Current SaaS Pricing Is Leaving Money on the Table

New survey data reveals companies could be capturing 5%-10% additional revenue growth

SaaS companies have generally performed well throughout the pandemic by pivoting their sales models for virtual selling and strengthening relationships with key customers. However, the recent inflationary surge has revealed a weak muscle: pricing. SaaS companies often focus on growing revenue from new customer acquisition, new products, demand gen marketing, or customer success initiatives, but not pricing. However, with inflation now at its highest level in 30 years, the potential pricing opportunity is bigger than ever and SaaS companies are largely missing out.

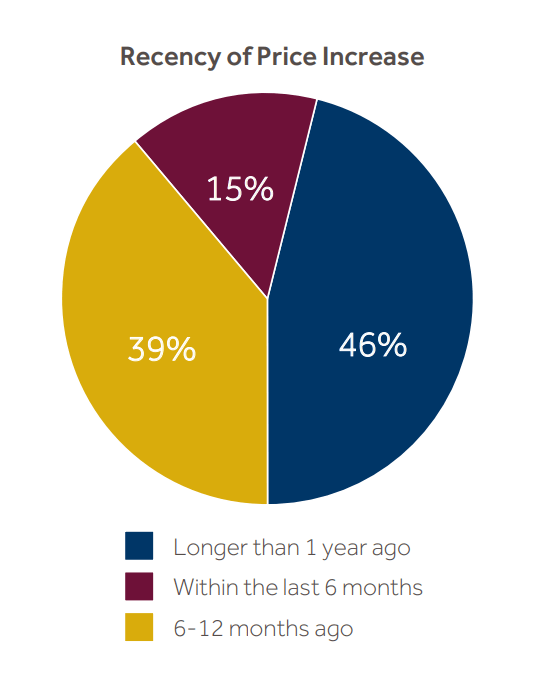

Our recent survey found that 85% of SaaS companies have not raised prices in the past six months, and those that have raised prices are capturing less than half the potential revenue. In addition to our survey findings, we include five actions boards and executive teams can take now to accelerate revenue and valuation through improved pricing.

Table of Contents

The Survey

In February 2022, Blue Ridge Partners surveyed the pricing leaders at 112 SaaS companies in the U.S. and Europe, gaining a number of important insights:

- 85% of SaaS companies did not raise prices during the recent inflationary spike beginning in Q4 2021.

