Value Added Resellers Building a World Class Managed Services Capability

Channel partners of technology vendors are facing significant challenges, they experience pressures from their customer base while they need to avoid dis-intermediation with the vendors. As the move to the cloud among customers and end-users rapidly accelerates, customers are becoming less ‘captive’, and VARs are experiencing pressure on revenues and margins. The market is also moving from products to solutions, forcing VARs to re-invent their offering and provide effective Day 2 Managed Services (MS) support. If they want to retain traction in their end-markets and continue to offer value to vendors, VARs will need to think hard about their path to growth in this ‘new world’.

VARs face challenges in their end-markets and with vendors

Our work across the technology value chain – with vendors, channel partners, service providers, and customers —has given us new insight into the challenges faced by channel partners. Proactively dealing with the changes among end markets is critical to delivering continued growth, a key focus for vendors. At the same time, understanding the perspectives and strategies of vendors is critical for channel partners to remain relevant in a changing channel mix.

In our work with technology vendors and channel partners to drive growth in the changing landscape, we looked at the shift to a service focus amidst changing buyer values, worked on channel productivity, and developed new engagement strategies for partners. In helping different players in the technology value chain think about their path to change and growth, we have seen a range of issues and challenges faced by value-added distributors, system integrators, and agents in technology, including:

- How do we re-invent our value proposition to end customers, who are moving to the cloud and who increasingly look for services rather than ‘boxes’?

- What are the Managed Service landscape and the typical evolution to a broader Managed Services offering?

- What are the implications of increasingly virtual software distribution for end-customer ownership and our value proposition?

- How do we ensure ongoing engagement with the end customers who are increasingly choice-rich, platform-independent, and less ‘captive’?

- What are the implications of a shift in the revenue model from mark-up to service models, how do we re-tool to remain in business?

- How do we adapt to the accelerated speed of change driven by technology development and market adoption of newer Emerging Technologies and cloud services?

This article addresses the key question many channel partners face and asks us to help them, in three parts: 1) What does the Managed Services landscape look like and how should I think about entering the market? 2) How to determine where to focus given rapidly changing customer needs & expectations? 3) How do I develop my Managed Services capabilities to grow a strong Solution and Services business?

