps fight back to their targets over time. For instance: ‘For each of the next three months, sales reps receive $1,000 if they identify 20 new opportunities and deliver 10 proposals (both approved by the sales manager).’ When near-term engagement with prospects and customers is difficult, the focus of SPIFs can be on rethinking accounts to target within a territory, revisiting account plans and developing call strategies.

- Temporary quota or commission multiplier. One of the biggest problems for sales compensation is quota achievement. Weaker demand naturally makes this difficult or impossible. This problem can be addressed via a temporary multiplier. For instance: for the next three months, compensation is 1.5x normal credit (i.e., quota attainment of $1.50 for every $1 in closed business / revenue; pay $1.50 rather than $1 for each $100 in sales).

- Reduction in minimum quota attainment thresholds. If your sales reps must meet a threshold before earning variable compensation or accelerator tiers, consider lowering the threshold (e.g., from 75% to 50% of quota). When doing so, consider reducing the payout rate ($ per 1% quota attainment or commission %) to the point where reps’ variable compensation at target remains unchanged. Similar to the quota / commission multiplier, this action makes short-term goals more attainable, motivating reps to higher levels of activity.

- Quarterly, rather than annual, quotas. This approach is better suited for situations where ales cycles are reasonably short and you want to keep reps motivated throughout the year, even if business declines for one or two quarters. However, this approach is less effective with lumpy deals (e.g., enterprise sales) and may encourage reps to delay certain deals in an effort to maximize variable compensation. Extending quota timeframes is another viable option but doing so increases complexity in future quarter over quarter and year over year comparisons.

- Modification of incentive measurement. There are cases where not all revenue generated retires quota (e.g., only certain products retire quota while others don’t). During and after the crisis, these restrictions may require redefinition so sales reps have an incentive to sell across products, geographies, customer segments, etc.

- Retention bonuses. This approach should be used sparingly as it guarantees additional pay regardless of activity or productivity levels. However, this tactic can help in retaining key sales reps when the risk of immediate attrition is particularly high. Ensure that bonuses are contingent upon continuous employment for a defined point of time (e.g., through year end, for 12 consecutive months).

What about quota reductions? While many companies consider a quota reduction during challenging periods, this is often not the optimal action due to reduced flexibility and difficulty forecasting full-year performance. Instead, consider the recommended actions above to achieve the same goals while retaining more long-term flexibility.

Additional Considerations and Enablers

Retaining and motivating sellers during a crisis period typically involves more than just modifying the compensation plan. You may also want to consider the following:

- Frequent communication with each seller to improve retention. These interactions (e.g., one-on-one calls) may cover specific questions and/or advice on keeping a positive attitude and staying focused on what reps can control. They are critical in a crisis, as that’s when competitors seek to poach top talent.

- Distribution of vacated territories. Following staff reductions (if applicable), consider reallocating territory and pipeline to retained reps, including top performers, while keeping quotas unchanged. By doing so, you strengthen reps’ motivation to stay with your company.

- Opportunistic hiring of high-performing reps. If funding is available and your company can successfully make a new-hire quickly productive, recruiting high performers from struggling companies can build bench strength for the future. Leveraging personal networks can help identify high performers looking for a new role. Before reaching out, define compensation adjustments (e.g., guaranteed variable compensation during ramp) necessary to entice them to join your company.

Any changes made to sales compensation plans need to be made considering broader cash preservation and cost containment strategies. For more information about these topics, please see our article, “Cutting Sales and Marketing Costs without Cutting Muscle.”

Now is the time to act decisively on sales compensation plans, balancing short-term and long- term impact, and aligning changes with strategic priorities. Regardless of the specific tactics selected, when dealing with a crisis it is better to make short-term changes that expire with the passage of time or when a turnaround arrives. While we cannot know when the economy will recover, the thoughtful actions taken today to address seller motivation, performance and retention will lessen the impact of the crisis and position the company for a strong recovery when the market rebounds. For further information please contact us at [email protected] or visit us at www. blueridgepartners.com.