Capturing Post-Merger Value from Commercial Integration: Part 1 Avoiding Common Pitfalls

Acquisitions (mergers, carve-outs, bolt-ons, and tuck-ins) are important to many companies as they manage their overall corporate development. Success depends upon

- Selecting acquisitions that can create value – making the right strategic choices

- Effectively managing the Post Merger Integration (PMI) – integrating the business and commercial engines effectively.

This article is part 1 in a 3-part series that talks about the second of these challenges – effective integration of the business and commercial engines. In this article, we examine the seven common commercial integration traps that create downside – and how to avoid them in order to maximize value creation.

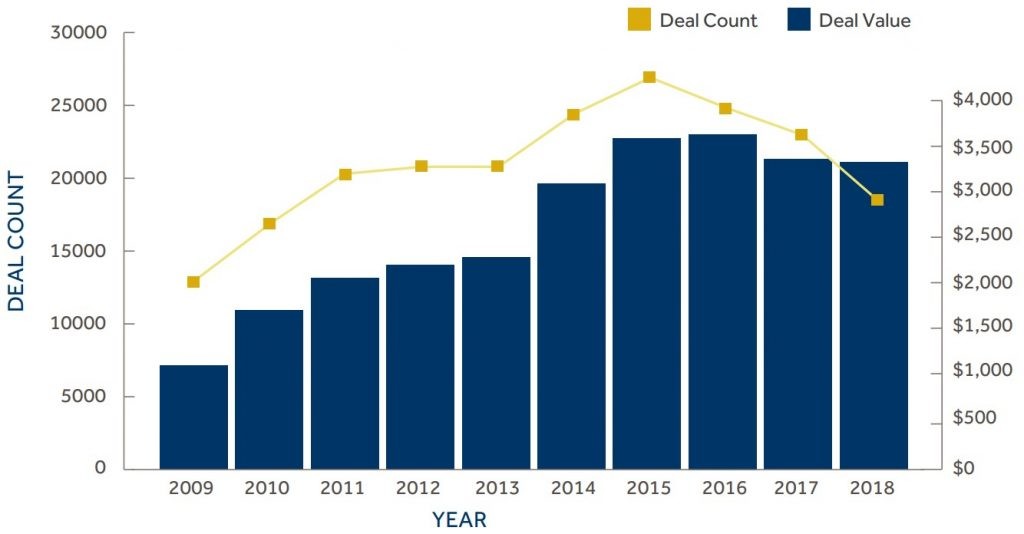

Companies are relying increasingly on mergers and acquisitions (M&A) to accelerate revenue and earnings growth. In the past 10 years, we’ve seen an increase in both the volume and value of M&A deals. Unfortunately, too many of these deals fail to deliver the results that were promised to investors.

There are many reasons that M&As don’t deliver on anticipated value, but typically one of four main culprits is to blame:

- Loss of focus. Too many topics of integration and transition can distract from the focus of key value drivers of the merger, leading to too many people focusing on too many things that seem urgent but do not add value.

- Loss of valuable customers. As a result of distraction by the integration topics, an inward focus, and competitive activity, key customers start defecting, leading to a decline in one or both merging businesses.

- Loss of talent. There is a lot of uncertainty following an M&A transaction and during its subsequent integration. In situations of uncertainty, top performers are highly subject to poaching by competitors, resulting in a drain of both companies’ best employees.

- Lack of alignment. All too frequently, organizations fail to get the teams aligned and headed toward a common goal. They can’t get both sides on the same page; one side or the other blocks access to customers or to the effectiveness of commercial efforts; or there’s reflexive resistance to change, with people thinking about the requested changes instead of getting on board and taking action.

Acquisitions are all about value creation. Occasionally, the optimal plan for creating that value is to let the acquired entity continue to operate completely independently. In most cases, more value is created by some level of integration and synergy capture; however, integration, by its very nature, introduces change and disruption and can be a source of unintended value leakage. Most companies inadvertently leak that value when they stumble into one of seven common commercial integration traps, each of which is related to one of the value-eroding culprits above.

By recognizing and avoiding these seven traps, companies can limit value leakage and reduce the downside risks of integration following M&A activity:

- Trap #1: Focusing on organization, reporting structure, and filling boxes. It is only natural that people are worried and want to know what the new roles, responsibilities, and reporting relationships will be following an M&A transaction. Certainly, these details need to be developed and communicated; however, it’s all too easy to let these worries pull leadership focus toward organizational boxes when their first focus should be on the development of the go-to-market models, sales processes, and alignment to strategic segments of the combined organization. The optimal operating model for the future should be informed by customer and market perceptions of the legacy organizations and by the potentially integrated value proposition. This value proposition, in turn, needs to be aligned with an updated segmentation of the market based on buying behaviors and it needs to be prioritized by the value targeted in the merger business case. This work is far more complex than filling boxes and defining reporting relationships. But it is far more important and needs to be tackled first.

