Trends in Accelerating Sales

Interviews with Business Leaders Reveal Revenue-Acceleration Trends and Challenges

Profitable revenue growth is top of mind for U.S. business leaders with 100% of companies currently investing in accelerating sales. This is one of the key findings that emerged from a series of interviews with over 100 private equity leaders, CEOs, board members, and heads of sales representing more than 130 mid-sized to large firms.

Interview Details

The findings here emerged from a series of interviews conducted during the past several months. The authors spoke with over 100 business leaders, most of whom siton multiple boards and, in all, representing 130+ companies. The interview participants included:

- TITLE

CEO: 22%

Board Member: 43%

Head of Sales: 10%

Private Equity Principal: 25% - ANNUAL REVENUE RANGE

$200M – $5B+

The interviews, conducted by Blue Ridge Partners over the past several months, sought to understand where companies are currently investing. The represented firms spanned a wide spectrum. Despite that breadth, the interviews found nearly every company is in a business-model transition and facing top-line pressures, prompting leaders to place high importance on revenue acceleration to build momentum and be in a position to self-fund the remaining transformation activities. Moreover, the interviews exposed a widespread frustration with the sales operations function and its overall lack of impact on the transformation process, revealing a potent opportunity for organizations in transition.

Key Findings

Each interview asked six baseline questions:

- How important is accelerating organic revenue to your firm at this moment?

- Do you have a modest list of sales and marketing operational priorities you are prosecuting to achieve new performance levels?

- Is your progress limited by knowing what to do or how to execute?

- Where do you have shortages in talent, skills, and/or other areas?

- What are your key priorities for driving top-line growth that you plan on investing in over the next 12 months?

- Where and when are consultants embraced and most impactful to assist?

When we compiled all the answers, we found far more commonality among the responses than we had anticipated. Three key findings stood out:

KEY FINDING #1: Accelerating sales is a top priority. 100% of the interviews revealed that the CEO and/or board of directors is investing in accelerating sales. In most cases, leaders have established a short list of priorities for achieving that goal. In just a few cases, the priority list was long.

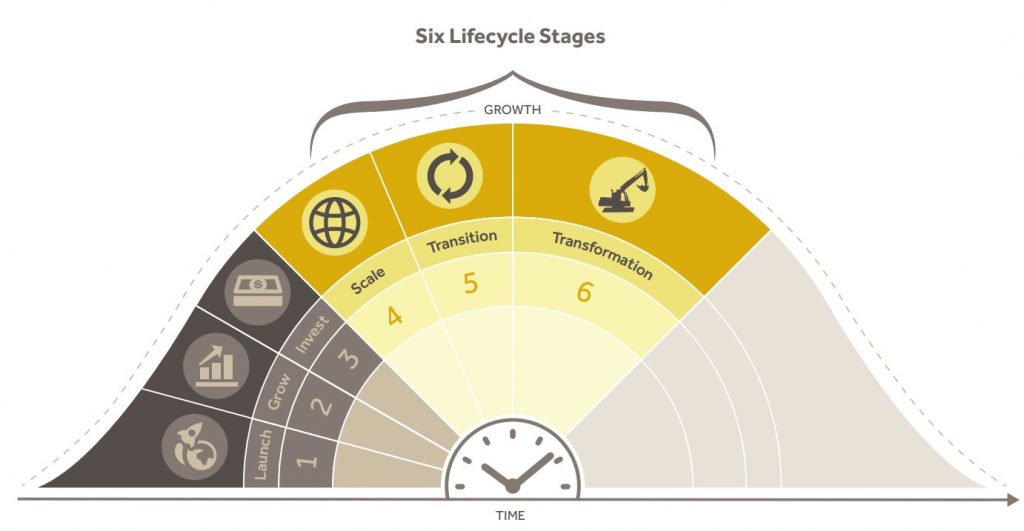

We believe one reason profitable revenue growth is getting such a focus right now is that every company represented in the interviews is large enough to be dealing with the complexity that occurs on the product lifecycle curve.

On the left side of this curve, companies are pulled by the market and expand on their ascent. A handful of the companies we interviewed were on this left side, still climbing the curve. At the apogee or post-apogee side of the cycle, complexity often throttles the growth of the top line and profitability of the model. The majority of our interviews were with leaders seeking to stay at the top or to maximize the right-hand side of the curve, which involves managing the complexity of optimizing profits in the core businesses of a company while managing the “pull” of growth in new businesses. From 10 o’clock to 2 o’clock on the curve, winning companies learn to manage the different complexities well.

KEY FINDING #2: The use of consultants is widespread – and causes some frustration. More than 7 in 10 companies are using – or previously used – consultants to supplement skills gaps or outright lack of bandwidth in order to advance change. About 70% of the leaders using consultants expressed some fatigue in dealing with consulting firms that come with protracted minimum engagement periods and high-end hourly rates and who focus exclusively on the “what” of change rather than the “how” of executing that change.

