A Peek Inside the Playbook of High Growth Companies

What We Did

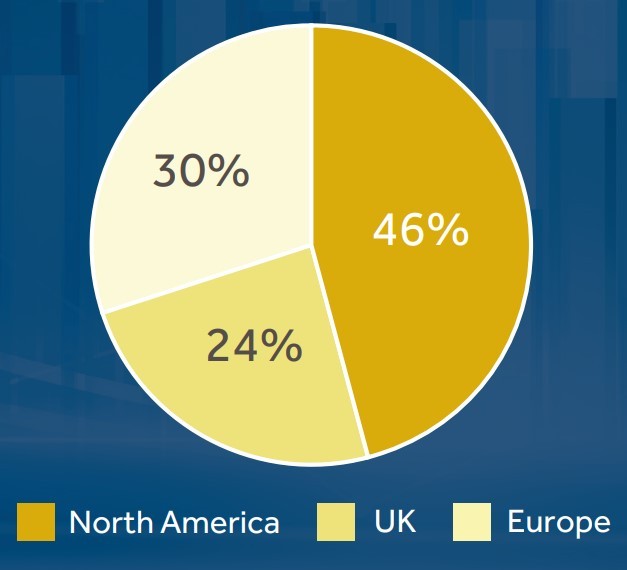

In the autumn of 2021, we surveyed 117 CEOs, COOs, and Chief Revenue Officers (CROs) to understand the commercial behaviors of both fast-growing companies and slower growers. We asked them about their sales, marketing, and customer service behaviors over the last 12 months and the next 12 months. Approximately half the respondents were from North America and a half from the UK and Europe.

They represented companies from a wide variety of industries:

- Financial Services

- Consumer and Retail

- Business Services

- Manufacturing and Distribution

- Technology and Telecom

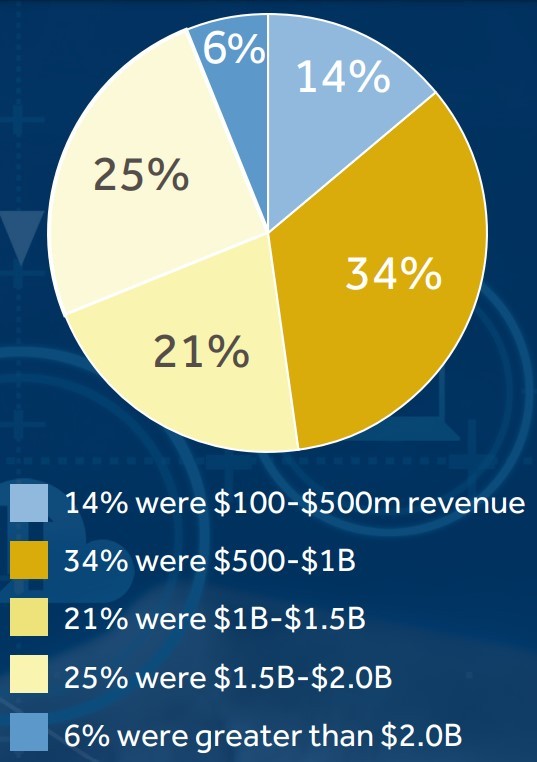

Approximately half of the respondents were from the middle market or upper middle market companies and the other half were large-cap companies. For purposes of this analysis, we grouped survey respondents into three growth rate categories:

- High growth companies >20% year over year

- Mid-level growers 11-20% year over year

- Low growth companies 10% or less year over year

Each growth rate category was well represented by company size, industry, and geography.

Summary

Over the last 12 months, high-growth companies followed a different playbook than low-growth companies. While they pulled some of the same levers in their commercial organizations, the differences in their actions were more striking than the similarities.

