Revenue Growth Is the #1 Driver of Private Equity Value Creation

For years, we have maintained that profitable revenue growth is the most powerful and durable driver of private equity returns. While financial engineering, cost optimization, and multiple expansion can contribute to value, they are rarely the primary engine of sustained outperformance.

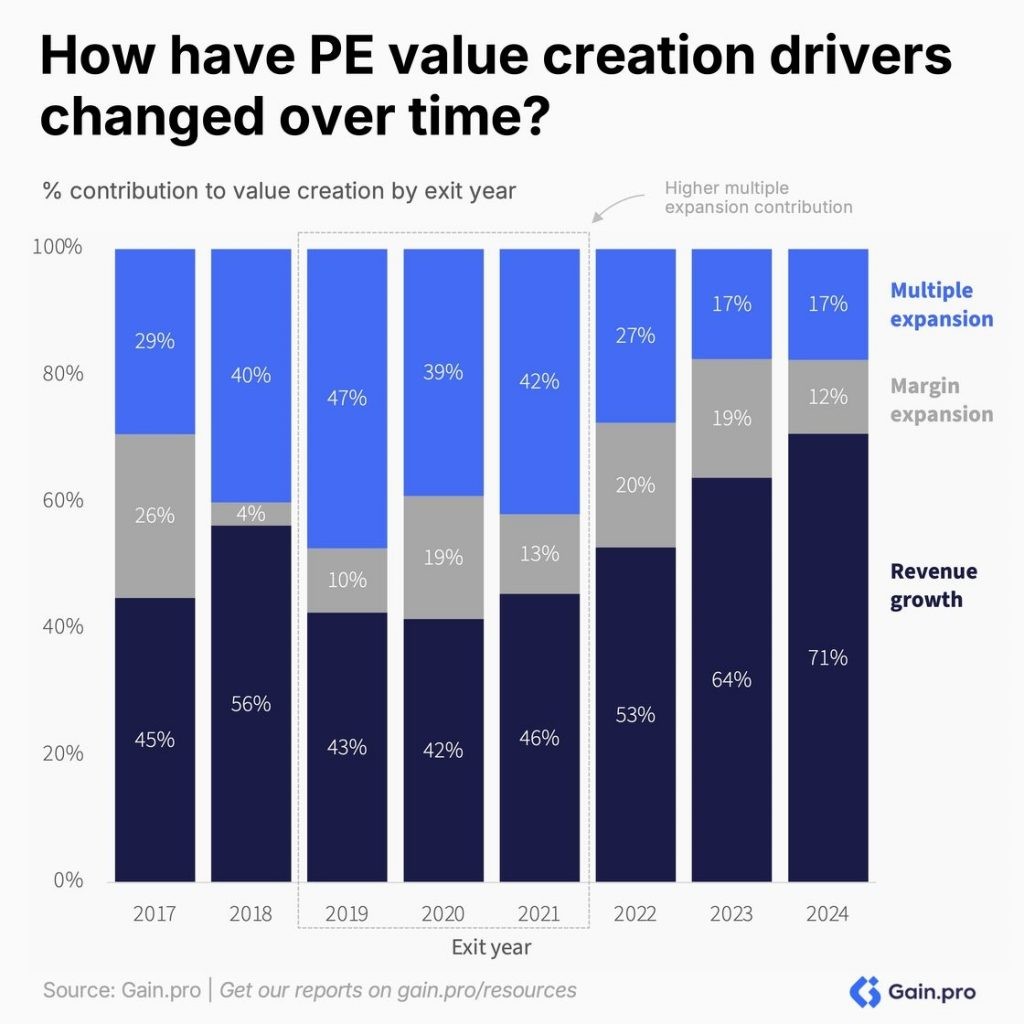

Today, new large-scale market data reinforces this view. According to Gain.pro’s 2025 Private Equity Value Creation Report, revenue growth accounts for 54 percent of total value creation across more than 10,000 global PE investments. By comparison, multiple expansion contributes 32 percent and margin improvement just 14 percent.

The conclusion is not new to us. But it is increasingly unavoidable for the market. Revenue growth is the central lever of private equity value creation.

Why Revenue Growth Matters More Than Ever

The private equity environment has shifted. Higher interest rates, longer hold periods, and more cautious buyers have reduced the reliability of traditional value creation levers.

