Why Cross-Selling Synergies Fail – and How to Unlock Revenue Growth

Cross-selling is one of the most attractive levers in revenue growth and a critical component of profitable growth – the #1 driver of private equity value creation. After acquisitions or a shift to a platform model, leadership teams often expect that expanding the product portfolio will naturally increase revenue per customer. The logic appears sound: more offerings should mean more wallet share.

Yet in practice, cross-selling synergies frequently fall short. Pipeline growth stalls, sellers revert to familiar motions, and boards or private equity sponsors begin questioning execution. Pricing adjustments, messaging changes, and even leadership turnover rarely solve the problem.

At its core, the issue is not strategy. It is execution.

For private equity investors and operating partners, this execution gap can materially dilute the value underwritten at acquisition – particularly when cross-selling synergies were part of the investment thesis.

Executive Summary

- Cross-selling synergies often underperform due to last-mile execution failure.

- Sellers default to familiar products even when messaging and pricing are strong.

- Incentives, ownership clarity, and perceived risk drive seller behavior.

- Technology and AI can reduce friction and accelerate cross-sell adoption when embedded into core workflows.

- Targeted interventions can unlock meaningful revenue lift within a fiscal year.

What Is the Cross-Selling Conundrum?

The cross-selling conundrum is the gap between expected cross-selling synergies and actual revenue realization.

Companies assume that expanding their product portfolio will naturally drive growth. In reality, sellers must change how they engage customers, collaborate across teams, and pursue larger, multi-solution opportunities.

Without deliberate intervention, cross-selling strategies break down in the last mile of execution.

Why Cross-Selling Initiatives Break Down

Most cross-selling strategies fail not because of flawed product portfolios, but because seller behavior does not change.

Common breakdown points include:

- Sellers continue to focus on legacy point solutions

- Team selling is perceived as risky and time-consuming

- Compensation plans reward individual performance over collaboration

- Territory design and ownership create friction

- Sales teams lack solution-selling skills

Even when strategy, pricing, and packaging are well-designed, execution friction prevents revenue lift.

In short, cross-selling synergies fail when seller behavior doesn’t change. They succeed when incentives, ownership, and execution discipline make cross-selling the default motion.

Case Example: Unlocking Cross-Selling in a Portfolio Company

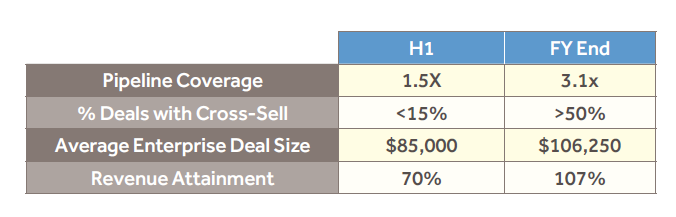

A U.S.-based technology company had completed multiple acquisitions to build an integrated solution platform. Leadership expected cross-selling synergies to accelerate growth. But by midyear, the company was off target by nearly 30 percent and facing a widening pipeline gap.

Blue Ridge Partners assessed that the market opportunity was real. The product portfolio was strong. The breakdown was execution.

What Was Holding Cross-Selling Back

The challenge was behavioral, not strategic. Specifically:

- Sellers could still meet quota selling legacy products

- Team selling introduced perceived risk and friction

- Compensation redesign midyear was impractical

- Sellers lacked discovery and solution-selling skills

Cross-selling was viewed as optional rather than essential.

What We Changed

Rather than launching a full sales transformation, we recommended targeted interventions designed to reduce friction and accelerate adoption:

- Introduced cross-selling incentive funds and accelerators

- Clarified opportunity ownership to reduce internal conflict

- Used CRM data and AI to identify accounts with the highest cross-sell potential

- Created territory-level targeting plans and practical seller job aids

- Implemented deal review panels earlier in the sales process

- Increased CEO and CRO oversight to drive accountability

Results Within Six Weeks

Within six weeks, the company began to see measurable lift:

- Average deal size increased 25 percent in the first quarter

- Fiscal year ended at 107 percent of annual growth target

- Win rates for complex enterprise deals improved 40 percent in the second half

Meaningful cross-selling momentum was achieved without overhauling the entire sales organization.

The Levers That Drive Cross-Selling Success

- Define the sales motion early.

Clarify who sells what, how collaboration works, and how credit is assigned. - Align incentives to desired behavior.

Compensation must reward multi-solution deals and cross-team collaboration. - Reduce seller risk.

Larger deals involve more stakeholders. Tools, deal reviews, and leadership support reduce perceived risk. - Enable skills and knowledge development.

Solution-selling requires discovery, value articulation, and coordination. AI can accelerate capability building. - Drive leadership accountability.

The CEO and CRO must inspect execution consistently. Cross-selling adoption does not occur passively.

Turning Cross-Selling Into a Repeatable Growth Lever

Cross-selling is one of the most powerful levers for portfolio value creation. But it does not succeed through product expansion alone.

Companies that unlock cross-selling growth:

- Focus on execution, not just strategy.

- Address incentives and behavioral friction.

- Embed technology into daily workflows.

- Hold leaders accountable for adoption.

Full-scale sales transformation is not always required. Targeted, disciplined changes – supported by technology – can generate meaningful growth within a fiscal year while laying the groundwork for durable change.

Frequently Asked Questions About Cross-Selling Strategy

- Why do cross-selling synergies fail?

Because seller behavior does not change, incentives misalign, and execution discipline is weak. - How can private equity firms unlock cross-selling in portfolio companies?

By aligning compensation, clarifying ownership, embedding cross-sell plays, and leveraging technology to reduce seller friction. - Does cross-selling require a full sales transformation?

Not necessarily. Targeted changes to incentives, tools, and leadership oversight can produce meaningful lift quickly.

Ready to Turn Cross-Selling into a Repeatable Growth Lever?

Most organizations pursue cross-selling synergies. Few execute in a way that consistently expands revenue and improves margin.

Blue Ridge Partners helps leadership teams redesign commercial workflows, embed AI where it matters, and align incentives and execution to unlock measurable revenue growth.