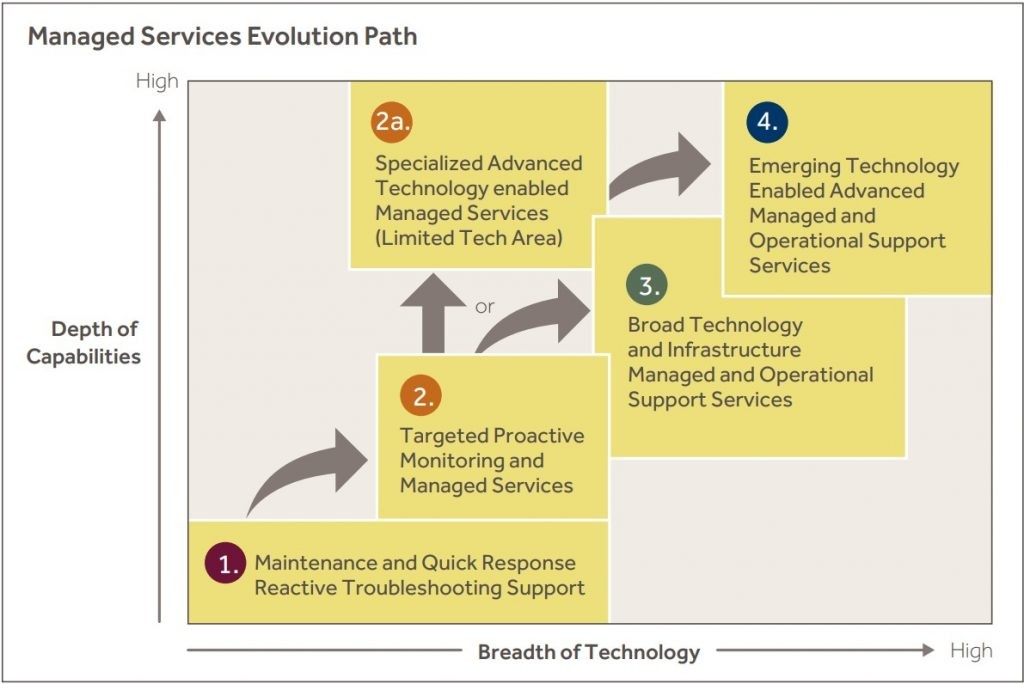

Answering these questions starts with a detailed understanding of the Managed Services landscape and the typical evolution from a narrow to a broad-based Managed Services offering. A channel partner or VAR that is moving from a Professional Services-based support model (selling design and installation of hardware and software) to Managed Services typically follows a logical trajectory.

Level 1

Basic maintenance resale coupled with Quick Response, Reactive Troubleshooting Support. This basic support level provides a “dial for help” lifeline for customers to get basic advice and troubleshooting support from a known and knowledgeable resource. It may be 24/7 but it is all reactive support and many times the support team does not have the latest customer configuration and infrastructure details to rapidly assist. Although better than nothing, it is a very limited and low-value support model.

Level 2

Targeted Proactive Monitoring and Managed Services. The step up from Level 1 provides a significant improvement by leveraging proactive, 24/7 monitoring and management. This support will come from an operational NOC which is constantly monitoring the clients’ infrastructure to identify and resolve problems before they cause additional issues or outages. This service relies upon detailed current customer infrastructure information summarized in run books, detailed ITIL or similar processes, specific infrastructure and application monitoring tooling, and problem resolution procedures including activating and managing OEMs or third parties and escalation notifications to the client. Typically this type of support is initially provided in a limited set of technology areas related to the VARs core business (e.g., basic Network Infrastructure (Route/Switch), UC&C, Data Center/Cloud, or Security). Some VARs will follow a specialization path – Level 2A—staying within a limited technology area but driving capabilities up—good examples would be advanced Managed Services in UC&C only (especially advanced Contact Center MS), Data Center MS, Cloud only provision and MS, and Security only MS.

Level 3

Broad Technology and Infrastructure Managed and Operational Support Services. The step up to Level 3 provides a Level 2 type of services but across a broad array of technology areas to become a core support element in the client’s infrastructure team. Most clients do not desire to have multiple different managed services providers each covering a specialized area. They look to leverage one, broadly capable support partner to simplify operations and engagement.

These offerings will typically cover the full range of infrastructure and application monitoring and support services including general route/switch/networking, UC&C, Data Center and Cloud, VDI/DaaS/Desktop/Helpdesk support, and Security (24/7 SOC, SIEM Tool, threat analysis) services. It is important to have the full range of capabilities, tooling, and support team to execute effectively. This level of VAR Managed services will typically also provide a broad range of services in a hosted or XaaS mode.

Level 4

Emerging Technology Enabled Advanced Managed and Operational Support Services. The step up to Level 4 takes the broad and deep capabilities in Level 3 and adds additional analysis and support capabilities by leveraging new emerging technologies in APM, Data Analytics, IoT, Dev Ops, and Advanced Security capabilities. Companies offering this Emerging Technology enabled Advanced Managed Services to become important extensions of the client’s organization providing deep analysis and development-oriented capabilities to anticipate and better respond to critical situations. These MS partners leverage a range of newer Emerging Technologies as seen in companies like Splunk, AppDynamics/Cisco, Cloudera, Forescout, IXIA, and FireEye.

Developing a Strong Managed Services Business

Given the evolution of a typical Managed Services, developing the actual plan needs to focus on several critical levers that—when implemented appropriately—can drive significant growth:

- Focus on the core – Segment customers on Managed Services needs and develop an evolutionary path to provide Managed Services. This growth strategy needs to consider the starting point, customer needs, and investment/ROI factors.