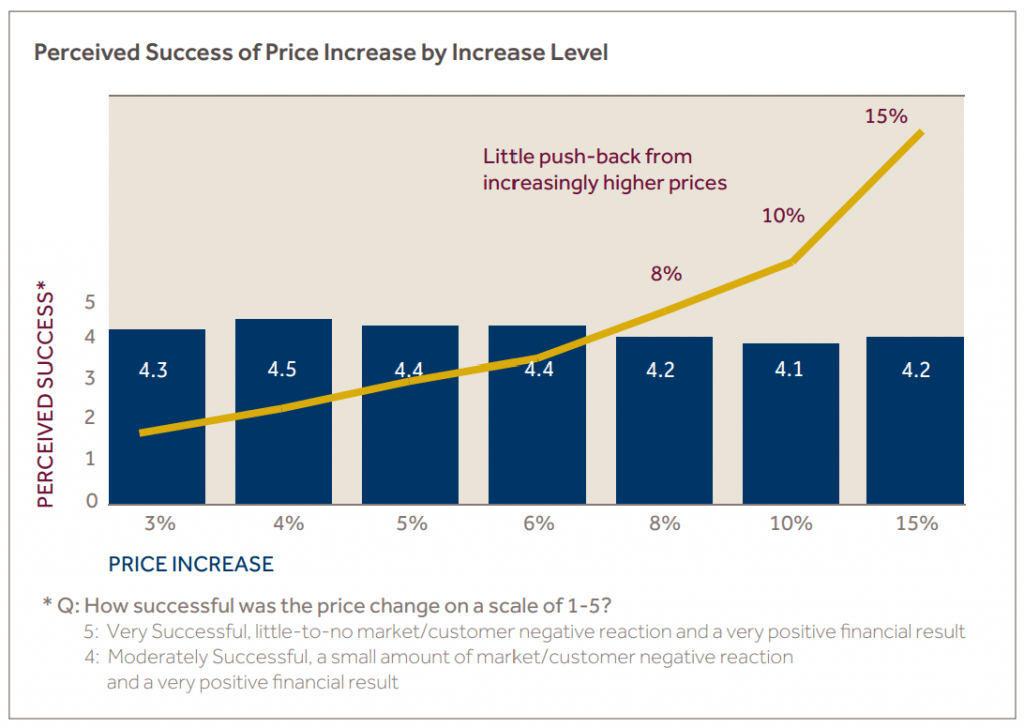

- Of all companies that did raise prices over the past year, none said the increase was unsuccessful, and those with the largest price increases (10%–15%+), saw only modestly more market resistance than those with smaller increases.

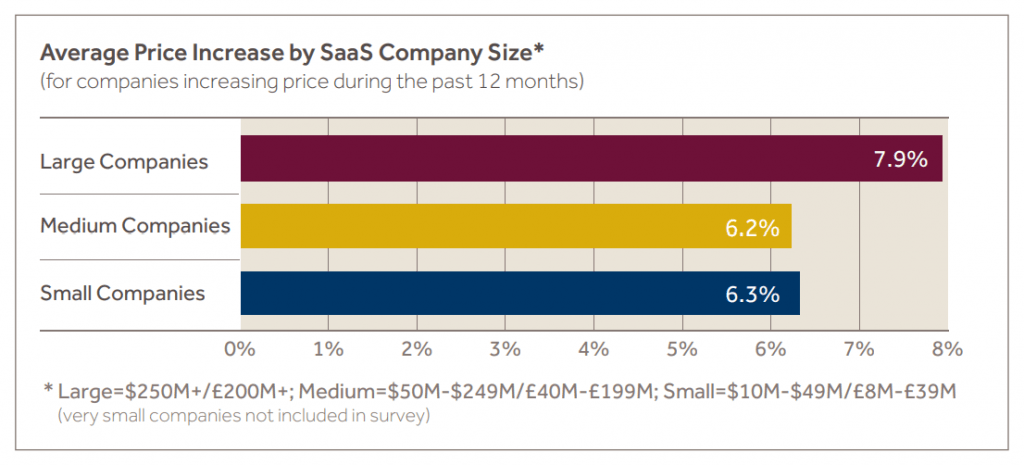

- Companies that raised prices reported generating an average revenue increase of 7.6% – half the industry best-practice result of 15%+.

- Medium and small SaaS companies’ price increases were about one-third lower than increases at large companies.

- 90% of small and medium-sized companies and 60% of large companies have not instituted annual price increases.

- Price increases in the U.S. and Europe over the past year were virtually identical.

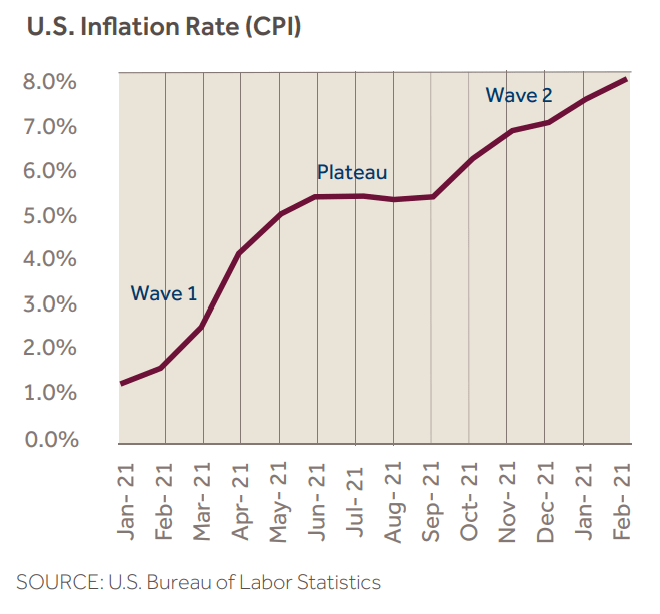

Inflation has not been this high for about 30 years – well before the SaaS industry existed. And we are now in the midst of a second inflation wave.