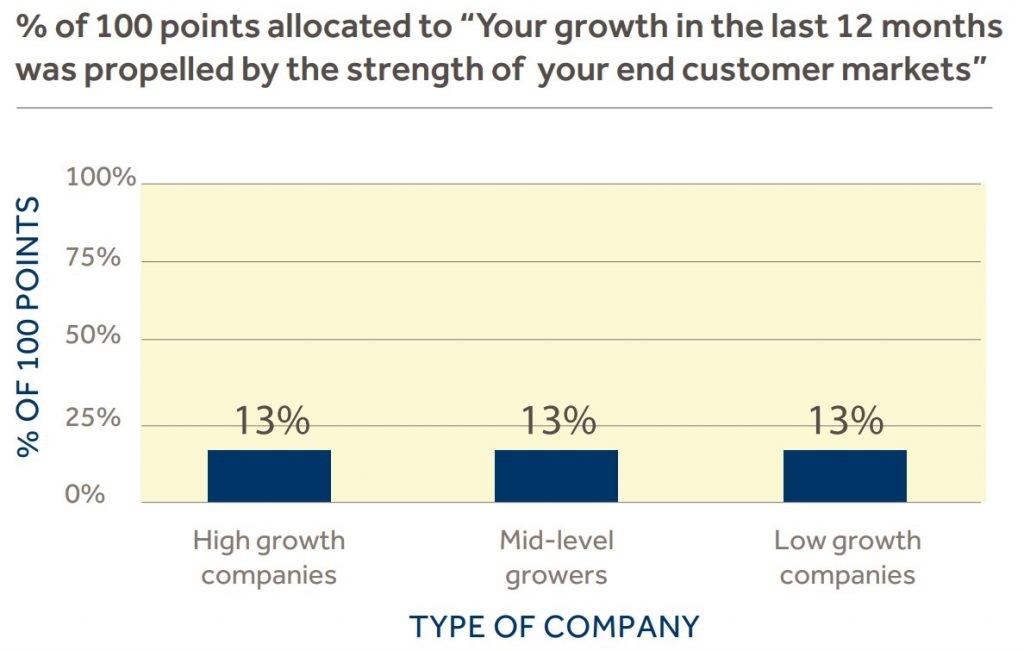

Unlike what one might assume, the differences in the growth rates achieved by these companies do not seem to be determined by the relative strength of their customer end markets. The respondents to our survey told us this was NOT the determining factor. In fact, the fast growers, mid-level growers, and slow growers assigned identical, relatively low weights to the influence of their end markets on their growth performance over the last 12 months.

Instead, these differences in growth rates seem to be driven by the playbooks they followed. There are some very clear distinctions between the actions taken by high-growth companies vs. low-growth companies. In general, the high-growth companies followed a market-responsive playbook while the slower-growth companies were more inwardly focused. Perhaps more significantly, these high-growth companies have different actions planned for the next 12 months than their slower-growing counterparts. We believe there are important learnings from these differences. This document describes the findings from our survey, along with input from separate discussions with the leaders of both high-growth and slow-growth companies.

Our Findings

We asked the survey respondents to tell us about the changes they made in their commercial organizations during the last 12 months and how these actions impacted their growth performance. The entire group (regardless of growth rate) responded with three consistent answers:

- DEFENDED THEIR CUSTOMER BASE

They focused on managing customer relationships to minimize the loss of customers and to find ways to cross-sell into existing relationships (finding new customers was more difficult for most companies) - USED DATA TO BE SMARTER ABOUT TARGETING

They used more sophisticated data analysis to allocate sales resources toward — 1) customers at risk of attrition and 2) customers with the highest potential for cross-selling. In many companies, these new

data analytic tools included propensity to buy models and reference account modeling for cross-selling - TIGHTENED PIPELINE MANAGEMENT

They beefed up their Revenue Operations capability to more tightly manage their pipeline — what opportunities are real? When might they be converted into revenue? Where are purchasing delays likely

to occur?

However, the high-growth companies did three additional things not as commonly mentioned by slower-growing companies. These are the actions suggesting that they were following a more market-responsive playbook.

- STUDIED AND UNDERSTOOD CHANGES IN THEIR CUSTOMERS

They spent time understanding how customer priorities and decision-making processes had changed due to COVID… How did the needs of their customers change and what were the implications of those changes?

- OPTIMIZED THEIR COVERAGE MODEL

They reallocated sales attention where the opportunities were greatest.

