The Untapped Potential of Aftermarket Revenue

Long ago, getting parts or service for a piece of equipment was simple: if you bought a John Deere tractor, you would go to a John Deere dealer for what you needed. Today, that purchase looks very different. Over the last 50 years, more and more of the aftermarket has been snapped up by independent companies who are often cheaper, more conveniently located, and easier to do business with than the OEM. As a result, when today’s equipment owners need parts or services, they are just as likely to head down to their local independent parts and service distributor as they are to think about going to the manufacturer’s direct or proprietary distribution.

Aftermarket “leakage” has accelerated rapidly over the past 2 decades and it is time for OEMs to recapture it.

While the seeping away of aftermarket revenue from OEMs is a trend that’s been unfolding for half a century, it has accelerated in the last two decades as manufacturers have focused more intensively on selling their original equipment, causing an erosion of their aftermarket value proposition. Independent distributors and servicers have filled that gap with robust offerings that are drawing millions of dollars away from OEMs. By our estimate, the aftermarket revenue “leakage” in heavy and light equipment today – i.e., the amount of revenue an OEM could be capturing and isn’t – ranges from 25%- 50% of total revenue.

To look at it another way, within the first ten years after a piece of equipment is sold, OEMs should earn as much in aftermarket revenue as the original equipment cost – but they are not. This not only costs millions of dollars in lost revenue, it’ also has a negative impact on shareholder value. In an analysis of 21 public manufacturing companies including both end-use equipment and major component manufacturers, Blue Ridge Partners found that for every 10% increase in aftermarket revenue, a company’s stock price increases by 7%.

Aftermarket is a huge opportunity. To drive growth and increase value, manufacturers should focus on it. The question is: How do you capture it?

Three-Pronged Approach

Pursuing aftermarket business can seem a herculean undertaking for OEMs that have not been focused here. In the vast aftermarket spectrum, what, specifically, should you pursue?

How can you begin to compete with independent service providers and parts distributors that have established large operations with nationwide coverage, low prices, and fast response times? Where do you start?

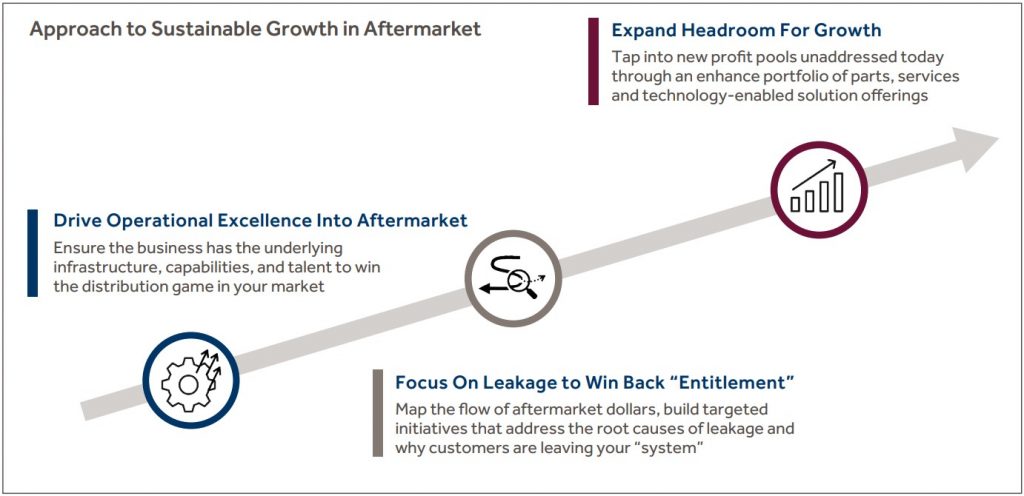

We recommend a three-pronged approach to address leakage and reclaiming aftermarket revenue entitlement. This approach enables companies to increase sales of traditional parts and services and also raise the water line by moving into new spaces such as technology-enabled services and solutions. The starting point is to improve the value proposition by driving operational excellence into the aftermarket business. In most cases, OEMs lack the basic blocking and tackling to win aftermarket – it is easier for a customer to go outside of the OEM’s designed customer experience and purchase the part or service from someone else. The second prong in our approach is winning back your entitlement by “plugging the leaky bucket”. This is done by identifying where leaks exist and building specific programs to fix them. Finally, when the holes are plugged, OEMs can expand headroom for growth by selling new services (usually technology-enabled solutions) that address the higher-order business problems of targeted customer segments.

