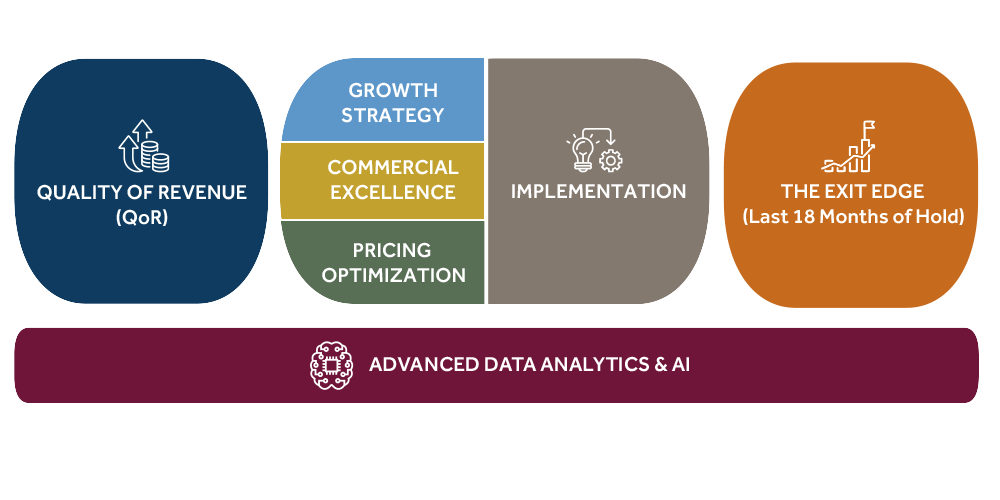

Quality of Revenue (QoR) Diligence

Blue Ridge Partners offers Quality of Revenue Diligence, a fact-based forecast of a company’s revenue performance.

-

Greater conviction in bidding

-

Faster start to organic growth acceleration

-

Mitigation of downside surprises

-

Earlier successful exits

The most proactive and exit-focused PE firms prioritize growth early. They evaluate a target’s QoR alongside its QoE and market context.

Revenue Growth Strategy

Using our proprietary methodologies, we help clients define their revenue growth strategy, including strategic actions and tactical improvements in execution.

- Adjacency Scans

- Market Assessment

- Competitor Position Analysis

- Internal Capability Assessment

- Opportunities to Play and Opportunities to Win

- Growth Plans Inside and Outside the Core

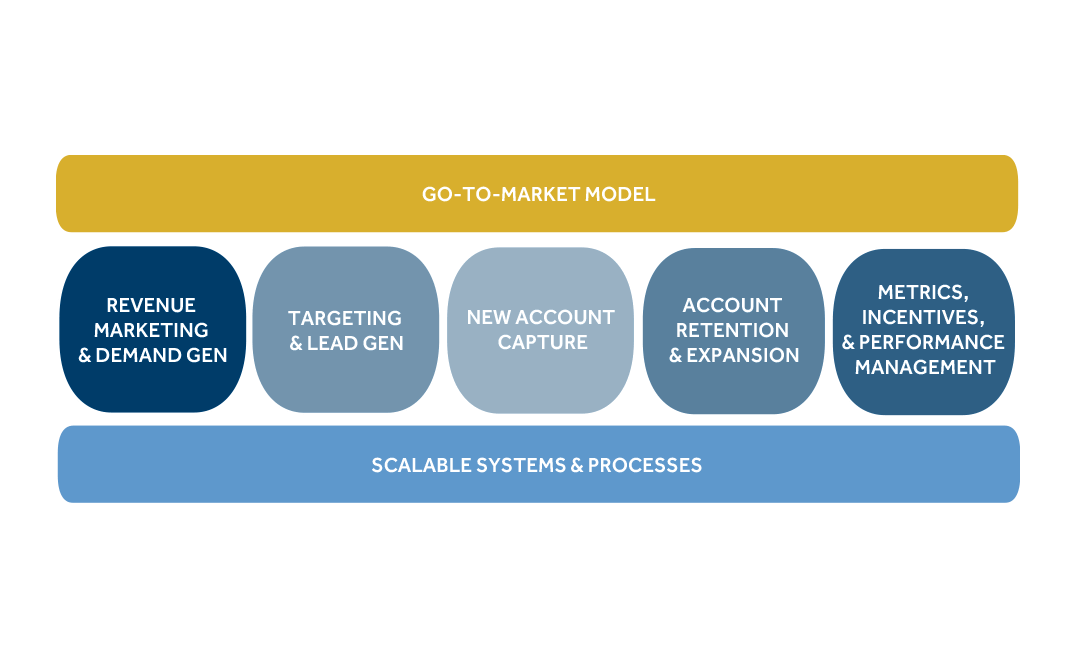

Commercial Effectiveness

Growth requires strong and reliable execution across an organization’s functions: sales, marketing, and customer service.

- Go-to-market model

- Talent, motivation, and culture

- Sales processes and tools

- Field marketing

- Sales enablement and operation

- Sales management

Pricing Optimization

Pricing is one of the most impactful profit levers a company can pull. Our clients often achieve 300 to 600 basis points or more of margin improvement.

Our pricing team tackles three key questions:

- How do you identify the right price?

- How do you ensure customers pay that price?

- How do you sustain and improve pricing performance?

Exit Preparation

Preparing for a successful exit starts early and requires strategic focus. Blue Ridge Partners offers The Exit Edge – Pricing, a high-impact, low-burden exit-focused pricing initiative that surfaces credible pricing upside and tells a fact-based, market-focused growth story. The Exit Edge – Pricing, provides:

- Higher exit valuations through market-validated, underwritable pricing upside

- Stronger buyer confidence with a third-party backed narrative and fact base

- Better prepared management teams who can articulate the pricing story during buyer discussions with conviction

- Faster diligence processes by addressing upside with proof-points buyers can trust

- Reduced risk of value erosion by avoiding blunt pricing actions near the end of the hold period

By taking a disciplined, buyer-focused approach, we help position your company for a high-value exit that captures its true potential.

Commercial AI & Data – Strategy & Transformation

Capturing growth in today’s business environment demands more than traditional commercial levers. Leading organizations are using AI and data to target customers more effectively, boost sales productivity, and uncover new sources of value.

At Blue Ridge Partners, we don’t treat AI as a standalone initiative. We see it as a strategic enabler – one that, when aligned with the right strategy, data, and capabilities, drives smarter execution and faster growth.

Our Commercial AI & Data Strategy team helps companies address five key questions:

- What are the best opportunities to use AI and data to drive growth and commercial efficiency?

- How much net-new impact from Commercial AI is possible and what is required to achieve this impact?

- Do we have the right tools, processes, architecture, and team to operationalize AI-driven insights and actions?

- Is our data ready for AI/analytics use cases and commercial decision-making?

- How do we create action from AI-powered solutions and turn insights into radically improved commercial performance?

The most forward-thinking companies are not just looking for ways to leverage commercial AI – they’re building the critical organizational capabilities to enable long-term AI success.