Four Growth Traps SaaS GTM Leaders Must Avoid

For private equity investors and SaaS executives, the margin for go-to-market (GTM) missteps has never been smaller. Capital is tighter, customer acquisition is more challenging, and execution faces greater scrutiny—making it harder than ever to scale revenue.

Why do some companies continue to accelerate growth while others stall? Blue Ridge Partners surveyed 275+ B2B SaaS executives, across pureplay subscription firms and hybrid models, to uncover what separates high performers from the rest. The findings reveal four recurring growth traps that even experienced GTM leaders can fall into—and what top performers do differently.

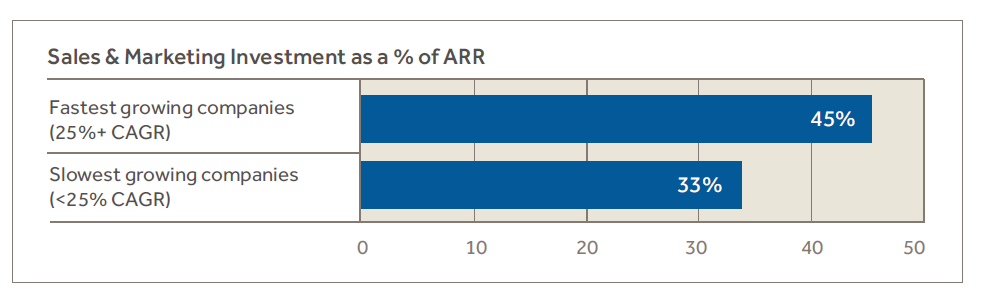

1. Why Cutting Sales & Marketing Too Soon Stalls SaaS Growth

It’s tempting to expect Sales & Marketing spend to shrink as a percentage of revenue as companies scale. Our research shows the opposite:

- Fastest-growing ARR firms (25%+ CAGR) invest ~45% of revenue in Sales & Marketing

- Firms growing <25% invest only ~33%

Sustained growth requires proportionally more investment as incremental market share becomes harder to win and GTM motions diversify. Top performers fund acquisition, expansion, and retention while entering new segments or geographies.

Key takeaway: Be efficient, but not shortsighted. Reallocate toward high-performing segments, talent, and management—not blanket cuts.

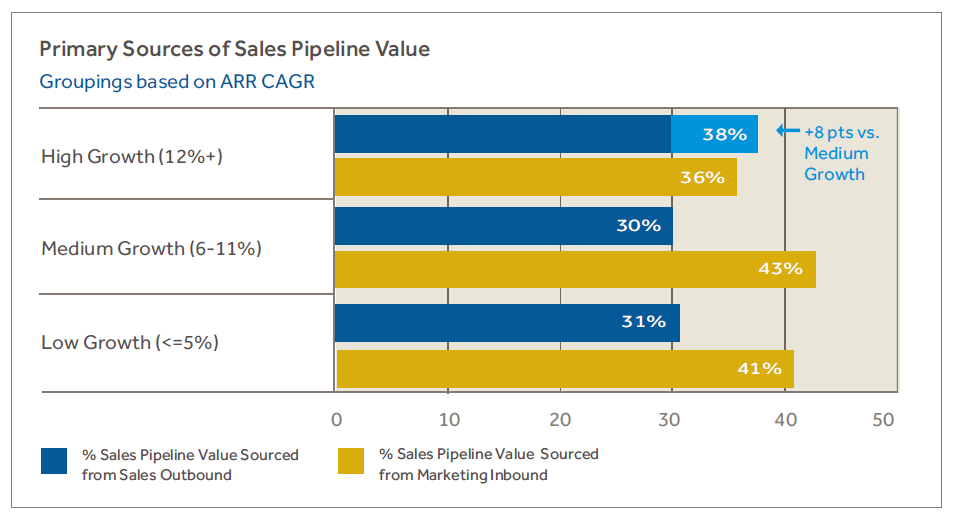

2. Weak Pipeline Discipline Is the #1 Growth Driver—And the #1 Gap

Pipeline development ranked as the top initiative to drive growth, yet only 15% of companies rate their efforts as highly effective.

- +37% higher investment in lead generation roles

- +24% better quality leads from a stronger pipeline

- +31% greater use of technology and AI in lead development

Their advantage? A disciplined, data-driven approach—tight alignment between Sales & Marketing and rigorous pipeline health checks.

Key takeaway: Scalable pipeline growth isn’t accidental. It demands clear ownership, strong SDR capability, and data-driven management to ensure high-quality leads convert reliably.

2. Weak Pipeline Discipline Is the #1 Growth Driver—And the #1 Gap

Pipeline development ranked as the top initiative to drive growth, yet only 15% of companies rate their efforts as highly effective.

- +37% higher investment in lead generation roles

- +24% better quality leads from a stronger pipeline

- +31% greater use of technology and AI in lead development

Their advantage? A disciplined, data-driven approach—tight alignment between Sales & Marketing and rigorous pipeline health checks.

Key takeaway: Scalable pipeline growth isn’t accidental. It demands clear ownership, strong SDR capability, and data-driven management to ensure high-quality leads convert reliably.

3. Outdated Segmentation Limits Growth

Many SaaS firms begin with an SMB or mid-market focus, but as they scale this can become a constraint.

Companies with at least 50% focus on large or strategic accounts grow ~20%, compared to ~13% for those with less focus.

As products mature and brand recognition grows, successful companies revisit segmentation and often move upmarket—unlocking higher average contract values (ACVs), improved margins, and stronger relationships.

Key takeaway: Regularly re-evaluate your ideal customer profiles and dedicate resources to strategic accounts to unlock step-change growth.

4. Over-Reliance on Channel Partners Slows Expansion

Channel partnerships can extend reach—especially for international expansion and vertical specialization—but when they dominate revenue, growth slows:

- Companies with >50% indirect revenue grew at only ~8%

- Those with <30% indirect revenue grew at ~20%

While channels may reduce Sales & Marketing costs, they also dilute gross margin and limit customer visibility—making upsell, renewals, and responsive GTM harder.

Key takeaway: Use partners strategically to extend reach or plug capability gaps—but never as a substitute for your own direct GTM muscle.

What Sets Growth Leaders Apart?

The firms that consistently outperform don’t just hire smart people or build great products – they also execute with commercial discipline. They:

- Invest proportionally more in Sales & Marketing as they scale

- Relentlessly manage pipeline generation, quality, and conversion

- Revisit segmentation to align with shifting market sweet spots

- Use channel partnerships selectively without over-reliance

Benchmark Your Strategy: The Growth Trap Diagnostic

The Growth Trap Diagnostic, included on page 7 of the full Executive Briefing, is a practical checklist to benchmark your go-to-market strategy against these four pitfalls.

Download the Full Executive Briefing (PDF)

Final Thoughts

Scaling a SaaS company today requires a disciplined, data-driven GTM strategy that avoids these traps and adapts to market dynamics.

Which growth traps might your team be walking into—without even realizing it? Use the Growth Trap Diagnostic to find out and position your company for sustained success.

If you’d like to explore these survey findings—or discuss ways to accelerate growth—contact us at [email protected].