- Trap #2: Not paying attention to the highest. Value customers, channel partners, and commercial employees. Key customers, salespeople, and channel partners typically get approached by competitors as soon as a deal is announced. It is therefore very important to identify the key customers, channel partners, and commercial team members who create the most value and proactively create initiatives to retain them. Focusing on satisfying and delighting customers and having a plan to maintain and track their retention is very important. So, too, are retention plans for top reps and channel partners to counter competitor efforts to sow doubt and lure them away.

- Trap #3: Focusing internally and fighting about accounts. Account allocations, if not managed properly, become a tug-of-war between various elements of the sales force. What tends to get lost in the fight is a clear focus on the customer and what is best for them. For example, in some cases, it may be important to maintain relationships between certain customers and salespeople (“Legacy Account” assignments) even if they run counter to the new general GTM model. It’s essential to reserve these decisions for the most significant accounts and establish a clear line of demarcation to reduce infighting. Complex transition processes and internal disputes regarding customer relationships and business allocations typically deteriorate customer service, which gives competitors the opportunity to enter or expand their share in major accounts.

- Trap #4: Assuming the acquiring entity has better systems, processes, and relationships. Many acquirers make this assumption, even though the acquiring company does not always possess the best commercial capabilities. Except in cases of the significant size disparity, leaders should not take the simplistic approach of bolting the acquisition onto the acquiring platform company but rather should employ objective diagnostic tools to assess the strengths and weaknesses of both organizations. Taking a best-of-both-worlds approach to structures, processes, and systems (including incentive systems) will maximize the value both organizations bring to the table. The selection of new processes, systems, and people should be solely driven by a vision for the most productive new environment rather than by the politics of the old companies. In doing so, it’s important not to try to integrate everything at once, but to have a clear plan and focus on higher-priority items.

- Trap #5: Being afraid to address compensation issues. Compensation can completely de-rail a commercial PMI all by itself. There is a good reason for this: sales forces are typically coin-operated and compensation plans control the coins. When two companies’ compensation plans need significant integration to reach a point of equilibrium, everyone knows it. In these cases, CEOs often delay attempts to harmonize the sales incentive compensation plans, believing that retaining the status quo is their best chance to keep top talent. That’s a mistake. Not addressing compensation differences sustains an environment of uncertainty and fear of future “shoe dropping,” which can lead to loss of good talent. Throwing short-term dollars at this issue only exacerbates it. Short-term increases in compensation and promises to “keep everyone whole” are both difficult to unwind later and can lead to bigger problems downstream. The reality is that most PMIs, by definition, cannot keep everyone whole. Approaching compensation planning with a neutral, logical, and systematic approach – and doing so quickly after the deal closes – is essential to retaining top talent and eliminating uncertainty.

- Trap #6: Neglecting the development of a long-term vision. Within the first 100 days of a deal, attention is typically focused on near-term, tactical moves. In this environment, it’s easy to neglect the development of a long-term vision based on a stronger value proposition to the market. A combined value proposition, however, is critical and must be grounded in a direct understanding of customer and market perceptions. Leaders must define both the immediate post-merger solution/product set and the initial roadmap to deliver the future combined value proposition. As a first step, we recommend establishing the essence of the growth strategy: define a growth aspiration, “sweet spots” for growth, and winning value propositions for each sweet spot.

- Trap #7: Underestimating the importance of the systems and tools to support the businesses. Disparate sales management systems, processes, and structures can create a barrier to assimilating new employees. Even more critically, poor integration of CRM systems can paralyze an entire sales organization and significantly reduce sales flow. In one extreme case where CRM integration was mismanaged, it led to more than 80,000 duplicate and redundant IDs that had to be re-validated manually. The sales force was caught not knowing what the final account assignments would be and the sales engine ground to a halt.

Knowing these seven traps ahead of time and putting processes and systems in place to avoid them will put an organization well along the path to realizing the intended value of a merger or acquisition.

Avoiding these seven traps enables CEOs to play better defense. But what about offense? Our experience with hundreds of engagements addressing commercial functions shows that understanding and leveraging the potential upside from revenue synergies and from building a more effective commercial engine can create significant value. In our next installment, we will delve into how this understanding allows an organization to play better offense by bidding more successfully and then capturing anticipated value more effectively.