- Aggressively build out a strong Managed Services offering – Build “Day 2 Support Mindset” into the fabric of the company and ensure high-quality Managed services are developed and launched sequentially

- The shift from boxes to services – Both in on-prem design and implementation and Cloud-supported services. Requires close linkage and active dialog between Professional Services teams and Managed services teams.

- Expand – Extend the range of day 2 support to eventually cover all day 1 support capabilities and gradually move to higher levels of Managed Services.

KSF FOR MANAGED SERVICES

- Clearly identify the targeted end state and the path to value-added Managed Services upfront

- Separate Technical Team (don’t rely on the Professional Services delivery team or just make it part of the current Level 1 reactive support team)

- Create a dedicated Managed Services organization with a skilled leader that owns the Managed Services resources and P&L

- Make clear Tooling and infrastructure choices (which are critical and can become expensive) and focus on value

- Realign the sales team or leverage overlays to sell

- Managed Services; typically, current sales reps find selling Managed Services very difficult

- Aggressively focus on process and process management—ITIL

- Develop strong Service Delivery and onboarding discipline

- Develop a Recurring revenue mindset

Case Example

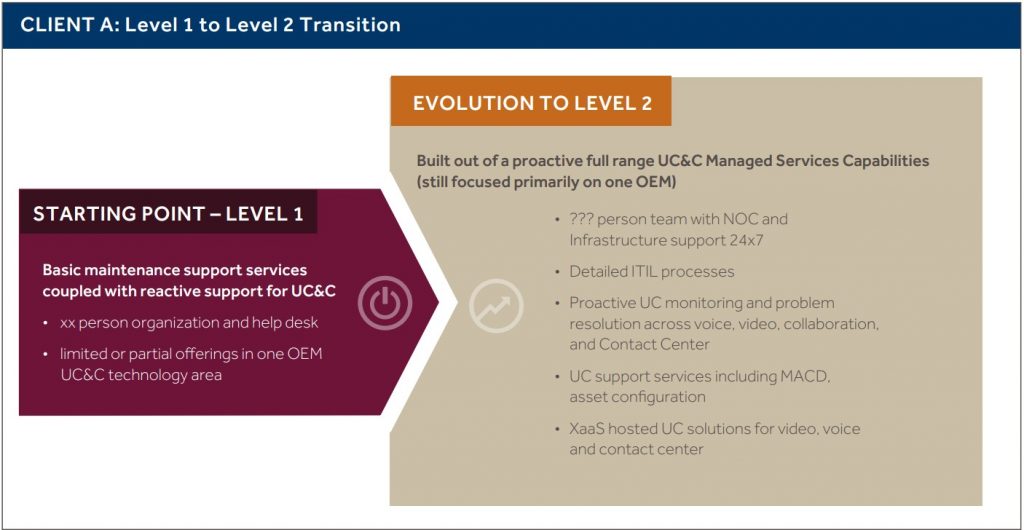

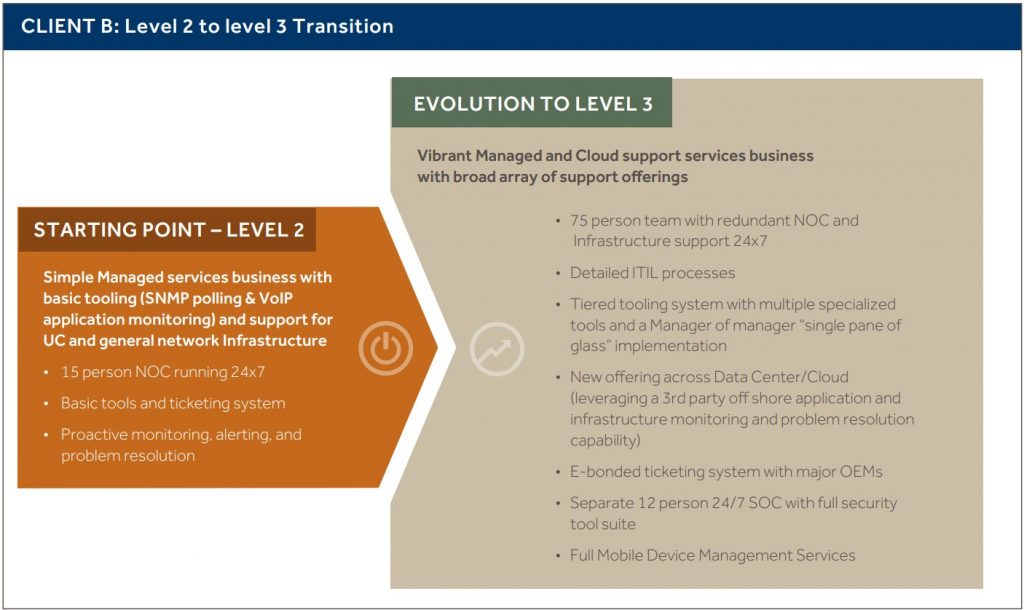

Leveraging these principles, we have worked with a number of clients to help them develop a strong Managed Services offering that was differentiated, backed by high-quality skills and capabilities, competitive, and very successful in the market. The process starts with a clear understanding of the current offer and the stage of development. This is based on a deep understanding of customer needs and buyer values, the ability of the current offering to meet the customer needs, where the company had a “right” to play, and the skills/capabilities of the company’s team to evolve to higher levels of Managed Services. With this information in hand, along with high-level investment parameters, the “To Be” Managed Services model can be developed and compared with the current “As Is” structure. The gaps between the two then outline the key activities required to build out the new managed services and offers.

With a clear road map in hand, over an 18-month period, the company moved from a high Level 1 to a low Level 3 Managed Services business that experienced strong growth as the capabilities were build-out.

Our approach to working with channel partners on Managed Services

