Inside the Minds of CEOs and CROs: Change is Coming to Commercial Organizations

We recently conducted a survey of over 50 mid-market CEOs, Chief Revenue Officers (CROs), and heads of sales to understand how they are managing the impact of COVID-19 on commercial function. We asked about their priorities and how they plan to manage these priorities during this period of economic disruption. In addition, we held dozens of client conversations with executives over the past several weeks to better understand these leadership issues.

Methodology: Our survey is heavily weighted toward B2B industries, including technology, media, telecom, industrial, and business services. It excludes uniquely impacted retail, healthcare, and financial services industries. Annual revenue of those surveyed ranges from $200M to $2B and includes both public and private equity-owned companies.

Key takeaways

- Respondents forecasted an average revenue decline of 12% for their businesses in 2020 and they expect the disruption to last into 2021.

- Executives are reacting to the revenue declines with broad-based cost take-outs, including significant cost reductions in the commercial organization—18% on average with some companies aiming for 30%.

- Cost reductions of this magnitude require execs to take actions that risk impacting customer relationships and might result in the loss of key sales talent.

- Large-scale cost take-outs in commercial organizations are not sustainable without redesigning the sales and marketing organizations, sales approaches, tools and skill sets.

- While some executives are cutting costs with a vision of a “go-forward” future state, most are focused more short-term, aiming for quick cuts to get through the current crisis.

The “consensus” outlook is for a depressed 2020 and full recovery by end of 2021

Surveyed executives expect monthly revenues to decline by about 14% over the next three- to four-month period, inching back to a monthly revenue run-rate at about 12% below pre-crisis levels by the end of 2020.

Some companies predicted even steeper revenue drops of 20-30%+ in the same period. A limited few—mostly in the technology sector—anticipated revenue increases. When asked about revenue run-rate by the end of 2021, respondents indicated an average revenue run rate of 101% of pre-crisis revenue levels. While none of the respondents has a crystal ball, the estimates as a whole give us a view that looks more like a U-shaped recovery rather than a quick bounce back in the coming months.

For some companies, the second wave of cost reductions may be required

As the COVID-19 crisis swelled, executives moved quickly to reduce spending across the commercial organization. Respondents expect to take out, or already have taken out, approximately 18% of their budgeted sales and marketing costs. Cost reductions of this magnitude are fraught with risks that include damaging important customer relationships and losing key sales talent.

Ominously, 42% of respondents reported a cost take-out goal below their expected rate of revenue decline. Assuming the economic recovery is a prolonged “U-shape” like

many believe, and assuming cost take-out percentages will need to approximate revenue declines, it is likely this 42% will need a second wave of cost reductions.

Our survey and executive discussions indicate that cost actions to date have been focused more on cash/liquidity management rather than on lasting structural changes to the go-

to-market organization, approaches, tools, or skill sets.