In light of these frustrations, one PE firm recently altered its consultant engagement strategy following an analysis of its portfolio companies. The firm now seeks to engage consultants who maximize near-term impact, return maximum value and assist management teams with the “how” of execution. PE firms as a whole tended to echo this view while public companies, though biased in this direction, were less emphatic about it.

KEY FINDING #3: Corporate priorities are remarkably consistent. There was a striking similarity among the distilled list of priorities for achieving revenue acceleration. While each firm naturally had its own sequence of focus and unique issues, roughly 90% of the interviews indicated a focus on at least one – and usually more – of these six areas:

- Transition. Most companies are in some form of business model and/or market transition. In many cases, they are moving from a one-time to a recurring revenue model and are almost universally wrestling with issues such as resource allocation, metrics (such as total value under contract) that managed the expectation of transition, the mix and role of the direct sales force versus channel partners, and an evaluation of whether new channel partners are needed. Many companies were launching or turning to digital transformation initiatives requiring a tighter coupling of marketing and sales. There was a prevalence of companies simultaneously optimizing the profitability of strong core business in concert with incubating higher growth in new segments or product portfolios.

- How to drive change. Leaders told us their primary limiting factor in transition is “how” – how to drive change and how to create change that works on the first or second attempt, not the fourth or fifth. There was a general recognition that getting the “how” right presumed that the “what” was already understood. Successful execution lay in the details. And successful execution was limited by talent – both numbers and skills available on staff – and the processes/systems employed to drive sustainable change.

- Expansion and redistricting segmentation. More than 6 in 10 of the companies represented in the interviews needed to identify and pursue new market segments to fuel growth. Most companies were looking for more new logo growth and more profitability in their core business. The pursuits ranged from granular micro-segmentation to the much broader domestic/international, enterprise, and mid-market sectors. Firms were also exploring how to profitably expand from one primary segment to a second growth segment with prudent resource allocation.

- Employing the right metrics. With changing business models, most business leaders lamented the difficulties of managing the transition of a core business using one set of metrics and the ascent of a new model using a different set of metrics. While everyone acknowledged key performance indicators as important, roughly half of those interviewed cited “leading indicators” – upstream activities that reliably predict downstream results – as being much more critical. Overall, those we interviewed are making it a priority to ensure the right metrics are in place for both internal and external investment managers. But identifying those “right metrics” to track through transition was an area where internal knowledge was frequently acknowledged to be inadequate and leaders stated that external assistance could be compelling.

- Sales operations. This function came up repeatedly as a trouble spot for companies seeking to accelerate top-line revenue growth. An overwhelming 95% of the interviews revealed sales operations to be an underwhelming element of transformation. Not only were leaders nearly unanimous in citing this function as a disappointment but the topic prompted the most evocative responses in the interviews. In raising sales operations as a concern, some leaders laughed while others shook their heads in dismay or went into a rant. Their reactions are unsurprisingly considered in light of the other results. When business leaders are navigating a business model transition, they need leading indicators that enable predictability in results – a job that sits squarely on the shoulders of sales ops. But when sales ops are not delivering, it puts that transition in jeopardy. Ideally, the sales operations function should be the hub of revenue-acceleration priorities. In transition, the CEO and board of directors need the sales operations function to be proactive, integrative with systems, and a key element in decision support and predictive analysis. Instead, it is frequently reactive and merely reports history. As one CEO put it, “sales operations is like walking in and obtaining a coroner’s report as opposed to a thoughtful medical prognosis for improved strength.” It is this gap that is driving the emotional responses we saw from leaders.

- Improving the sales engine. The majority of interviews revealed a narrative around the recession. When we pressed on the topic of urgency and outlook, there was an overwhelming view that a recession looms within the next 18 months. In nearly all cases where this view was expressed, leaders were preparing a “rainy day” plan or playbook to be reviewed soon by the Board of Directors. Hence, improving the sales engine is now urgent and relevant. Furthermore, there was a general recognition that, what sells inbound to a recession differs from the mix of solutions that exit a recession, making top-line playbooks essential from a resource allocation perspective.

In summary, most of the 130+ companies represented in our interviews are in transition and, facing pressure on their top lines, are investing in accelerating revenue. While there is investment across the board, PE firms expressed a slightly greater sense of urgency around revenue growth than public companies. However, all firms in transition are facing shortages in skills and in the sheer quantity of people to support the change, and they are struggling with questions around the “how” of driving change.

The sales operations function, widely viewed as a necessary, crucial, albeit underwhelming function, is in the cross-hairs of many leaders who want it to become an enabling function for change and decision support. Creating improvement in this function can lead to better leading indicators of activity, new key performance indicators, revised areas of resource allocation, revised approaches to the channel, and improved approaches to pricing and compensation – all of which are central to executing a successful business model transition. Additionally, the sales operations function could take a proactive role in preparing a top-line playbook to address concerns over a looming recession. In short, a “call to arms” around a renaissance in sales operations would be responsive to a long-time organizational wound and enable higher transformation yields in growth and profit relatively quickly.