– If customers in a specific segment were less likely to buy, the sales resources were shifted away from these segments

– The coverage model was changed to reflect the productivity improvements from virtual selling/lack of sales reps traveling, meaning more customer calls per week were now possible

- INVESTED IN DIGITAL AND ECOMMERCE

The high-growth companies invested in communicating and transacting with prospects/customers via digital channels

The slower-growing companies described a more inwardly focused playbook over the last 12 months including actions such as redesigning sales processes, adjusting compensation plans, and improving indirect channels. These topics were addressed by high-growth companies but were viewed as less important to their overall growth performance.

What’s the Next Chapter in the Playbook for High Growth Companies?

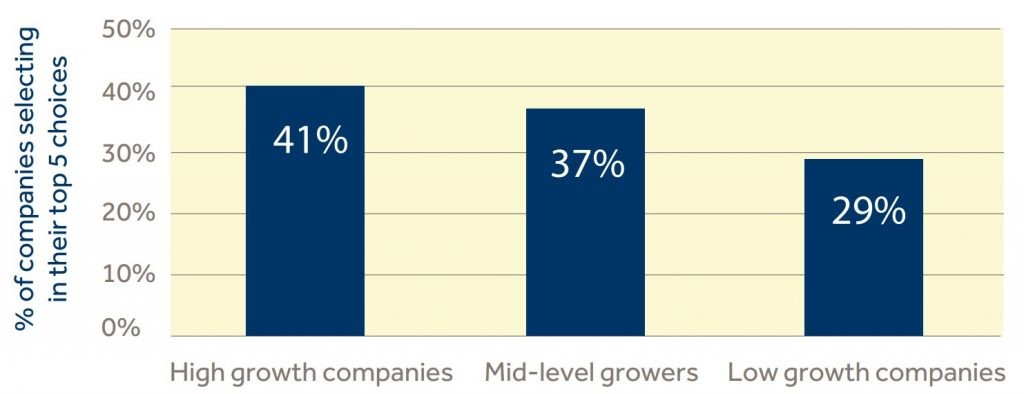

We asked the survey respondents to look forward to the next 12 months. What actions were most likely to drive their future growth performance? Interestingly, we heard a continued divergence between the plans of the high-growth companies and the low growers.