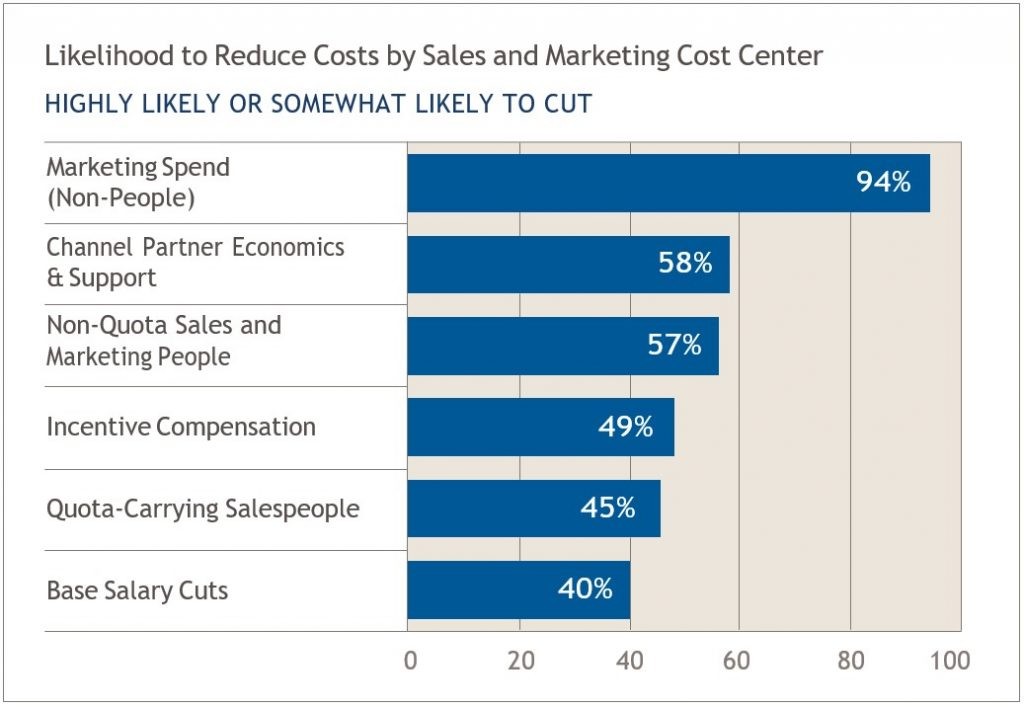

Unsurprisingly, initial cost take-out actions are targeting marketing, which is typically heavy on program spend vs. headcount. More than 9 out of 10 respondents indicated they were highly likely or somewhat likely to cut spending on marketing. Other cost elements, such as channel support, non-quota-carrying staff, and quota-carrying salespeople are also targets for reduction.

Cost-cutting actions are mostly quick-impact efforts and “non-surgical” in nature

Executives have been forced to reduce their cost structures quickly given the rapid erosion of revenue. Many of these actions are fast and effective against the short-term cost-reduction goal but are not sustainable. Examples of fast, broad-brush cost-cutting actions being undertaken include:

- Cutting salaries 30% across the board

- Eliminating bonus programs in sales and marketing

- Across-the-board headcount reductions in both quota-carrying and non-quota-carrying roles

Given the urgent need for cost reduction, 27% of executives are not considering a post- crisis future state commercial model as they make their cost cuts. Roughly one-quarter are thinking about a future model, but cost-cutting still dominates their mindsets. Given the speed at which executives need to reduce spending, they have had little time to thoughtfully consider a future state model.

Executives are balancing several key priorities, which makes cost-cutting a challenge to do thoughtfully