In most cases, these three actions should be taken stepwise. It is impossible to plug leaks or drive expansion without operational excellence and a compelling value proposition. However, companies might find themselves at different starting points of this journey depending on the maturity of their aftermarket program.

STEP 1: Drive operational excellence into the aftermarket.

Most OEMs have focused so intently on selling their original equipment that they do not have the value proposition to win in the aftermarket. Their delivery time is not 24 hours. Their backorder resolution time is much longer than most independent distributors’. This is a fundamental problem; OEMs simply cannot win in the aftermarket until they improve their value proposition sufficiently to compete with the independents whose sole focus is to deliver excellence in the aftermarket arena.

When we assess a business’ aftermarket operations, we often find issues with parts availability, pricing, or the ordering process. At most OEMs, there is ample opportunity to improve operations that support these elements. Take the issue of parts availability for instance. We benchmarked one manufacturer whose parts availability was only 68% compared to a market threshold of 95% in that industry. When we asked this company’s customers why they were choosing to go to their local parts dealer instead of the OEM, 4 in 10 cited the lack of available parts at the manufacturer as a reason for taking their business elsewhere.

When a company is looking to improve its value proposition and operational capabilities, it is helpful to ask a series of introspective questions in three critical areas of aftermarket performance:

- Parts. When it comes to parts, most OEMs lag in four areas that are key to reducing leakage: availability, pricing, backorder time, and ordering process. Ask yourself… Do you have parts availability compared to, say, NAPA Auto Parts? Do you have the right delivery time and quality to take back the share from distributors? Do you have enough portfolio parts or are you selling only propriety parts? Can customers order online without setting up their own accounts? Do you have competitive and optimized pricing? There are many things to consider here when it comes to establishing a winning value proposition.

- Technical services. Do you have smooth delivery, set-up, installation, and handoff? Do you have the right field coverage? The right documentation to enable users to perform self-service? The good news is that most manufacturers meet “threshold” levels

of technical service because they have focused on it. The most common areas of improvement are in delivery, set-up, installation, and handoff, though making smaller tweaks to this area can help lay the foundation for future growth. - Commercial Operating Capabilities. Do you have an underlying commercial system that is sufficiently effective and efficient to tap into lost aftermarket revenue? For instance, do you have a structured installed base of machines to sell against and is

it uploaded into your CRM in a way that inside reps can prospect and leverage? Do you have an automated marketing system, sufficient e-commerce platform, and

customer portal that will enable you to transact quickly with customers? Each of these commercial capabilities is foundational to driving excellence into the aftermarket and without them, dollars will be left on the table.

In addition to the above, there are other areas where operational excellence is needed and typically prove fruitful for near-term aftermarket growth:

- Pricing management & controls

- Inventory management

- Warehouse management

- SBOM management & service tech

- Installed base creation and integration into the CRM

- Marketing automation

Before deciding on which opportunity to pursue, organizations must benchmark to identify if they have the value proposition to win in the distribution game and understand how much improvement is needed to shore up leakage. Done right, these initiatives can have an immediate impact. Operational excellence is not only the foundation of aftermarket transformation, it is also a key growth driver that can have an in-year impact.

STEP 2: Focus on leakage and root causes to win back entitlement.

Driving operational excellence in a system will plug some leaks and help to capture some aftermarket, but to actively win back entitlement requires an understanding of how dollars flow outside your system – and a plan for bringing them back in. In mapping the dollar flow, most OEMs discover there are several points in a customer’s journey where that customer must step outside the OEM’s structure to get the required service level.

For example, if a customer needs a critical part and it is available faster and cheaper from an independent distributor, customers won’t hesitate to take that detour. Where and why are customers leaving your system? That’s the first thing to understand in seeking to win back entitlement – and the best way to get the answer is to map the parts and services dollar flow of your leakage, then map the dollar flow across your industry and competitors. Depending on your data, this exercise should not t take more than a few weeks. We recently analyzed this for a client and found four addressable areas of leakage, as well as a few others that were outside of their control. It is critical for OEMs to assess which points of leakage can be plugged and which cannot. For this client, there were four leakage points they could tackle:

- Customers were purchasing parts from independent distributors instead of the OEM

- Independent service dealers and “mom & pop” mechanic shops had better locations and the client was not controlling the point of service sufficiently

- Service dealers and mechanics were going direct to distributors, not to the OEM, to purchase parts

- End customers and servicers were going to competing OEMs for all their parts despite having a mixed fleet.