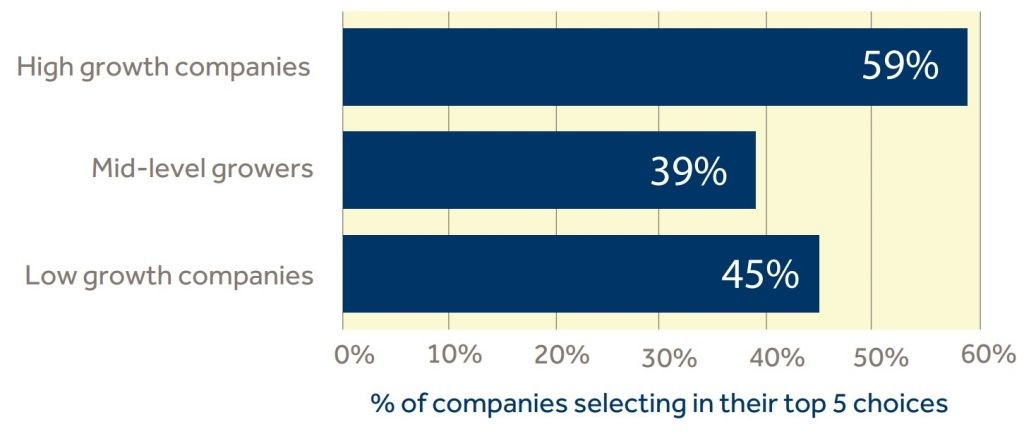

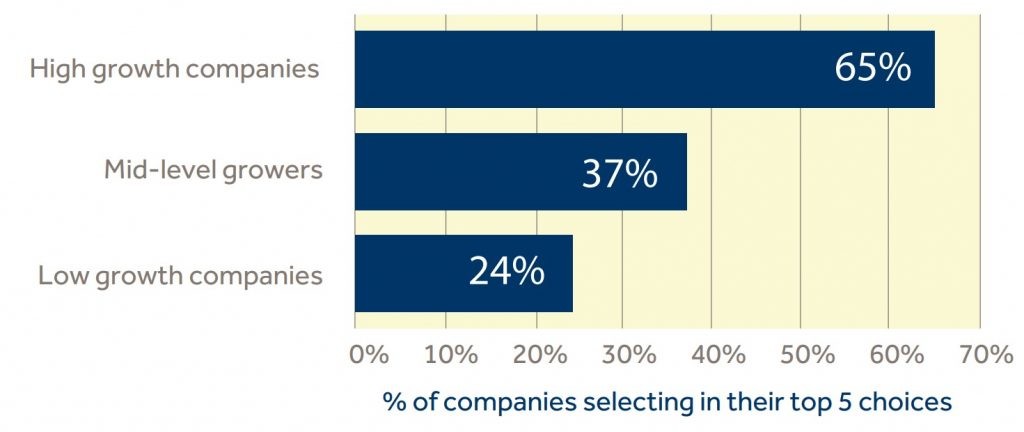

High-growth companies seem to be building on their strengths and moving to a new level of their maturity curve. They reported two major priorities for the next 12 months:

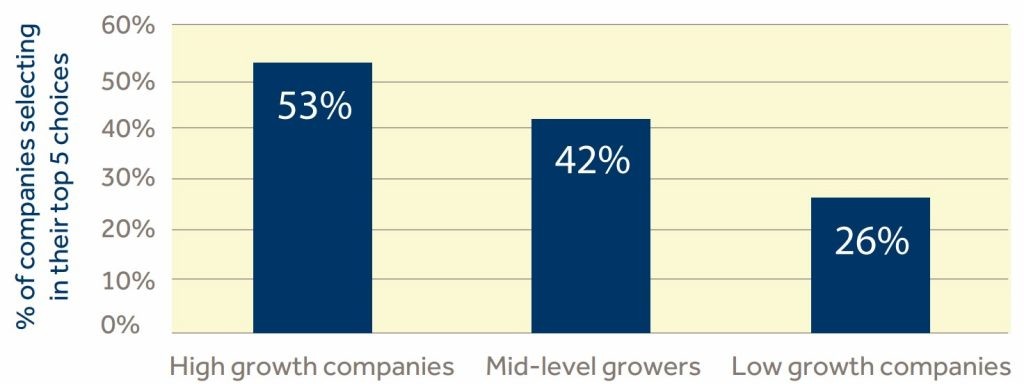

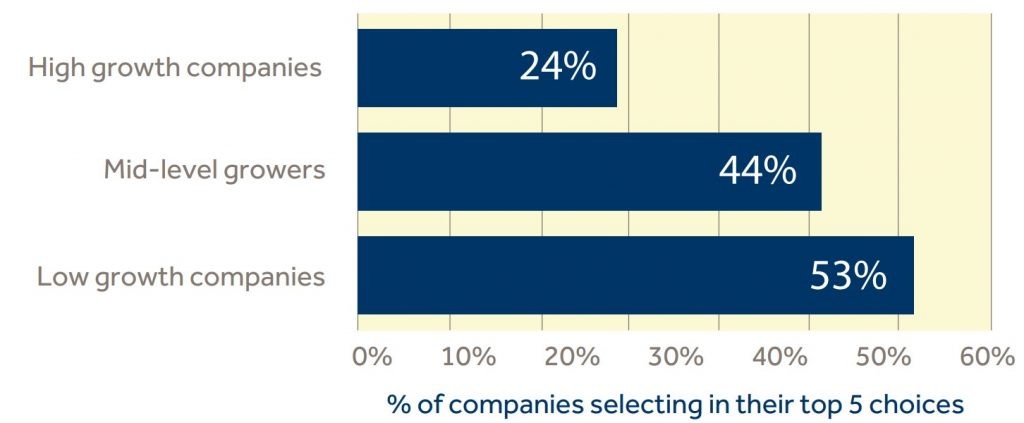

Low-growth companies seem to have one dominant priority for the next 12 months — improving the quality of their sales talent. Over half of low-growth companies chose this as one of their 5 future priorities while only a quarter of the high-growth companies identified it as one of their 5 priorities.