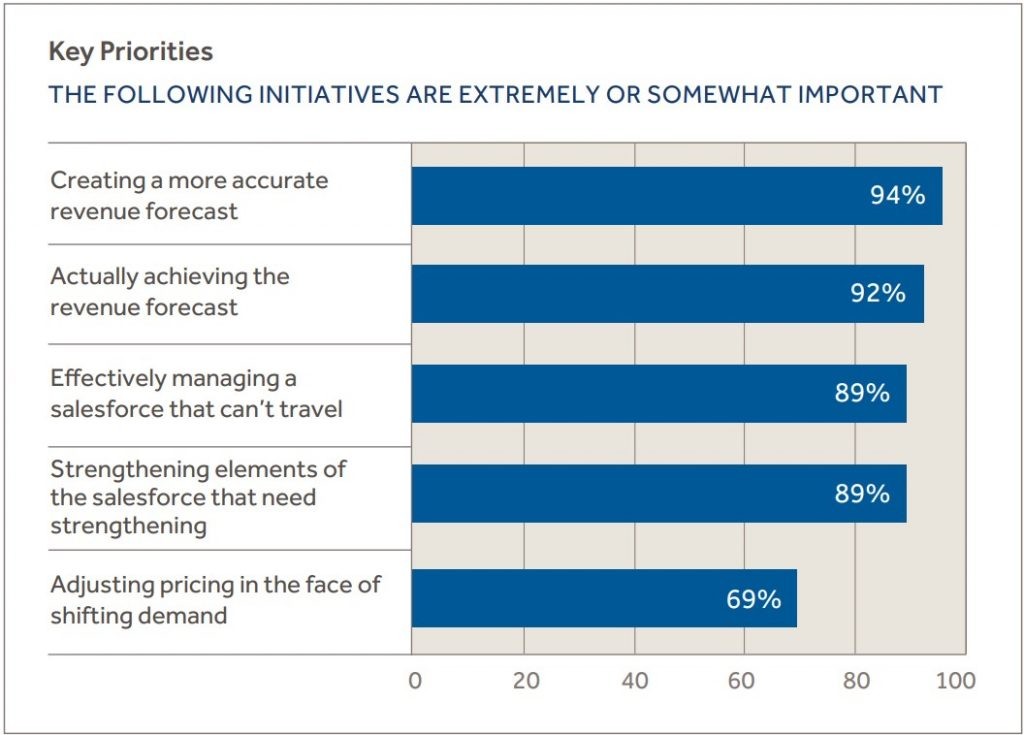

Executives identified five other priorities that need to be balanced with cost take-out. At least 70% of respondents said the following initiatives were extremely or somewhat important:

Companies are figuring out how to manage a salesforce that can’t travel

Teams have been forced to adapt quickly to virtual interactions. We have observed fundamentally new practices for managing this virtual salesforce, which includes:

- Daily team huddles on video conference

- More frequent frontline sales manager interactions with team members (daily not weekly)

- A renewed focus on forecast discipline to improve accuracy in the face of less predictable customer actions.

- Greater need for empathy in all sales communications.

Firms may need to re-evaluate their go-to-market strategy and consider a realignment/optimization effort

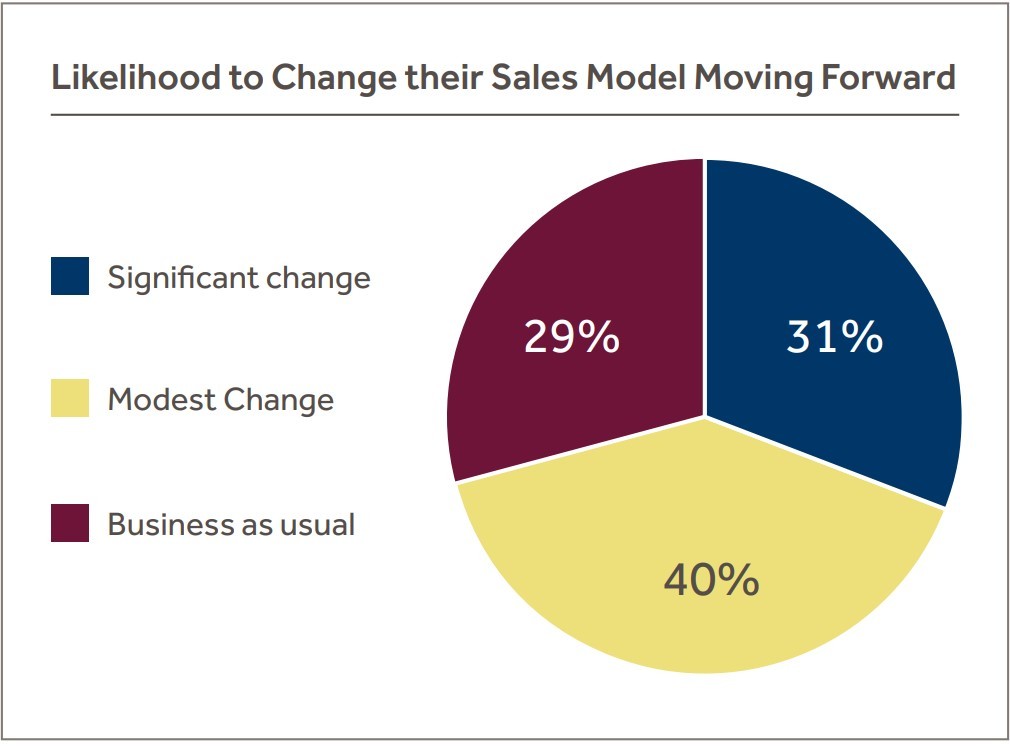

More than 7 in 10 respondents believe they will need to make changes to their go-to-market model as they more fully understand how the economic disruption will impact their company and their customers. Clearly, there is a significant shift coming for some portion of the sales process.