Our work with channel partners on Managed Services is always tailored to the issues at hand. In our approach, we leverage our understanding of the wider value chain and customer needs and requirements, always focusing on key insights and results. There are typically seven aspects to helping channel partners re-tool in this ‘new world’:

- Build external view of the market – Thoroughly understand end customer values, what they want and need, and how they make purchasing decisions. We actively engage with stakeholders as part of our work

- Prioritize end-customer segments – Segment end-markets and identify high-value segments. We look at the pace of adoption, and receptiveness to SaaS / XaaS. This results in revenue opportunities and urgency to reach

- Design optimal set of solutions – Identify what the optimal suite of solutions is suited to new end-customer values

- Identify capability gaps – Understand what is required to sell and market the right suite of solutions. Gap analysis of capabilities to deliver vs what is in place. Identify missing capabilities and implement those

- Revamp the sales model – Adapt the sales model to the changed perspective of customers, the different decision-making dynamics, and the more managed service type of offering

- Understand the vendor perspective – Understand vendor perspective and strategy, concerns, and priorities, and build this into the go-to-market strategy

- Develop a Go-To-Market strategy – targeting high-value customer segments, and delivering an optimal set of solutions, in collaboration with the vendor. We take an active role in the implementation to ensure results

Our tried & tested tools and methodologies

To support us in our work with clients, helping them accelerate profitable revenue growth, we have developed a set of ‘battle-tested’ methodologies and tools:

- The Nine Voices of the Market™ – Our methodology for gathering deep and relevant insights into changing values and decision-making of end-customer segments.

- Channel Partner Assessment Framework – yada yada• Capabilities assessment – Our structured analysis of current vs desired capabilities in light of a changing market: gap analysis and implementation support.

- Competitive benchmarking – Our approach to understanding competitor value propositions, competencies, and go-to-market models.

- Waves of change – Our approach to phasing in a change program allows the most important, foundational changes to be completed first and within a controllable change management program

- 100 Behaviors of High Performing Revenue Engines™ – A set of “better practices” we use to evaluate company capabilities relative to peers and identify strengths and weaknesses.

We have developed significant experience working with key players in the technology value chain. We can help VARs understand the implications of a changing ‘world’, and drive profitable revenue growth in light of vendor priorities and concerns.