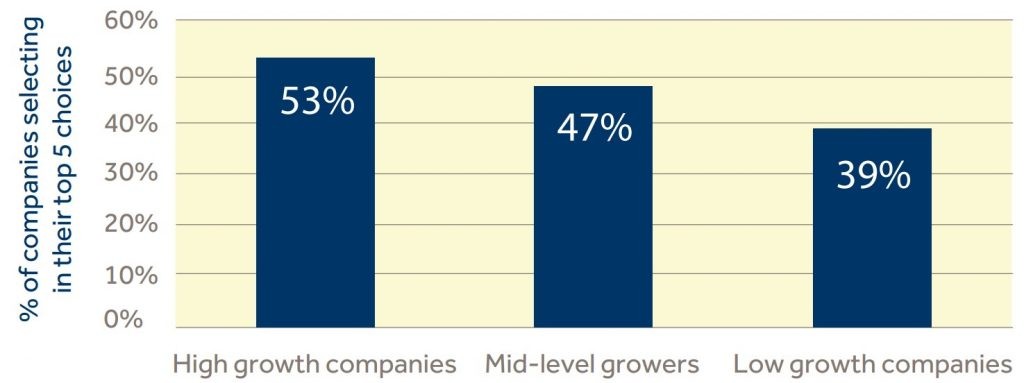

Note: The only significant difference between survey responses from North America and the UK/Europe was the relative priority placed on pricing. Only 31% of the UK/Europe respondents chose it as one of their 5 priorities while 58% of North American respondents selected it in their top 5.

Summary

Clearly, there is no one recipe for accelerating profitable revenue growth. Each company faces a bespoke set of external market conditions and internal capabilities. The most appropriate growth playbook must consider these unique circumstances. But this survey highlighted seven actions being taken by high-growth companies which might be useful for all companies to consider:

- Make sure you understand the changes occurring in your customers’ priorities and decision-making processes. This is a topic that should have been addressed in 2020 but if it wasn’t done thoroughly, it’s never too late to get this right.

- Refresh your overall go-to-market approach. High-growth companies are rethinking various aspects of their go-to-market approach including customer segmentation, role definitions, skill sets, organization design, sales messaging, performance metrics, tools used in the tech stack, and compensation plans.

- Optimize your coverage model. For some companies, there have been many changes in their markets — competitor positions, segment priorities, messaging, and virtual selling that might dictate necessary revisions in the coverage model. Some of these changes will result in the ability of sales reps to handle a broader customer base… but which customers and how should they be covered? The growth potential in some market segments has declined while it has expanded in other segments. This might suggest the need to shift your coverage model. Also, the prevalence of virtual selling has increased the number of customers reachable each day and the length of many meetings has been shortened. How should these factors be considered in a new coverage model?

- Add/upgrade sales talent. Many companies are realizing they need to expand the size of their commercial teams. Finding, attracting, and onboarding this talent can be a significant challenge. In some industries, a new set of skills are required such as technical savvy, the ability to sell to a more senior buyer, and the ability to sell a broader product line.

- Expand digital and e-commerce. COVID accelerated the acceptance and relevance of digital in nearly every aspect of the customer journey. Customers are much more self-reliant in each step including gathering information about your company, watching videos about your products/services, and entering orders.

- Adopt more sophisticated pricing and margin management techniques. Many companies are experiencing increased input costs and are wondering where there might be premium pricing opportunities. As a result, they are reexamining pricing strategies, pricing architectures, price points, and internal processes.

- Expand the use of data analytics throughout the commercial organization. Data analytics have been underutilized in most commercial organizations. High-performance companies will apply them to target prospects, to understand where to cross-sell, recognize when customers might be vulnerable to attrition, and to create a fact-based dashboard for a deeper understanding of overall commercial engine performance.