During Wave 1 in the first half of 2021, about 40% of SaaS companies surveyed increased prices, but only 15% of companies did so in Wave 2, beginning Q4, 2021.

Is it acceptable to raise prices more than once a year? Absolutely yes, provided prices are consistent with the market perception of fairness relative to value. Clearly, buyers have seen gasoline, food and many other prices increase multiple times recently. Does this apply to SaaS? Yes, labor shortages and compensation increases are driving rising costs in the SaaS industry.

In our experience working with SaaS companies and in conversations with SaaS leaders, we have found three reasons that generally explain why SaaS companies have not raised prices (again) over the past several months:

- General lack of pricing expertise.

- Specific lack of experience pricing in inflationary times.

- Not enough executive team focus on pricing best practices.

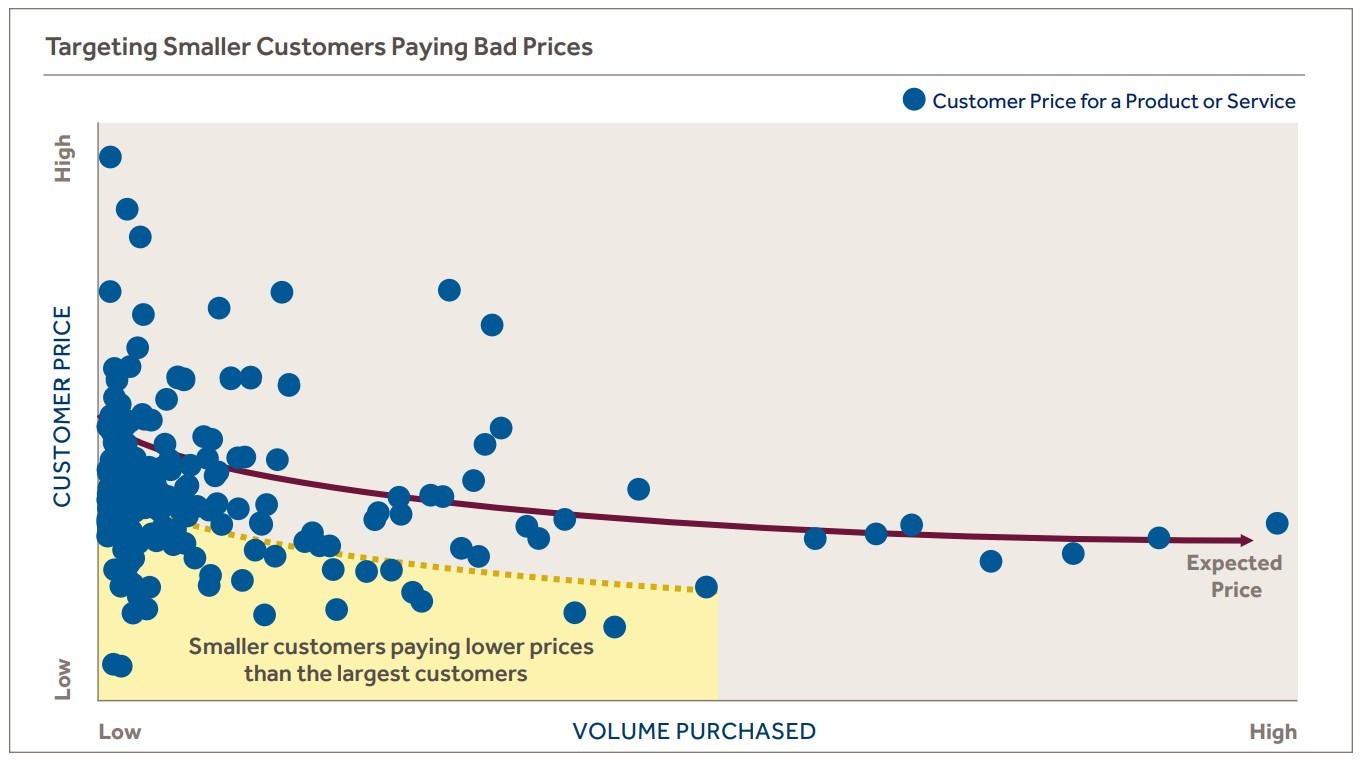

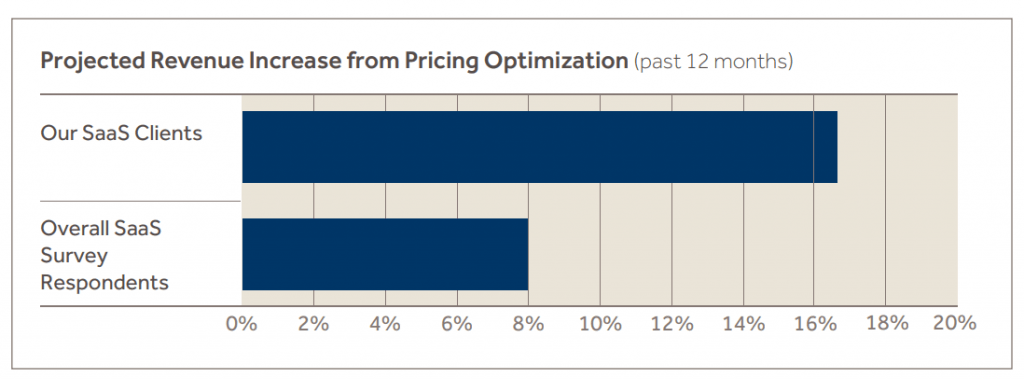

While small and medium-sized SaaS companies are often growing faster and tend to be more aggressive than larger firms, the survey data showed they are underperforming in their ability to price correctly in inflationary times. This makes sense as smaller companies typically focus on organic growth and rarely have pricing expertise on staff. But this lack of pricing focus comes at a big cost, as the chart below shows.

To assess how aggressively SaaS companies could increase prices, we asked survey respondents how their most recent price increase was received by customers. Not a single company said their price increase was unsuccessful, and companies with the largest price increases (10%–15% or more) received only modestly more pushback than companies with smaller increases.