To be productive with significantly fewer resources, companies can’t return to the old model of selling. They will need to consider how to better serve their customers and prospects in a lower-cost, more productive selling environment. This will include re-evaluating lead generation, coverage models, sales processes, and customer service processes.

Some firms foresee a more digitally-enabled future

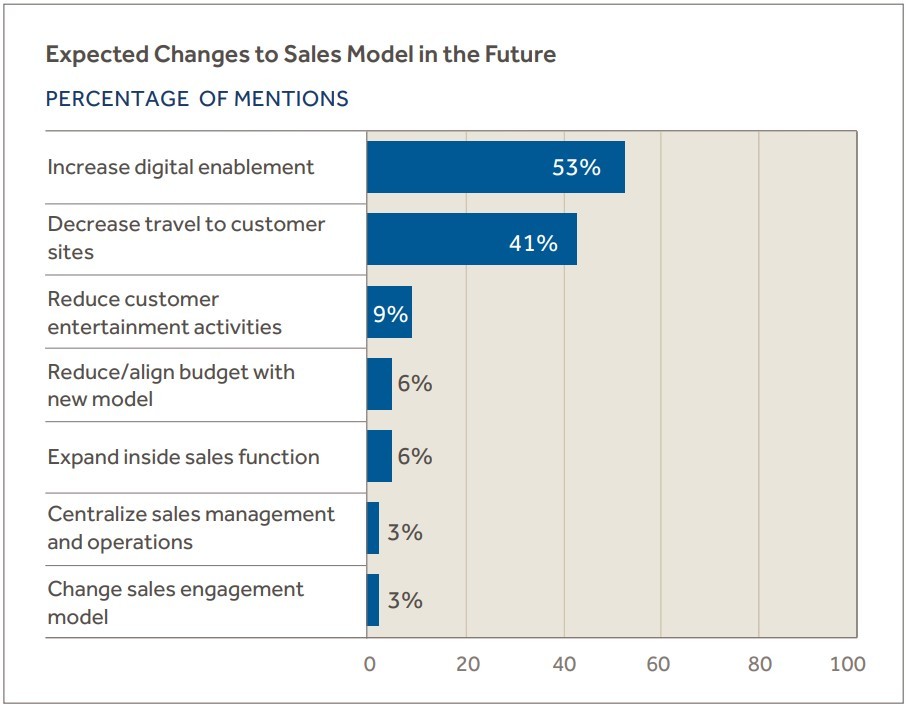

Many companies believe that selling will never be the same and are preparing for the continued use of video and digital tools in the sales process. In write-in responses to a question about how they see their sales model changing going forward, more than half of those who answered foresaw increased digital enablement and 4 in 10 anticipated less travel. Together, these two projected future states received more than triple the number of responses as the other answers combined.

Prior to COVID-19, we were already seeing a shift toward more digital/less travel beginning to happen in some sales organizations. This shift is being enabled in part by an emerging role, the Virtual Account Executive (VAE). This new role is being leveraged to meet the needs of modern buyers by using digital communication channels.

These digital communication channels can be used to generate new leads, nurture customer/prospect relationships and connect customers with the expertise they want— all with less travel and enabled by the very precise use of technology. For more on this topic and our perspective on digital enablement of the sales process, visit our content here.

While many companies are “heads down” trying to simply survive the current economic upheaval, it is our view that the drastic cost-cutting measures being undertaken today are best done with a view toward the future. COVID-19 is a crisis—but it’s also an opportunity to rethink the design and function of the sales organization, particularly in light of transformed buying behaviors. Smart leaders are viewing it as such; while they are cutting deeply like everyone else, they are doing so with a vision of a “go-forward” state. These are the companies that will be best poised for growth when the post-COVID rebound happens.