Once you’ve mapped the dollar flows and identified specific profit pools of addressable leakage, you next must identify the root causes of leakage in each area. You’ll usually find multiple root causes for each addressable area. Let’s look at our client’s service center leakage. When we dug in to find out what was prompting customers to choose independent services centers over the OEM, we found six root causes driving that decision:

- Customers had their own in-house service centers and needed to see the value of outsourcing

- The OEM did not have enough technicians, service centers, or parts and its time to repair was too long

- OEM servicing options were too expensive compared to independent service centers

- The OEM’s maintenance service offerings were too limited

- The OEM was not aware, quickly enough, of when a customer’s machine went down

- Internal & external scheduling difficulties and time to repair lead customers to go elsewhere

From here, the path ahead is straightforward. When companies understand their addressable leakage and respective root causes, they are positioned to launch corrective initiatives. In short, when you frame up the problem correctly, with root causes and dollar flows, you will find the plan for plugging leakage and winning back entitlement begins to write itself.

STEP 3: Expand headroom for growth.

The final step in transforming your aftermarket business is to raise the water line by tapping into new profit pools through an enhanced portfolio of parts, services, and technology-enabled solution offerings. This means alternative services and solutions not currently offered by a company, but which have a high potential for driving growth. This step should only be taken after you have driven sufficient operational excellence into your aftermarket business, but companies can start to go here in parallel with step 2 of reducing specific areas of leakage.

There are typically three types of new profit pools into which organizations can expand to increase headroom. First, and most simple, they can backward integrate into new profit pools and parts that others are going after. Take hydraulics, for instance. Most OEMs do not make hydraulics; they outsource them. This means that companies like Caterpillar spend a lot of time managing many different base manufacturers, who are sending hydraulic parts all over the world. Often, delivery times are slow and the parts are critical and proprietary, so why not backward integrate into that profit pool? Otherwise, it is hard to address that leakage – and it’s usually a fairly sizeable profit pool.

The second type of new profit pool that increases headroom is forward integrating into services or distribution. Kone Cranes, for instance, was forward integrated into 600 service centers from 2001- 2016. The company recognized that success in the aftermarket relies largely on controlling the

point of sale and point of service. They knew if they could control the point of service, they could get their parts through those points of service and reclaim those aftermarket revenues.

The third type of new profit pool is value-added aftermarket services (VAAS). There are four broad types of VAAS that should be investigated as you build out your aftermarket services portfolio:

- Operating Services (compliance, operation, operator safety & performance, & Jobsite readiness)

- Optimization Services (business process effectiveness and fleet & lifecycle management)

- Ownership Services (financial management services, and using services such as rental)

- Lifecycle Services (including maintenance & repair, equipment overhaul, and disposal)

Success in identifying, designing, and commercializing VAAS requires a manufacturer to shift from an engineering-out to a market-in mindset.

In our experience, operating services and lifecycle services generate the most pull as these are areas where customers are willing to pay and can adopt. That is key: a lot of times customers get excited about a new value proposition but are unable to adopt it as doing so

would necessitate changes to their underlying business systems. Also, as you decide which avenues to pursue, bear in mind you can usually charge 20-30% on an annual basis for unlocking value. In other words, for every

$100 you save the customer, you can charge $20-30. Understanding your customer economics and which avenues will unlock the most savings for them will be helpful in deciding which option to pursue. Identifying, designing, and commercializing a VAAS portfolio can be a challenge for manufacturers that are typically engineering-out-oriented firms and the key is to start with a more market-in approach to customer value, willingness to pay, and adoption potential.

Bottom line: There is an enormous untapped opportunity in the aftermarket for companies that follow this three-pronged approach to aftermarket transformation. It necessarily starts with establishing operational excellence, but this foundational step is an opportunity that generates in-year returns itself. It then lays the groundwork for you to recapture entitlement and expand across the value chain. Do not wait. Building a strong aftermarket business is the next wave in OEM growth – and to thrive in industrial manufacturing, companies need to be ahead of that wave.