Armed with these results, we next sought to understand how the in-house pricing increases of the past several months measured against what we would expect to see from best-practice pricing initiatives. To do so, we compared our 2022 survey results to our historical SaaS pricing client impact. Our findings indicate that SaaS companies are achieving less than half the revenue impact that could be achieved by applying pricing best practices. Best-practice potential averages 15% or more revenue growth, meaning that even recent price increases are leaving tens of millions in revenue and far more valuation upside on the table.

Immediate Action Items

Best practices for optimizing prices include improving bundle definitions to simplify buying and selling, collecting and analyzing buyer feedback data, tuning pricing for key segments and countries, improving renewal upsell performance, and consistently executing annual price increases. With those in mind, here are five actions boards and executive teams should consider doing now, while we are still in Wave 2 of inflationary growth:

- If prices have not increased in the last six months or more, increase them now.

- Develop a plan that gets your price increase into the 10%–15%+ range by increasing prices differently by segment and country.

- Ensure that all contracts going forward have provisions for annual price increases based on the current inflation rates.

- Establish a pricing czar (pricing leader) if you don’t already have one and schedule regular pricing updates for the board. Many SaaS companies leave tens of millions of dollars on the table simply because they lack the internal resources to price effectively.

- Close price leakages – e.g., eliminate discounts for non-compliant contracts, apply larger increases in renewal pricing for over-discounted small customers, and strengthen your discount approval process.

About the SaaS Pricing Survey

In February 2022, Blue Ridge Partners surveyed the pricing leaders at 112 SaaS companies in the U.S. and Europe. Included companies reported their primary product as being B2B software-as-a-service (SaaS) with a recurring revenue model. Survey respondents reported they were responsible for managing or reviewing and approving company pricing, with one-third of companies being headquartered in Europe and two-thirds in the U.S.