Cost reduction remains important, but it is finite. Multiple expansion has become less predictable. And leverage is more expensive.

In this environment, the firms that outperform are those that treat growth as a discipline, not an assumption.

The Gain.pro report reinforces three realities:

- Revenue growth drives more than half of total value creation

- Multiple expansion contributes meaningfully but is far less controllable

- Margin improvement matters, but it rarely creates enough lift on its own

In short, profitable revenue growth has become the most scalable and repeatable path to sustained outperformance.

Why Revenue Growth Compounds Value More Than Any Other Lever

Revenue growth creates value in two ways.

First, it increases earnings by expanding the revenue base and improving operating leverage. Second, it strengthens exit outcomes by improving buyer confidence and valuation dynamics.

This is why revenue growth is so powerful in private equity. It does not simply lift EBITDA. It can also improve exit optionality and strengthen the multiple applied to earnings.

Margin improvement matters, but it is finite. Multiple expansion is uncertain. Revenue growth is the lever that compounds.

Commercial Growth Must Be Intentional, Not Incidental

Many sponsors already recognize that growth is essential. The challenge is that growth is often underwritten without sufficient clarity on whether it can realistically be delivered.

Market diligence can confirm that demand exists. Financial diligence can validate historical performance. But too often, investors enter the hold period without a fact-based understanding of whether the company’s commercial model is capable of executing the growth plan – creating a commercial blind spot during diligence.

This is where many investments fall short.

Two companies can operate in the same market, facing the same tailwinds, and still produce dramatically different outcomes. The difference is execution.

Sustainable revenue growth is determined by what happens inside the business: pricing discipline, sales productivity, pipeline conversion, customer retention, and the operating cadence that drives commercial performance – areas where the commercial AI execution gap often limits impact.

The Revenue Engine Is the Real Source of Differentiation

In our work across more than 1,300 companies globally, we have seen that profitable revenue growth comes from a small set of repeatable commercial disciplines. These disciplines form what we refer to as the Revenue Engine.

The strongest portfolio companies build growth through:

- Pricing strategy and pricing realization governance

- Sales effectiveness and productivity improvement

- Pipeline quality, conversion discipline, and forecasting rigor

- Customer segmentation and targeting clarity

- Retention and expansion execution

- Commercial operating cadence and performance management

These are not theoretical levers. They are the day-to-day drivers of revenue durability and growth acceleration.

In today’s market, commercial excellence is not a functional improvement initiative. It is the defining driver of private equity value creation.

What the Best PE Firms Are Doing Differently

Top-performing private equity firms treat revenue growth as a proactive strategy, not a post-close aspiration. They do not assume growth will occur simply because the market is attractive. They build the conditions required for growth to become repeatable.

We consistently see leading firms do three things differently.

1. They Pressure-Test Growth Before Close

They validate not only the market opportunity, but whether the company’s commercial model and execution capabilities can realistically deliver the forecast.

2. They Launch Value Creation Immediately Post-Close

They use the diligence window to establish a fact base, align with management, and prioritize the highest-impact initiatives so execution begins on Day 1, not Month 9 – avoiding lost months of value creation.

3. They Focus on a Few High-Impact Commercial Initiatives

Rather than spreading resources across dozens of initiatives, top firms focus on three or four commercial moves and execute them with discipline. This is where outsized impact is created.

The result is faster time-to-value, stronger momentum through the hold period, and greater conviction at exit.

Revenue Growth Is Now the Defining Driver of PE Performance

The Gain.pro findings reinforce what the market is already signaling: revenue growth is the largest contributor to private equity value creation, and its importance is increasing.

In an environment where multiple expansion is less reliable and margin levers are finite, profitable revenue growth remains the most scalable and durable path to outperformance. The firms that win will be those that treat growth as something to be built systematically, not assumed in underwriting.

Next Steps for Private Equity Leaders

For both deal and operating partners, the question is not whether growth matters. It is whether the Revenue Engine is built to deliver it.

Blue Ridge Partners works with private equity firms and portfolio company leadership teams to strengthen commercial execution, accelerate profitable revenue growth, and translate diligence insights into actionable value creation plans. If you would like to discuss how to make revenue growth a more deliberate and durable driver of value creation across your portfolio, contact us at [email protected].